Gnumeric is a spreadsheet program that is part of the GNOME Free Software Desktop Project. Gnumeric version 1.0 was released on 31 December 2001. Gnumeric is distributed as free software under the GNU General Public License; it is intended to replace proprietary spreadsheet programs like Microsoft Excel. Gnumeric was created and developed by Miguel de Icaza, but he has since moved on to other projects. The maintainer as of 2002 was Jody Goldberg.

Microsoft Excel is a spreadsheet developed by Microsoft for Windows, macOS, Android and iOS. It features calculation or computation capabilities, graphing tools, pivot tables, and a macro programming language called Visual Basic for Applications (VBA). Excel forms part of the Microsoft Office suite of software.

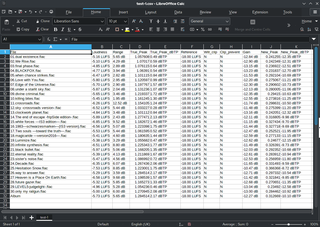

A spreadsheet is a computer application for computation, organization, analysis and storage of data in tabular form. Spreadsheets were developed as computerized analogs of paper accounting worksheets. The program operates on data entered in cells of a table. Each cell may contain either numeric or text data, or the results of formulas that automatically calculate and display a value based on the contents of other cells. The term spreadsheet may also refer to one such electronic document.

Visual Basic for Applications (VBA) is an implementation of Microsoft's Event-Driven Programming language Visual Basic 6.0 built into most desktop Microsoft Office applications. Although based on pre-.NET Visual Basic, which is no longer supported or updated by Microsoft, the VBA implementation in Office continues to be updated to support new Office features. VBA is used for professional and end-user development due to its perceived ease-of-use, Office's vast installed userbase, and extensive legacy in business.

Monte Carlo methods, or Monte Carlo experiments, are a broad class of computational algorithms that rely on repeated random sampling to obtain numerical results. The underlying concept is to use randomness to solve problems that might be deterministic in principle. They are often used in physical and mathematical problems and are most useful when it is difficult or impossible to use other approaches. Monte Carlo methods are mainly used in three problem classes: optimization, numerical integration, and generating draws from a probability distribution.

The Microsoft Windows Script Host (WSH) is an automation technology for Microsoft Windows operating systems that provides scripting abilities comparable to batch files, but with a wider range of supported features. This tool was first provided on Windows 95 after Build 950a on the installation discs as an optional installation configurable and installable by means of the Control Panel, and then a standard component of Windows 98 and subsequent and Windows NT 4.0 Build 1381 and by means of Service Pack 4. The WSH is also a means of automation for Internet Explorer via the installed WSH engines from IE Version 3.0 onwards; at this time VBScript became means of automation for Microsoft Outlook 97. The WSH is also an optional install provided with a VBScript and JScript engine for Windows CE 3.0 and following and some third-party engines including Rexx and other forms of Basic are also available.

Monte Carlo methods are used in corporate finance and mathematical finance to value and analyze (complex) instruments, portfolios and investments by simulating the various sources of uncertainty affecting their value, and then determining the distribution of their value over the range of resultant outcomes. This is usually done by help of stochastic asset models. The advantage of Monte Carlo methods over other techniques increases as the dimensions of the problem increase.

In mathematical finance, a Monte Carlo option model uses Monte Carlo methods to calculate the value of an option with multiple sources of uncertainty or with complicated features. The first application to option pricing was by Phelim Boyle in 1977. In 1996, M. Broadie and P. Glasserman showed how to price Asian options by Monte Carlo. An important development was the introduction in 1996 by Carriere of Monte Carlo methods for options early exercise features.

A pivot table is a table of grouped values that aggregates the individual items of a more extensive table within one or more discrete categories. This summary might include sums, averages, or other statistics, which the pivot table groups together using a chosen aggregation function applied to the grouped values.

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment.

GNU MCSim is a suite of simulation software. It allows one to design one's own statistical or simulation models, perform Monte Carlo simulations, and Bayesian inference through (tempered) Markov chain Monte Carlo simulations. The latest version allows parallel computing of Monte Carlo or MCMC simulations.

Psychometric software is software that is used for psychometric analysis of data from tests, questionnaires, or inventories reflecting latent psychoeducational variables. While some psychometric analyses can be performed with standard statistical software like SPSS, most analyses require specialized tools.

XLfit is a Microsoft Excel-based plug-in that performs regression analysis, curve fitting, and statistical analysis. XLfit generates 2D and 3D graphs and analyses data sets produced by any type of research. XLfit can make linear and non-linear curve fits, smoothing, statistics, weighting, and error bars.

Ecolego is a simulation software tool that is used for creating dynamic models and performing deterministic and probabilistic simulations. It is also used for conducting risk assessments of complex dynamic systems evolving over time.

Microsoft Office shared tools are software components that are included in all Microsoft Office products.

The Public Sector Credit Framework is an open source tool for estimating the default risk of and assigning ratings to government debt. The PSCF installation package was released on May 2, 2012. At the same time, source code was published on GitHub. The publishers, PF2 Securities Evaluations and Public Sector Credit Solutions, said that they released the software in response to the need for "transparent, objective and up-to-date government credit ratings." The project has similar goals to an earlier mass collaboration bond rating effort, Wikirating.

Sparx Systems Enterprise Architect is a visual modeling and design tool based on the OMG UML. The platform supports: the design and construction of software systems; modeling business processes; and modeling industry based domains. It is used by businesses and organizations to not only model the architecture of their systems, but to process the implementation of these models across the full application development life-cycle.

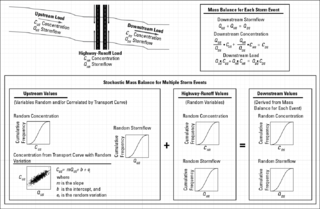

The stochastic empirical loading and dilution model (SELDM) is a stormwater quality model. SELDM is designed to transform complex scientific data into meaningful information about the risk of adverse effects of runoff on receiving waters, the potential need for mitigation measures, and the potential effectiveness of such management measures for reducing these risks. The U.S. Geological Survey developed SELDM in cooperation with the Federal Highway Administration to help develop planning-level estimates of event mean concentrations, flows, and loads in stormwater from a site of interest and from an upstream basin. SELDM uses information about a highway site, the associated receiving-water basin, precipitation events, stormflow, water quality, and the performance of mitigation measures to produce a stochastic population of runoff-quality variables. Although SELDM is, nominally, a highway runoff model is can be used to estimate flows concentrations and loads of runoff-quality constituents from other land use areas as well. SELDM was developed by the U.S. Geological Survey so the model, source code, and all related documentation are provided free of any copyright restrictions according to U.S. copyright laws and the USGS Software User Rights Notice. SELDM is widely used to assess the potential effect of runoff from highways, bridges, and developed areas on receiving-water quality with and without the use of mitigation measures. Stormwater practitioners evaluating highway runoff commonly use data from the Highway Runoff Database (HRDB) with SELDM to assess the risks for adverse effects of runoff on receiving waters.

SolverStudio is a free Excel plug-in developed at the University of Auckland that supports optimization and simulation modelling in a spreadsheet using an algebraic modeling language. It is popular in education, the public sector and industry for optimization users because it uses industry-standard modelling languages and is faster than traditional Excel optimisation approaches.