A nonprofit organization (NPO) or non-profit organization, also known as a non-business entity, or nonprofit institution, is a legal entity organized and operated for a collective, public or social benefit, in contrary with an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without securing tax-exempt status.

The Christian Coalition of America (CCA), a 501(c)(4) organization, is the successor to the original Christian Coalition created in 1987 by religious broadcaster and former presidential candidate Marion Gordon "Pat" Robertson. This US Christian advocacy group includes members of various Christian denominations, including Baptists (50%), mainline Protestants (25%), Roman Catholics (16%), and Pentecostals among communicants of other churches.

The Georgetown University Law Center is the law school of Georgetown University, a private research university in Washington, D.C., United States. It was established in 1870 and is the largest law school in the United States by enrollment and the most applied to, receiving more full-time applications than any other law school in the country.

Metropolitan Washington Council of Governments (MWCOG) is an independent, nonprofit association where area leaders address regional issues affecting the District of Columbia, suburban Maryland, and Northern Virginia. MWCOG comprises 24 local governments in the Washington metropolitan area, as well as area members of the Maryland and Virginia state legislatures, the U.S. Senate, and the U.S. House of Representatives. About 300 local, state, and federally elected officials make up its membership. It was founded in 1957 and formally incorporated on May 28, 1965.

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

Bread for the World is a non-partisan Christian advocacy organization based in the United States that advocates for policy changes to end hunger and helps others do the same, which might include politicians meeting with their constituents and working in coalition with other organizations.

The Los Angeles LGBT Center is a provider of programs and services for lesbian, gay, bisexual and transgender people. The organization's work spans four categories, including health, social services, housing, and leadership and advocacy. The center is the largest facility in the world providing services to LGBT people.

Laws regulating nonprofit organizations, nonprofit corporations, non-governmental organizations, and voluntary associations vary in different jurisdictions. They all play a critical role in addressing social, economic, and environmental issues. These organizations operate under specific legal frameworks that are regulated by the respective jurisdictions in which they operate.

In the United States, Tax Day is the day on which individual income tax returns are due to be submitted to the federal government. Since 1955, Tax Day has typically fallen on or just after April 15. Tax Day was first introduced in 1913, when the Sixteenth Amendment was ratified.

So Others Might Eat (SOME) is a nonprofit organization that provides services to assist those dealing with poverty and homelessness in Washington, D.C. The organization provides affordable housing, job training, counseling and other healthcare services, and daily needs such as food and clothing to the poor and homeless. It spends the largest portion of its annual budget on affordable housing, with a majority of its residents recovering from addiction. SOME describes its mission as helping "our vulnerable neighbors in Washington, DC, break the cycle of homelessness through our comprehensive and transformative services".

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

A private foundation is a tax-exempt organization that does not rely on broad public support and generally claims to serve humanitarian purposes.

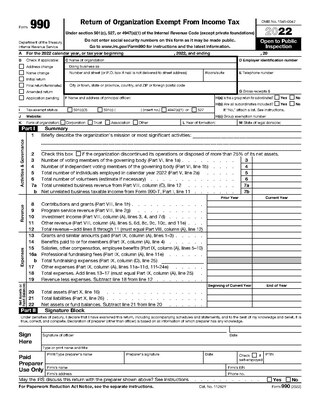

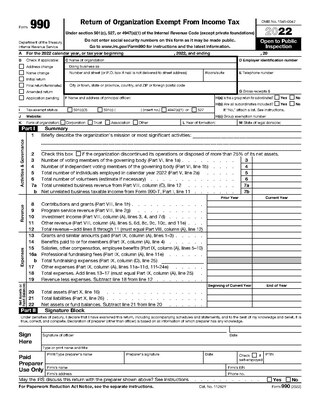

Form 990 is a United States Internal Revenue Service (IRS) form that provides the public with information about a nonprofit organization. It is also used by government agencies to prevent organizations from abusing their tax-exempt status. Some nonprofits, such as hospitals and other healthcare organizations, have more comprehensive reporting requirements.

Mary Margaret Richardson was an American tax lawyer. She served as Commissioner of Internal Revenue at the Internal Revenue Service (IRS) from 1993 to 1997. She was the second woman to hold the position, after her immediate predecessor, Shirley D. Peterson.

Scientology was founded in the United States by science fiction author L. Ron Hubbard and is now practiced in many other countries.

The Internal Revenue Service (IRS) is the revenue service for the United States federal government, which is responsible for collecting U.S. federal taxes and administering the Internal Revenue Code, the main body of the federal statutory tax law. It is an agency of the Department of the Treasury and led by the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The duties of the IRS include providing tax assistance to taxpayers; pursuing and resolving instances of erroneous or fraudulent tax filings; and overseeing various benefits programs, including the Affordable Care Act.

The clergy housing allowance is an allowance paid to ordained ministers and rabbis in Canada and the United States.

The Church of Scientology International (CSI) is a California 501(c)(3) non-profit corporation. Within the worldwide network of Scientology corporations and entities, CSI is officially referred to as the "mother church" of the Church of Scientology.

Safe Horizon, formerly the Victim Services Agency, is the largest victim services nonprofit organization in the United States, providing social services for victims of abuse and violent crime. Operating at 57 locations throughout the five boroughs of New York City. Safe Horizon provides social services to over 250,000 victims of violent crime and abuse and their families per year. It has over 800 employees, and has programs for victims of domestic violence, child abuse, sexual assault, and human trafficking, as well as homeless youth and the families of homicide victims. Safe Horizon's website has been accessible for the Spanish-speaking population since 2012. Safe Horizon has an annual budget of over $63 million.