Overview

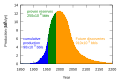

A Crude Awakening: The Oil Crash explores key historical events, data and predictions regarding the theory of global peak in petroleum production through interviews with petroleum geologists, former OPEC officials, energy analysts, politicians, and political analysts. The film contains contemporary footage interspersed with news and commercial footage from the growth heyday of petroleum production. The documentary focuses on information and testimony that supported the projection of a near-term oil production "peak" - a theory since debunked by the revolution in fracking and record-breaking production in the United States, once said to have already peaked in the 1970s.

The documentary examines our dependence on oil, showing how oil is essential for almost every aspect of our modern lifestyle, from driving to work to clothing to medicine and clean tap water. A Crude Awakening asks the tough question, “What happens when we run out of cheap oil?” Through expert interviews and archival footage, the film spells out in startling detail the challenges we would face in dealing with the possibility of a world without cheap oil—a world in which it may ultimately take more energy to drill for oil than we can extract from the oil the wells produce.

This page is based on this

Wikipedia article Text is available under the

CC BY-SA 4.0 license; additional terms may apply.

Images, videos and audio are available under their respective licenses.