Related Research Articles

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution funded by 190 member countries, with headquarters in Washington, D.C. It is regarded as the global lender of last resort to national governments, and a leading supporter of exchange-rate stability. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world."

Hans Eichel is a German politician (SPD) and the co-founder of the G20, or "Group of Twenty", an international forum for the governments and central bank governors of twenty developed and developing nations to discuss policy issues pertaining to the promotion of international financial stability.

Marek Marian Belka is a Polish professor of economics and politician who has served as Prime Minister of Poland and Finance Minister of Poland in two governments. He is a former director of the International Monetary Fund's (IMF) European Department and former Head of Narodowy Bank Polski. He has served as a Member of the European Parliament (MEP) since July 2019.

The Group of Seven (G7) is an intergovernmental political and economic forum consisting of Canada, France, Germany, Italy, Japan, the United Kingdom and the United States; additionally, the European Union (EU) is a "non-enumerated member". It is organized around shared values of pluralism, liberal democracy, and representative government. G7 members are major IMF advanced economies.

The Group of 22 was announced by the leaders of APEC in 1997. The intention was to convene a number of meetings between finance ministers and central bank governors to make proposals on reform of the global financial system. The Group of 22 comprised members of the then-G8 and 14 other countries. It first met in 1998 in Washington, D.C., US, to consider the stability of the international financial system and capital markets. In 1999, it was superseded by the Group of 33, which itself was superseded by the Group of 20 (G-20) later that year.

The Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development, or The Group of 24 (G-24) was established in 1971 as a chapter of the Group of 77 in order to help coordinate the positions of developing countries on international monetary and development finance issues, as well as and to ensure that their interests are adequately represented in negotiations on international monetary matters. Though originally named after the number of founding Member States, it now has 28 Members. Although the G-24 officially has 28 member countries, any member of the G-77 can join discussions.

The G20 or Group of 20 is an intergovernmental forum comprising 19 sovereign countries, the European Union (EU), and the African Union (AU). It works to address major issues related to the global economy, such as international financial stability, climate change mitigation and sustainable development.

Singapore 2006 was a group of several concurrent events that were held in Singapore in support of the 61st Annual Meetings of the Boards of Governors of the International Monetary Fund and the World Bank Group. The opening ceremony and plenary sessions for the main meetings took place from 19–20 September 2006 at the Suntec Singapore International Convention and Exhibition Centre (SSICEC) in Marina Centre. The ministers of G8, G10 and G24 coincided with the event on 16 September. Registration for event delegates began on 11 September 2006 at City Hall, and the three-day Program of Seminars from 16 September 2006 at the Pan Pacific Singapore. Other concurrent events that were held at various venues include the Singapore Biennale 2006, the Raffles Forum 2006, Indonesia Day and the Global Emerging Markets Investors Forum and Networking Reception.

The 2006 G20 Meeting of Finance Ministers and Central Bank Governors was held in Melbourne, Australia between 18 and 19 November 2006. Issues discussed included "the outlook for the global economy; developments in resource markets and ways to improve their efficiency; the impact of demographic change on global financial markets; and further reform of the International Monetary Fund and the World Bank."

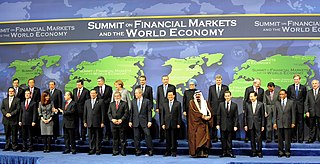

The 2008 G20 Washington Summit on Financial Markets and the World Economy took place on November 14–15, 2008, in Washington, D.C., United States. It achieved general agreement amongst the G20 on how to cooperate in key areas so as to strengthen economic growth, deal with the 2008 financial crisis, and lay the foundation for reform to avoid similar crises in the future. The Summit resulted from an initiative by the French and European Union President, Nicolas Sarkozy, Australian Prime Minister Kevin Rudd, and the British Prime Minister, Gordon Brown. In connection with the G7 finance ministers on October 11, 2008, United States President George W. Bush stated that the next meeting of the G20 would be important in finding solutions to the economic crisis. Since many economists and politicians called for a new Bretton Woods system to overhaul the world's financial structure, the meeting has sometimes been described by the media as Bretton Woods II.

The Financial Stability Forum (FSF) was a group consisting of major national financial authorities such as finance ministries, central bankers, and international financial bodies. It was first convened in April 1999 in Washington. At the 2009 G20 London summit, the G20 nations established a successor to the FSF, called the Financial Stability Board with an expanded membership and broadened mandate.

The Chiang Mai Initiative (CMI) is a multilateral currency swap arrangement among the ten members of the Association of Southeast Asian Nations (ASEAN), the People's Republic of China, Japan, and South Korea. It draws from a foreign exchange reserves pool worth US$120 billion and was launched on 24 March 2010. That pool has been expanded to $240 billion in 2012.

