Palladium is a chemical element; it has symbol Pd and atomic number 46. It is a rare and lustrous silvery-white metal discovered in 1802 by the English chemist William Hyde Wollaston. He named it after the asteroid Pallas, which was itself named after the epithet of the Greek goddess Athena, acquired by her when she slew Pallas. Palladium, platinum, rhodium, ruthenium, iridium and osmium form a group of elements referred to as the platinum group metals (PGMs). They have similar chemical properties, but palladium has the lowest melting point and is the least dense of them.

A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

Precious metals are rare, naturally occurring metallic chemical elements of high economic value. Precious metals, particularly the noble metals, are more corrosion resistant and less chemically reactive than most elements. They are usually ductile and have a high lustre. Historically, precious metals were important as currency but are now regarded mainly as investment and industrial raw materials. Gold, silver, platinum, and palladium each have an ISO 4217 currency code.

The London Metal Exchange (LME) is a futures and forwards exchange in London, United Kingdom with the world's largest market in standardised forward contracts, futures contracts and options on base metals. The exchange also offers contracts on ferrous metals and precious metals. The company also allows for cash trading. It offers hedging, worldwide reference pricing, and the option of physical delivery to settle contracts.

Bullion is non-ferrous metal that has been refined to a high standard of elemental purity. The term is ordinarily applied to bulk metal used in the production of coins and especially to precious metals such as gold and silver. It comes from the Anglo-Norman term for a melting-house where metal was refined, and earlier from French bouillon, "boiling". Although precious metal bullion is no longer used to make coins for general circulation, it continues to be held as an investment with a reputation for stability in periods of economic uncertainty. To assess the purity of gold bullion, the centuries-old technique of fire assay is still employed, together with modern spectroscopic instrumentation, to accurately determine its quality.

The London Gold Fixing is the setting of the price of gold that takes place via a dedicated conference line. It was formerly held on the London premises of Nathan Mayer Rothschild & Sons by the members of The London Gold Market Fixing Ltd.

The bid–ask spread is the difference between the prices quoted for an immediate sale (ask) and an immediate purchase (bid) for stocks, futures contracts, options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless asset.

Johnson Matthey plc is a British multinational speciality chemicals and sustainable technologies company headquartered in London, England. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.

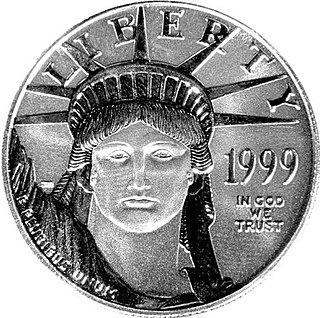

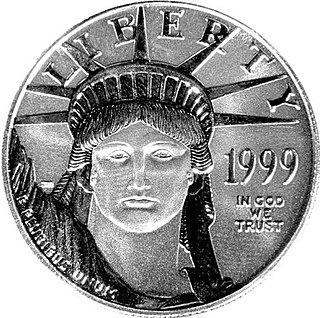

A bullion coin is a coin struck from highly refined precious metal (bullion) and kept as a store of value or an investment rather than used in day-to-day commerce. A bullion coin is distinguished by its weight and fineness on the coin. Unlike rounds, bullion coins are minted by government mints and have a legal tender face value. Bullion coins can have fineness ranging from 91.9% to 99.99% purity.

Of all the precious metals, gold is the most popular as an investment. Investors generally buy gold as a way of diversifying risk, especially through the use of futures contracts and derivatives. The gold market is subject to speculation and volatility as are other markets. Compared to other precious metals used for investment, gold has been the most effective safe haven across a number of countries.

Silver may be used as an investment like other precious metals. It has been regarded as a form of money and store of value for more than 4,000 years, although it lost its role as legal tender in developed countries when the use of the silver standard came to an end in 1935. Some countries mint bullion and collector coins, however, such as the American Silver Eagle with nominal face values. In 2009, the main demand for silver was for industrial applications (40%), jewellery, bullion coins, and exchange-traded products. In 2011, the global silver reserves amounted to 530,000 tonnes.

GFMS are research and consultancy company for the precious metal markets. Since 2011 they have been part of Thomson Reuters. As well as other commodities, they research gold, silver, platinum, palladium, and copper trading.

The London Bullion Market Association, established in 1987, is the international trade association representing the global Over The Counter (OTC) bullion market, and defines itself as "the global authority on precious metals". It has a membership of approximately 150 firms globally, including traders, refiners, producers, miners, fabricators, as well as those providing storage and secure carrier services.

Platinum as an investment is often compared in financial history to gold and silver, which were both known to be used as money in ancient civilizations. Experts posit that platinum is about 15–20 times scarcer than gold and approximately 60–100 times scarcer than silver, on the basis of annual mine production. Since 2014, platinum prices have fallen lower than gold. Approximately 75% of global platinum is mined in South Africa.

Rand Refinery (Pty) Limited is the largest integrated single-site precious metals refining and smelting complex in the world. It was established in 1920 to refine gold within South Africa which until that time had been refined in London.

ScotiaMocatta, originally founded as Mocatta Bullion in 1684, was a precious metal and base metal trading company that operated as the metals trading division of the Bank of Nova Scotia (Scotiabank) from 1997 until January 2019.

MKS (Switzerland) SA is a trader of precious metals. Based in Geneva, the group employs approximately 1,500 workers. MKS is an associate of the London Bullion Market Association (LBMA), and its subsidiary PAMP has been on the LBMA’s Gold List, widely recognised in the financial services industry as the indicator of quality, since 1987.

The London bullion market is a wholesale over-the-counter market for the trading of gold, silver, platinum and palladium. Trading is conducted amongst members of the London Bullion Market Association (LBMA), tightly overseen by the Bank of England. Most of the members are major international banks or bullion dealers and refiners.

Pallion designs, manufactures, and distributes precious metal products and related services. It is the largest precious metal services group in Australasia. Pallion is the result of the merger in 2014 of the ABC Bullion and Palloys Group of companies founded in 1972 and 1951 respectively. The group maintains its headquarters in Sydney NSW Australia and is a wholly privately owned group of companies with manufacturing facilities and offices in Sydney, Melbourne, Brisbane and Perth in Australia, Hong Kong (SAR), mainland China, Thailand and Western Europe.

PAMP SA is an independently operated precious metals refining and fabricating company and member of the MKS Group. It was established in 1977 in Ticino, Switzerland.