The Organization of the Petroleum Exporting Countries is an organization enabling the co-operation of leading oil-producing and oil-dependent countries in order to collectively influence the global oil market and maximize profit. It was founded on 14 September 1960 in Baghdad by the first five members. The organization, which currently comprises 12 member countries, accounted for an estimated 30 percent of global oil production. A 2022 report further details that OPEC member countries were responsible for approximately 38 percent of it. Additionally, it is estimated that 79.5 percent of the world's proven oil reserves are located within OPEC nations, with the Middle East alone accounting for 67.2 percent of OPEC's total reserves.

In October 1973, the Organization of Arab Petroleum Exporting Countries (OAPEC) announced that it was implementing a total oil embargo against the countries who had supported Israel at any point during the Fourth Arab–Israeli War, which began after Egypt and Syria launched a large-scale surprise attack in an ultimately unsuccessful attempt to recover the territories that they had lost to Israel during the Third Arab–Israeli War. In an effort that was led by Faisal of Saudi Arabia, the initial countries that OAPEC targeted were Canada, Japan, the Netherlands, the United Kingdom, and the United States. This list was later expanded to include Portugal, Rhodesia, and South Africa. In March 1974, OAPEC lifted the embargo, but the price of oil had risen by nearly 300%: from US$3 per barrel ($19/m3) to nearly US$12 per barrel ($75/m3) globally. Prices in the United States were significantly higher than the global average. After it was implemented, the embargo caused an oil crisis, or "shock", with many short- and long-term effects on the global economy as well as on global politics. The 1973 embargo later came to be referred to as the "first oil shock" vis-à-vis the "second oil shock" that was the 1979 oil crisis, brought upon by the Iranian Revolution.

Ghawar is an oil field located in Al-Ahsa Governorate, Eastern Province, Saudi Arabia. Measuring 280 by 30 km, it is by far the largest conventional oil field in the world, and accounts for roughly a third of the cumulative oil production of Saudi Arabia as of 2018.

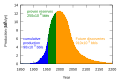

Peak oil is the theorized point in time when the maximum rate of global oil production will occur, after which oil production will begin an irreversible decline. The primary concern of peak oil is that global transportation heavily relies upon the use of gasoline and diesel fuel. Switching transportation to electric vehicles, biofuels, or more fuel-efficient forms of travel may help reduce oil demand.

The 1990 oil price shock occurred in response to the Iraqi invasion of Kuwait on August 2, 1990, Saddam Hussein's second invasion of a fellow OPEC member. Lasting only nine months, the price spike was less extreme and of shorter duration than the previous oil crises of 1973–1974 and 1979–1980, but the spike still contributed to the recession of the early 1990s in the United States. The average monthly price of oil rose from $17 per barrel in July to $36 per barrel in October. As the U.S.-led coalition experienced military success against Iraqi forces, concerns about long-term supply shortages eased and prices began to fall.

Matthew Roy Simmons was founder and chairman emeritus of Simmons & Company International, and was a prominent figure in the field of peak oil. Simmons was motivated by the 1973 energy crisis to create an investment banking firm catering to oil companies. He served as an energy adviser to U.S. President George W. Bush and was a member of the National Petroleum Council and the Council on Foreign Relations.

Oil depletion is the decline in oil production of a well, oil field, or geographic area. The Hubbert peak theory makes predictions of production rates based on prior discovery rates and anticipated production rates. Hubbert curves predict that the production curves of non-renewing resources approximate a bell curve. Thus, according to this theory, when the peak of production is passed, production rates enter an irreversible decline.

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus, and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level.

Oil megaprojects are large oil field projects.

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

Peter Maass is an American journalist and author.

The Simmons–Tierney bet was a wager made in August 2005 between Houston banking executive Matthew R. Simmons and New York Times columnist John Tierney. The stakes of the bet were US$10,000.00. The subject of the bet was the year-end average of the daily price-per-barrel of crude oil for the entire calendar year of 2010 adjusted for inflation, which Simmons predicted to be at least $200. The bet was to be settled on January 1, 2011.

