Petroleum or crude oil, also referred to as simply oil, is a naturally occurring yellowish-black liquid mixture of mainly hydrocarbons, and is found in geological formations. The name petroleum covers both naturally occurring unprocessed crude oil and petroleum products that consist of refined crude oil.

Oil shale is an organic-rich fine-grained sedimentary rock containing kerogen from which liquid hydrocarbons can be produced. In addition to kerogen, general composition of oil shales constitutes inorganic substance and bitumens. Based on their deposition environment, oil shales are classified as marine, lacustrine and terrestrial oil shales. Oil shales differ from oil-bearing shales, shale deposits that contain petroleum that is sometimes produced from drilled wells. Examples of oil-bearing shales are the Bakken Formation, Pierre Shale, Niobrara Formation, and Eagle Ford Formation. Accordingly, shale oil produced from oil shale should not be confused with tight oil, which is also frequently called shale oil.

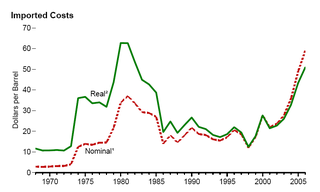

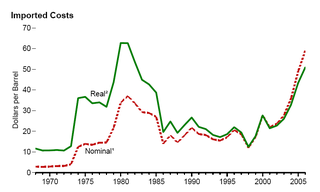

An energy crisis or energy shortage is any significant bottleneck in the supply of energy resources to an economy. In literature, it often refers to one of the energy sources used at a certain time and place, in particular, those that supply national electricity grids or those used as fuel in industrial development. Population growth has led to a surge in the global demand for energy in recent years. In the 2000s, this new demand – together with Middle East tension, the falling value of the US dollar, dwindling oil reserves, concerns over peak oil, and oil price speculation – triggered the 2000s energy crisis, which saw the price of oil reach an all-time high of $147.30 per barrel ($926/m3) in 2008.

Liquefied natural gas (LNG) is natural gas (predominantly methane, CH4, with some mixture of ethane, C2H6) that has been cooled down to liquid form for ease and safety of non-pressurized storage or transport. It takes up about 1/600th the volume of natural gas in the gaseous state at standard conditions for temperature and pressure.

Peak oil is the theorized point in time when the maximum rate of global oil production will occur, after which oil production will begin an irreversible decline. The primary concern of peak oil is that global transportation heavily relies upon the use of gasoline and diesel fuel. Switching transportation to electric vehicles, biofuels, or more fuel-efficient forms of travel may help reduce oil demand.

In economics, the Jevons paradox occurs when technological progress increases the efficiency with which a resource is used, but the falling cost of use induces increases in demand enough that resource use is increased, rather than reduced. Governments typically assume that efficiency gains will lower resource consumption, ignoring the possibility of the paradox arising.

Colin J. Campbell was a British petroleum geologist who predicted that oil production would peak by 2007. He claimed the consequences of this are uncertain but drastic, due to the world's dependency on fossil fuels for the vast majority of its energy. His theories have received wide attention but are disputed and have not significantly changed governmental energy policies at this time. To deal with declining global oil production, he proposed the Rimini protocol.

From the mid-1980s to September 2003, the inflation-adjusted price of a barrel of crude oil on NYMEX was generally under US$25/barrel in 2008 dollars. During 2003, the price rose above $30, reached $60 by 11 August 2005, and peaked at $147.30 in July 2008. Commentators attributed these price increases to many factors, including Middle East tension, soaring demand from China, the falling value of the U.S. dollar, reports showing a decline in petroleum reserves, worries over peak oil, and financial speculation.

Coal liquefaction is a process of converting coal into liquid hydrocarbons: liquid fuels and petrochemicals. This process is often known as "Coal to X" or "Carbon to X", where X can be many different hydrocarbon-based products. However, the most common process chain is "Coal to Liquid Fuels" (CTL).

