This article relies largely or entirely on a single source .(February 2016) |

| |

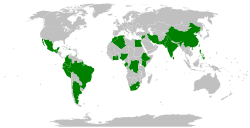

Members of the Group of 24 as of 2019 | |

| Abbreviation | G-24 |

|---|---|

| Named after | Number of founding Member States |

| Formation | 1971 |

| Founder | Group of 77 |

| Founded at | Lima, Peru |

| Type | Intergovernmental trade bloc |

| Purpose | To aid in the coordination of the positions of developing countries on monetary and development issues |

| Headquarters | Washington, D.C., United States |

| Methods | Collective bargaining, lobbying, reports and studies |

| Fields | International trade |

| Membership | 29 Member States (2019) |

Chair of the G-24 | Adama Coulibaly (Adama Coulibaly in French) |

Parent organization | Group of 77 |

| Affiliations | United Nations |

| Website | www.g24.org |

The Intergovernmental Group of Twenty-Four on International Monetary Affairs and Development, or The Group of 24 (G-24) was established in 1971 as a chapter of the Group of 77 in order to help coordinate the positions of developing countries on international monetary and development finance issues, as well as and to ensure that their interests are adequately represented in negotiations on international monetary matters. Though originally named after the number of founding Member States, it now has 28 Members (plus China, which acts as a Special Invitee). [1] Although the G-24 officially has 28 member countries, any member of the G-77 can join discussions. By the 1st of November 2025, Nigeria, will assume the chairmanship of the Group. [2]

Contents

- Member states

- Observers

- Organization

- Leadership

- Political leadership

- Secretariat

- Chair

- Research and publications

- References

- External links

Although the group is not an organ of the International Monetary Fund, the IMF provides secretariat services for the Group. It meets biannually, first prior to the International Monetary and Financial Committee, and secondly prior to the Joint Ministerial Committee of the Boards of Governors of the Bank and the Fund. These meetings allow developing country members to discuss agenda items prior to these important meetings of the IMF/World Bank.