The proven oil reserves in Saudi Arabia are reportedly the second largest in the world, estimated in 2017 to be 268 billion barrels, including 2.5 Gbbl in the Saudi–Kuwaiti neutral zone. This would correspond to more than 50 years of production at current rates. In the oil industry, an oil barrel is defined as 42 US gallons, which is about 159 litres, or 35 imperial gallons. The oil reserves are predominantly found in the Eastern Province. These reserves were apparently the largest in the world until Venezuela announced they had increased their proven reserves to 297 Gbbl in January 2011. The Saudi reserves are about one-fifth of the world's total conventional oil reserves. A large fraction of these reserves comes from a small number of very large oil fields, and past production amounts to 40% of the stated reserves. Other sources state that Saudi Arabia has about 297.7 billion barrels.

The proven oil reserves in Venezuela are recognized as the largest in the world, totaling 300 billion barrels (4.8×1010 m3) as of 1 January 2014. The 2019 edition of the BP Statistical Review of World Energy reports the total proved reserves of 303.3 billion barrels for Venezuela (slightly more than Saudi Arabia's 297.7 billion barrels).

From the mid-1980s to September 2003, the inflation adjusted price of a barrel of crude oil on NYMEX was generally under $25/barrel. Then, during 2004, the price rose above $40, and then $60. A series of events led the price to exceed $60 by August 11, 2005, leading to a record-speed hike that reached $75 by the middle of 2006. Prices then dropped back to $60/barrel by the early part of 2007 before rising steeply again to $92/barrel by October 2007, and $99.29/barrel for December futures in New York on November 21, 2007. Throughout the first half of 2008, oil regularly reached record high prices. Prices on June 27, 2008, touched $141.71/barrel, for August delivery in the New York Mercantile Exchange, amid Libya's threat to cut output, and OPEC's president predicted prices may reach $170 by the Northern summer. The highest recorded price per barrel maximum of $147.02 was reached on July 11, 2008. After falling below $100 in the late summer of 2008, prices rose again in late September. On September 22, oil rose over $25 to $130 before settling again to $120.92, marking a record one-day gain of $16.37. Electronic crude oil trading was temporarily halted by NYMEX when the daily price rise limit of $10 was reached, but the limit was reset seconds later and trading resumed. By October 16, prices had fallen again to below $70, and on November 6 oil closed below $60. Then in 2009, prices went slightly higher, although not to the extent of the 2005–2007 crisis, exceeding $100 in 2011 and most of 2012. Since late 2013 the oil price has fallen below the $100 mark, plummeting below the $50 mark one year later.

Oil 101 is a 2009 book by New York based American commodities trader Morgan Downey. Downey has been cited in the press as an expert in oil markets, Oil 101 was called a "must read" by a Financial Times blogger. and a leading oil blog reviewed the book as an addition to its select group of top oil books.

A Thousand Barrels a Second: The Coming Oil Break Point and the Challenges Facing an Energy Dependent World is a 2007 book by Canadian energy economist and columnist Peter Tertzakian that describes the multiple pressures forcing an upending of oil's dominant role in the global energy supply mix and conjectures about how economic, social and technological innovation will drive the inevitable adjustment process.

Safaniya Oil Field, operated and owned by Saudi Aramco, is the largest offshore oil field in the world. It is located about 265 kilometres (165 mi) north of the company headquarters in Dhahran on the coast of the Persian Gulf, Saudi Arabia. Measuring 50 by 15 kilometres, the field has a producing capability of more than 1.2 million barrels per day.

The 2010s oil glut was a significant surplus of crude oil that started in 2014–2015 and accelerated in 2016, with multiple causes. They include general oversupply as unconventional US and Canadian tight oil production reached critical volumes, geopolitical rivalries among oil-producing nations, falling demand across commodities markets due to the deceleration of the Chinese economy, and possible restraint of long-term demand as environmental policy promotes fuel efficiency and steers an increasing share of energy consumption away from fossil fuels.

On 8 March 2020, Saudi Arabia initiated a price war on oil with Russia, which facilitated a 65% quarterly fall in the price of oil. The price war was triggered by a break-up in dialogue between the Organization of the Petroleum Exporting Countries (OPEC) and Russia over proposed oil-production cuts in the midst of the COVID-19 pandemic. Russia walked out of the agreement, leading to the fall of the OPEC+ alliance.