Malcolm D. Knight is a Canadian economist, policymaker and banker. He is currently Visiting Professor of Finance at the London School of Economics and Political Science and a Distinguished Fellow at the Center for International Governance Innovation. From 2008 to 2012, Knight was Vice Chairman of Deutsche Bank Group where he was responsible for developing and coordinating the bank's global approach to issues in financial regulation, supervision, and financial stability. He served as general manager of the Bank for International Settlements from 2003 to 2008 and as Senior Deputy Governor of the Bank of Canada (1999-2003), after holding senior positions at the International Monetary Fund (1975-1999).

The 2009 G20 London Summit was the second meeting of the G20 heads of government/heads of state, which was held in London on 2 April 2009 at the ExCeL Exhibition Centre to discuss financial markets and the world economy. It followed the first G20 Leaders Summit on Financial Markets and the World Economy, which was held in Washington, D.C., on 14–15 November 2008. Heads of government or heads of state from the G20 attended, with some regional and international organisations also represented. Due to the extended membership, it has been referred to as the London Summit.

The Financial Stability Board (FSB) is an international body that monitors and makes recommendations about the global financial system. It was established in the 2009 G20 Pittsburgh Summit as a successor to the Financial Stability Forum (FSF). The Board includes all G20 major economies, FSF members, and the European Commission. Hosted and funded by the Bank for International Settlements, the board is based in Basel, Switzerland, and is established as a not-for-profit association under Swiss law.

Domenico Lombardi is a former director of the Global Economy program at the Centre for International Governance Innovation (CIGI), a non-partisan global governance think tank in Waterloo, Ontario, Canada. He is also chair of the Oxford Institute for Economic Policy. Until 2013 he was a senior fellow at the Brookings Institution.

This article is a list of all notable reaction to James Tobin's 1972 proposal of what is now known as the Tobin tax.

The Currency War of 2009–2011 was an episode of competitive devaluation which became prominent in the financial press in September 2010. It involved states competing with each other in order to achieve a relatively low valuation for their own currency, so as to assist their domestic industry. Due to the Great Recession, the export sectors of many emerging economies experienced declining orders and from 2009, several states began or increased their levels of currency intervention. According to many analysts the currency war had largely fizzled out by mid-2011 although the war rhetoric persisted into the following year. In 2013, there were concerns of an outbreak of another currency war, this time between Japan and the Euro-zone.

Liviu Voinea has been Alternate Executive Director at the World Bank since March 1, 2024. Between August 2019 and August 2023 he was Romania's representative to the International Monetary Fund and Senior Advisor to the IMF Executive Director. In this capacity he was a member of the executive board of the International Monetary Fund. He also represented Montenegro to the IMF.

Canada is one of the original members of the International Monetary Fund, having joined it on December 27, 1945. It has a quota of 11,023.9 million SDRs and 11,698 votes, 2.31% of the total IMF quota and votes, ranking the 9th of all. Canada has been represented on the IMF Board of Governors by Minister of Finance Chrystia Freeland since 2020. Canada elects an executive director on the fund's Executive Board with Antigua and Barbuda, Barbados, Ireland, Bahamas, Belize, Dominica, Grenada, Jamaica, St. Kitts and Nevis, St. Lucia, St. Vincent and the Grenadines. Philip John Jennings is the elected alternate director. Canada is the only G7 country that represents both lenders and borrowers at the IMF.

References

- ↑ "Singapore takes flak for ban on protests". The Sunday Times (Singapore) . 2006-09-10. Archived from the original on 2006-09-14. Retrieved 2006-09-10.

- ↑ "2002 Annual Meetings -- International Monetary Fund and World Bank Group".

- ↑ "2003 Annual Meetings. -- World Bank Group and International Monetary Fund".

- ↑ "2004 Annual Meetings -- International Monetary Fund and World Bank Group".

- ↑ "2005 Annual Meetings -- International Monetary Fund and World Bank Group".

- ↑ "2006 Annual Meetings -- International Monetary Fund and World Bank Group".

- ↑ "2007 Annual Meetings -- World Bank Group and International Monetary Fund".

- ↑ "2008 Annual Meetings -- International Monetary Fund and World Bank Group".

- ↑ "Annual Meetings : Home".

- ↑ "Annual Meetings 2010 : Home".

- ↑ "Annual Meetings 2011 : Home".

- ↑ "Press Release: IMF and World Bank Group to Hold 2012 Annual Meetings".

- ↑ "Annual Meetings 2013 of the World Bank Group and International Monetary Fund, October 11-13, 2013".

- ↑ GW Today - Five Updates on the Global Economy from Christine Lagarde’s ‘Hardtalk’ Interview

- ↑ "2014 Annual Meetings".

- ↑ "2015 Annual Meetings".

- ↑ "2016 Annual Meetings of the IMF and the World Bank Group, Washington DC - October 7-9, 2016".

- ↑ "2017 Annual Meetings of the World Bank Group and the IMF, Washington, DC, October 9-15, 2017".

- ↑ "Home".

- ↑ "Annual Meetings".

- ↑ "Annual". IMF. Retrieved 2023-08-26.