This aims to be a complete list of the articles on real estate.

Owner-occupancy or home-ownership is a form of housing tenure in which a person, called the owner-occupier, owner-occupant, or home owner, owns the home in which they live. The home can be a house, such as a single-family house, an apartment, condominium, or a housing cooperative. In addition to providing housing, owner-occupancy also functions as a real estate investment.

Real estate economics is the application of economic techniques to real estate markets. It tries to describe, explain, and predict patterns of prices, supply, and demand. The closely related field of housing economics is narrower in scope, concentrating on residential real estate markets, while the research on real estate trends focuses on the business and structural changes affecting the industry. Both draw on partial equilibrium analysis, urban economics, spatial economics, basic and extensive research, surveys, and finance.

In the United Kingdom, the Retail Prices Index or Retail Price Index (RPI) is a measure of inflation published monthly by the Office for National Statistics. It measures the change in the cost of a representative sample of retail goods and services.

Subsidized housing is government sponsored economic assistance aimed towards alleviating housing costs and expenses for impoverished people with low to moderate incomes. In the United States, subsidized housing is often called "affordable housing". Forms of subsidies include direct housing subsidies, non-profit housing, public housing, rent supplements/vouchers, and some forms of co-operative and private sector housing. According to some sources, increasing access to housing may contribute to lower poverty rates.

A real-estate bubble or property bubble is a type of economic bubble that occurs periodically in local or global real estate markets, and it typically follows a land boom. A land boom is a rapid increase in the market price of real property such as housing until they reach unsustainable levels and then declines. This period, during the run-up to the crash, is also known as froth. The questions of whether real estate bubbles can be identified and prevented, and whether they have broader macroeconomic significance, are answered differently by schools of economic thought, as detailed below.

Buy-to-let is a British phrase referring to the purchase of a property specifically to let out, that is to rent it out. A buy-to-let mortgage is a mortgage loan specifically designed for this purpose. Buy-to-let properties are usually residential but the term also encompasses student property investments and hotel room investments.

Affordable housing is housing which is deemed affordable to those with a household income at or below the median as rated by the national government or a local government by a recognized housing affordability index. Most of the literature on affordable housing refers to mortgages and a number of forms that exist along a continuum – from emergency homeless shelters, to transitional housing, to non-market rental, to formal and informal rental, indigenous housing, and ending with affordable home ownership.

Workforce housing is a term that is increasingly used by planners, government, and organizations concerned with housing policy or advocacy. It is gaining cachet with realtors, developers and lenders. Workforce housing can refer to any form of housing, including ownership of single or multi-family homes, as well as occupation of rental units. Workforce housing is generally understood to mean affordable housing for households with earned income that is insufficient to secure quality housing in reasonable proximity to the workplace.

A starter home or starter house is a house that is usually the first which a person or family can afford to purchase, often using a combination of savings and mortgage financing. In the real estate industry the term commonly denotes small one- or two-bedroom houses, often older homes but sometimes low-cost new developments. The concept originated in the United States during the post-World War II era when entry-level home ownership was a preferred option for young families and regarded as part of the American Dream.

Home ownership in Australia is considered a key cultural icon, and part of the Australian tradition known as the Great Australian Dream of "owning a detached house on a fenced block of land." Home ownership has been seen as creating a responsible citizenry; according to a former Premier of Victoria: "The home owner feels that he has a stake in the country, and that he has something worth working for, living for, fighting for."

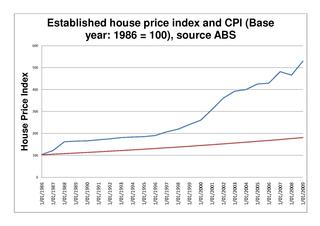

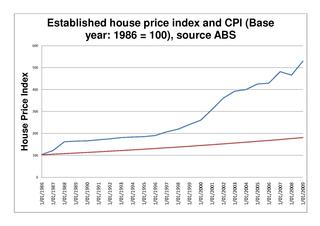

The Australian property bubble is the economic theory that the Australian property market has become or is becoming significantly overpriced and due for a significant downturn. Since the early 2010s, various commentators, including one Treasury official, have claimed the Australian property market is in a significant bubble.

A housing affordability index (HAI) is an index that measures housing affordability, usually the degree to which the median person or family in a particular country or region can afford housing/housing-related costs.

Affordable housing in Canada is living spaces that are deemed financially accessible to those with a median household income in Canada. The property ladder continuum of affordable housing in Canada includes market, non-market, and government-subsidized housing.

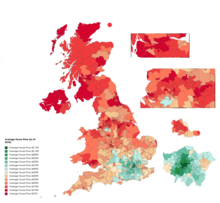

Housing in the United Kingdom represents the largest non-financial asset class in the UK; its overall net value passed the £5 trillion mark in 2014. Housing includes modern and traditional styles. About 30% of homes are owned outright by their occupants, and a further 40% are owner-occupied on a mortgage. About 18% are social housing of some kind, and the remaining 12% are privately rented.

The Median multiple or Median house price to income ratio is a housing indicator used to indicate the affordability of housing in any given community. The Median house price to income ratio WAS the primary indicator H1 of the 1991 World Bank/UNCHS Housing Indicator system. It was subsequently used as a measure of affordability by the UN Commission for Sustainable Development, the National Association of Realtors, State of the Environment 2003 Tasmania; and the Mortgage Guide UK along with many other organisations.

The property bubble in New Zealand is a major national economic and social issue. Since the early 1990s, house prices in New Zealand have risen considerably faster than incomes, putting increasing pressure on public housing providers as fewer households have access to housing on the private market. The property bubble has produced significant impacts on inequality in New Zealand, which now has one of the highest homelessness rate in the OECD and a record-high waiting list for public housing. Government policies have attempted to address the crisis since 2013, but have produced limited impacts to reduce prices or increase the supply of affordable housing. However, prices started falling in 2022 in response to tightening of mortgage availability and supply increasing. Some areas saw drops as high as around 9% - albeit from very high prices.

Since about 1970, California has been experiencing an extended and increasing housing shortage, such that by 2018, California ranked 49th among the states of the U.S. in terms of housing units per resident. This shortage has been estimated to be 3-4 million housing units as of 2017. Experts say that California needs to double its current rate of housing production to keep up with expected population growth and prevent prices from further increasing, and needs to quadruple the current rate of housing production over the next seven years in order for prices and rents to decline.

Affordable housing is housing that is deemed affordable to those with a median household income as rated by the national government or a local government by a recognized housing affordability index. A general rule is no more than 30% of gross monthly income should be spent on housing, to be considered affordable as the challenges of promoting affordable housing varies by location.

The Canadian property bubble refers to a significant rise in Canadian real estate prices from 2002 to present which some observers have called a real estate bubble. The Dallas Federal reserve rated Canadian real estate as "exuberant" beginning in 2003. From 2003 to 2018, Canada saw an increase in home and property prices of up to 337% in some cities. In 2016, the OECD warned that Canada's financial stability was at risk due to elevated housing prices, investment and household debt. By 2018, home-owning costs were above 1990 levels when Canada saw its last housing bubble burst. Bloomberg Economics ranked Canada as the second largest housing bubble across the OECD in 2019 and 2021. Toronto scored the highest in the world in Swiss bank UBS' real estate bubble index in 2022, with Vancouver also scoring among the 10 riskiest cities in the world. By 2023 Canada’s nonfinancial debt exceeded 300% of GDP and household debt surpassed 100% of GDP, both higher than the levels seen in the United States before the 2008 global financial crisis.