| Convention on International Transport of Goods Under Cover of TIR Carnets | |

|---|---|

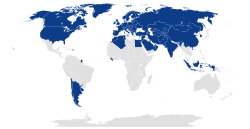

Contracting Parties to the TIR Convention | |

| Signed | 14 November 1975 |

| Location | Geneva |

| Effective | 20 March 1978 |

| Condition | 5 ratifications |

| Signatories | 17 |

| Parties | 78 |

| Depositary | Secretary-General of the United Nations |

| Languages | English, French and Russian |

The Convention on International Transport of Goods Under Cover of TIR Carnets (TIR Convention) is a multilateral treaty that was concluded at Geneva on 14 November 1975 to simplify and harmonise the administrative formalities of international road transport. (TIR stands for "Transit International Routier" or "International Road Transport".) The 1975 convention replaced the TIR Convention of 1959, which itself replaced the 1949 TIR Agreement between a number of European countries. [1] The conventions were adopted under the auspices of the United Nations Economic Commission for Europe (UNECE). As of March 2023, there are 78 parties to the convention, including 77 states and the European Union.

Contents

The TIR Convention establishes an international customs transit system with maximum facility to move goods:

- in sealed vehicles or containers;

- from a customs office of departure in one country to a customs office of destination in another country;

- without requiring extensive and time-consuming border checks at intermediate borders;

- while, at the same time, providing customs authorities with the required security and guarantees.

The TIR system not only covers customs transit by road, but a combination is possible with other modes of transport (e.g., rail, inland waterway, and even maritime transport), as long as at least one part of the total transport is made by road.

To date, more than 33,000 international transport operators had been authorised (by their respective competent national authorities) to access the TIR system, using around 1.5 million TIR carnets per year.

In light of the expected increase in world trade, further enlargement of its geographical scope and the forthcoming introduction of an electronic TIR system (so-called "eTIR-system"), it is expected that the TIR system will remain the only truly global customs transit system.

Due to the large blue-and-white TIR plates carried by vehicles using the TIR convention, the word "TIR" entered many languages, such as Italian, [2] [3] Polish, [4] European Portuguese, [5] Romanian [6] or Turkish, [7] as a neologism, becoming the default generic name of a large lorry.

Saudi Arabia acceded to the convention on 17 May 2018, and the convention entered into force for Saudi Arabia on 17 November 2018. Egypt acceded to the convention on 16 December 2020, and entered into force in Egypt on 16 June 2021.

With the accession of Saudi Arabia and Egypt, the TIR Convention had seventy-seven Contracting Parties. [8] [9]

In March 2023, Iraq became the 78th member of the convention, and in April 2025, after successful pilot operations, TIR went fully operational in the country. [10] [11]