Oil depletion is the decline in oil production of a well, oil field, or geographic area. The Hubbert peak theory makes predictions of production rates based on prior discovery rates and anticipated production rates. Hubbert curves predict that the production curves of non-renewing resources approximate a bell curve. Thus, according to this theory, when the peak of production is passed, production rates enter an irreversible decline.

Gas to liquids (GTL) is a refinery process to convert natural gas or other gaseous hydrocarbons into longer-chain hydrocarbons, such as gasoline or diesel fuel. Methane-rich gases are converted into liquid synthetic fuels. Two general strategies exist: (i) direct partial combustion of methane to methanol and (ii) Fischer–Tropsch-like processes that convert carbon monoxide and hydrogen into hydrocarbons. Strategy ii is followed by diverse methods to convert the hydrogen-carbon monoxide mixtures to liquids. Direct partial combustion has been demonstrated in nature but not replicated commercially. Technologies reliant on partial combustion have been commercialized mainly in regions where natural gas is inexpensive.

Robert L. Hirsch is an American physicist who has been involved in energy issues from the late 1960s. Through the 1970s he directed the U.S. fusion energy program at a variety of government positions as responsibility for the project moved from the Atomic Energy Commission to the Energy Research and Development Administration and finally to the Department of Energy. After that time he was a senior energy program adviser for Science Applications International Corporation and is a Senior Energy Advisor at MISI and a consultant in energy, technology, and management.

The price of oil, or the oil price, generally refers to the spot price of a barrel of benchmark crude oil—a reference price for buyers and sellers of crude oil such as West Texas Intermediate (WTI), Brent Crude, Dubai Crude, OPEC Reference Basket, Tapis crude, Bonny Light, Urals oil, Isthmus, and Western Canadian Select (WCS). Oil prices are determined by global supply and demand, rather than any country's domestic production level.

United States energy independence is the concept of eliminating or substantially reducing import of petroleum to satisfy the nation's need for energy. Some proposals for achieving energy independence would permit imports from the neighboring nations of Canada and Mexico, in which case it would be called North American energy independence. Energy independence is espoused by those who want to leave the US unaffected by global energy supply disruptions and would restrict reliance upon politically unstable states for its energy security.

Fossil fuel phase-out is the gradual reduction of the use and production of fossil fuels to zero, to reduce deaths and illness from air pollution, limit climate change, and strengthen energy independence. It is part of the ongoing renewable energy transition, but is being hindered by fossil fuel subsidies.

Peak oil is the point at which oil production, sometimes including unconventional oil sources, hits its maximum. Predicting the timing of peak oil involves estimation of future production from existing oil fields as well as future discoveries. The most influential production model is Hubbert peak theory, first proposed in the 1950s. The effect of peak oil on the world economy remains controversial.

The 1980s oil glut was a significant surplus of crude oil caused by falling demand following the 1970s energy crisis. The world price of oil had peaked in 1980 at over US$35 per barrel ; it fell in 1986 from $27 to below $10. The glut began in the early 1980s as a result of slowed economic activity in industrial countries due to the crises of the 1970s, especially in 1973 and 1979, and the energy conservation spurred by high fuel prices. The inflation-adjusted real 2004 dollar value of oil fell from an average of $78.2 in 1981 to an average of $26.8 per barrel in 1986.

The Age of Oil, also known as the Oil Age, the Petroleum Age, or the Oil Boom, refers to the era in human history characterised by an increased use of petroleum in products and as fuel. Though unrefined petroleum has been used for various purposes since ancient times, it was during the 19th century that refinement techniques were developed and gasoline engines were created.

In the United States, synthetic fuels are of increasing importance due to the price of crude oil, and geopolitical and economic considerations.

The 1970s energy crisis occurred when the Western world, particularly the United States, Canada, Western Europe, Australia, and New Zealand, faced substantial petroleum shortages as well as elevated prices. The two worst crises of this period were the 1973 oil crisis and the 1979 energy crisis, when, respectively, the Yom Kippur War and the Iranian Revolution triggered interruptions in Middle Eastern oil exports.