The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole.

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

The NIFTY Next 50 is a stock market index provided and maintained by NSE Indices. It represents the next rung of liquid securities after the NIFTY 50. It consists of 50 companies representing approximately 10% of the traded value of all stocks on the National Stock Exchange of India. It is quoted using the symbol NIFTYJR.

The Korea Composite Stock Price Index or KOSPI (Korean: 한국종합주가지수) is the index of all common stocks traded on the Stock Market Division—previously, Korea Stock Exchange—of the Korea Exchange. It is the representative stock market index of South Korea, analogous to the S&P 500 in the United States.

The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain's principal stock exchange. Initiated in 1992, the index is administered and calculated by Sociedad de Bolsas, a subsidiary of Bolsas y Mercados Españoles (BME), the company which runs Spain's securities markets. It is a market capitalization weighted index comprising the 35 most liquid Spanish stocks traded in the Madrid Stock Exchange General Index and is reviewed twice annually. Trading on options and futures contracts on the IBEX 35 is provided by MEFF, another subsidiary of BME.

The SSE Composite Index also known as SSE Index is a stock market index of all stocks that are traded at the Shanghai Stock Exchange.

The Straits Times Index is a capitalisation-weighted measurement stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the Singapore Exchange (SGX).

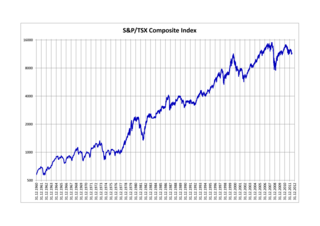

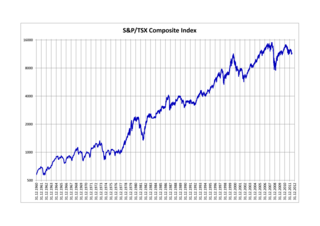

The S&P/TSX Composite Index is the benchmark Canadian stock market index representing roughly 70% of the total market capitalization on the Toronto Stock Exchange (TSX). Having replaced the TSE 300 Composite Index on May 1, 2002, as of September 20, 2021 the S&P/TSX Composite Index comprises 237 of the 3,451 companies listed on the TSX. The index reached an all-time closing high of 22,185.25 on April 1, 2024, and an intraday record high of 22,220.91 on March 28, 2024.

The Standard and Poor's 100, or simply the S&P 100, is a stock market index of United States stocks maintained by Standard & Poor's.

The EURO STOXX 50 is a stock index of Eurozone stocks designed by STOXX, an index provider owned by Deutsche Börse Group. The index is composed of 50 stocks from 11 countries in the Eurozone.

Tokyo Stock Price Index, commonly known as TOPIX, along with the Nikkei 225, is an important stock market index for the Tokyo Stock Exchange (TSE) in Japan, which tracks the entire market of domestic companies and covers most stocks in the Prime Market and some stocks in the Standard Market. It is calculated and published by the TSE. As of January 2024, there will be 1,716 companies listed on the TSE, since about 400 stocks with low liquidity will be phased out after the TSE reform in 2022.

The S&P/ASX 200 (XJO) index is a market-capitalisation weighted and float-adjusted stock market index of stocks listed on the Australian Securities Exchange. The index is maintained by Standard & Poor's and is considered the benchmark for Australian equity performance. It is based on the 200 largest ASX listed stocks, which together account for about 82% of Australia's share market capitalisation.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

The Moscow Interbank Currency Exchange or MICEX was a stock exchange that operated in Russia from 1992 to 2011. MICEX was the leading Russian stock exchange and one of the largest universal stock exchanges in Eastern Europe. It merged with the Russian Trading System in 2011, creating Moscow Exchange.

The Russian Trading System was a stock market that operated in Moscow from 1995 to 2011. It was established in September 1995 to consolidate various regional trading floors into one exchange. In December 2011 it merged with Moscow Interbank Currency Exchange (MICEX), creating Moscow Exchange. Originally RTS was modeled on NASDAQ's trading and settlement software; in 1998 the exchange went on line with its own in-house system. Initially created as a non-profit organisation, it was transformed into a joint-stock company.

The NYSE Composite (^NYA) is a stock market index covering all common stock listed on the New York Stock Exchange, including American depositary receipts, real estate investment trusts, tracking stocks, and foreign listings. It includes corporations in each of the ten industries listed in the Industry Classification Benchmark. It uses free-float market cap weighting.

The Ukrainian Exchange was founded in 15 May 2008 and its operation premises are situated at 7g, Tropinina Street, Kyiv.

The Moscow Exchange is the largest exchange in Russia, operating trading markets in equities, bonds, derivatives, the foreign exchange market, money markets, and precious metals. The Moscow Exchange also operates Russia's central securities depository, the National Settlement Depository (NSD), and the country's largest clearing service provider, the National Clearing Centre. The exchange was formed in 2011 in a merger of the Moscow Interbank Currency Exchange and the Russian Trading System.

The MOEX Russia Index, formerly the MICEX Index, is the main ruble-denominated benchmark of the Russian stock market. It was established by the Moscow Interbank Currency Exchange (MICEX) on 22 September 1997. MICEX merged with the Russian Trading System to form Moscow Exchange (MOEX) in 2011 and the index was renamed to MOEX Russia Index on 27 November 2017.