A request that this article title be changed to S&P 500 is under discussion. Please do not move this article until the discussion is closed. |

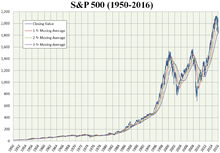

S&P 500 Index from 1950 to 2016 | |

| Foundation | March 4, 1957 [1] |

|---|---|

| Operator | S&P Dow Jones Indices [2] |

| Exchanges | NYSE, NASDAQ, Cboe BZX Exchange |

| Constituents | 506 [2] |

| Type | Large-cap [2] |

| Market cap | US$30.5 trillion (as of August 31, 2020) [2] |

| Weighting method | Free-float capitalization-weighted [3] |

| Related indices | |

| Website | www |

The S&P 500, [2] or simply the S&P, [4] is a stock market index that measures the stock performance of 500 large companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices. [5]

Contents

- Investing in the S&P 500

- Mutual and exchange-traded funds

- Derivatives

- History

- Selection criteria

- Index value calculation

- Performance

- Price history & milestones

- Returns by year

- References

- External links

The S&P 500 index is a capitalization-weighted index and the 10 largest companies in the index account for 26% of the market capitalization of the index. The 10 largest companies in the index, in order of weighting, are Apple Inc., Microsoft, Amazon.com, Facebook, Alphabet Inc. (class A & C), Berkshire Hathaway, Johnson & Johnson, JPMorgan Chase & Co. and Visa Inc., respectively. [2] For a list of the components of the index, see List of S&P 500 companies. The components that have increased their dividends in 25 consecutive years are known as the S&P 500 Dividend Aristocrats. [6] :25

Index funds that track the S&P 500 have been recommended as investments by Warren Buffett, Burton Malkiel, and John C. Bogle for investors with long time horizons. [7]

Although the index includes only companies listed in the United States, companies in the index derive on average only 71% of their revenue in the United States. [8]

The index is one of the factors in computation of the Conference Board Leading Economic Index, used to forecast the direction of the economy. [9]

The index is associated with many ticker symbols, including: ^GSPC, [10] INX, [11] and $SPX, depending on market or website. [12] The index value is updated every 15 seconds, or 1,559 times per trading day, with price updates disseminated by Reuters. [13]

The S&P 500 is maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global, and its components are selected by a committee. [14] [15]