The economy of Denmark is a modern high-income and highly developed mixed economy. The economy of Denmark is dominated by the service sector with 80% of all jobs, whereas about 11% of all employees work in manufacturing and 2% in agriculture. The nominal gross national income per capita was the ninth-highest in the world at $68,827 in 2023.

Environmental economics is a sub-field of economics concerned with environmental issues. It has become a widely studied subject due to growing environmental concerns in the twenty-first century. Environmental economics "undertakes theoretical or empirical studies of the economic effects of national or local environmental policies around the world. ... Particular issues include the costs and benefits of alternative environmental policies to deal with air pollution, water quality, toxic substances, solid waste, and global warming."

Environmental finance is a field within finance that employs market-based environmental policy instruments to improve the ecological impact of investment strategies. The primary objective of environmental finance is to regress the negative impacts of climate change through pricing and trading schemes. The field of environmental finance was established in response to the poor management of economic crises by government bodies globally. Environmental finance aims to reallocate a businesses resources to improve the sustainability of investments whilst also retaining profit margins.

In economics, an externality or external cost is an indirect cost or benefit to an uninvolved third party that arises as an effect of another party's activity. Externalities can be considered as unpriced goods involved in either consumer or producer market transactions. Air pollution from motor vehicles is one example. The cost of air pollution to society is not paid by either the producers or users of motorized transport to the rest of society. Water pollution from mills and factories is another example. All consumers are made worse off by pollution but are not compensated by the market for this damage. A positive externality is when an individual's consumption in a market increases the well-being of others, but the individual does not charge the third party for the benefit. The third party is essentially getting a free product. An example of this might be the apartment above a bakery receiving the benefit of enjoyment from smelling fresh pastries every morning. The people who live in the apartment do not compensate the bakery for this benefit.

This aims to be a complete article list of economics topics:

A subsidy or government incentive is a type of government expenditure for individuals and households, as well as businesses with the aim of stabilizing the economy. It ensures that individuals and households are viable by having access to essential goods and services while giving businesses the opportunity to stay afloat and/or competitive. Subsidies not only promote long term economic stability but also help governments to respond to economic shocks during a recession or in response to unforeseen shocks, such as the COVID-19 pandemic.

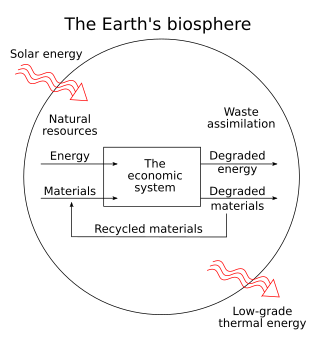

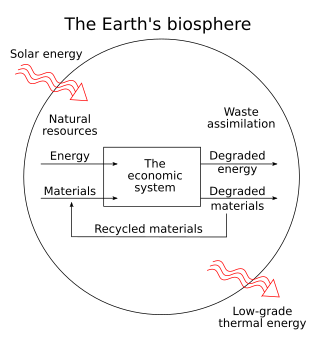

Ecological economics, bioeconomics, ecolonomy, eco-economics, or ecol-econ is both a transdisciplinary and an interdisciplinary field of academic research addressing the interdependence and coevolution of human economies and natural ecosystems, both intertemporally and spatially. By treating the economy as a subsystem of Earth's larger ecosystem, and by emphasizing the preservation of natural capital, the field of ecological economics is differentiated from environmental economics, which is the mainstream economic analysis of the environment. One survey of German economists found that ecological and environmental economics are different schools of economic thought, with ecological economists emphasizing strong sustainability and rejecting the proposition that physical (human-made) capital can substitute for natural capital.

An environmental tax, ecotax, or green tax is a tax levied on activities which are considered to be harmful to the environment and is intended to promote environmentally friendly activities via economic incentives. One notable example is a carbon tax. Such a policy can complement or avert the need for regulatory approaches. Often, an ecotax policy proposal may attempt to maintain overall tax revenue by proportionately reducing other taxes ; such proposals are known as a green tax shift towards ecological taxation. Ecotaxes address the failure of free markets to consider environmental impacts.

Eco-capitalism, also known as environmental capitalism or (sometimes) green capitalism, is the view that capital exists in nature as "natural capital" on which all wealth depends. Therefore, governments should use market-based policy-instruments to resolve environmental problems.

A green economy is an economy that aims at reducing environmental risks and ecological scarcities, and that aims for sustainable development without degrading the environment. It is closely related with ecological economics, but has a more politically applied focus. The 2011 UNEP Green Economy Report argues "that to be green, an economy must not only be efficient, but also fair. Fairness implies recognizing global and country level equity dimensions, particularly in assuring a Just Transition to an economy that is low-carbon, resource efficient, and socially inclusive."

Environmental accounting is a subset of accounting proper, its target being to incorporate both economic and environmental information. It can be conducted at the corporate level or at the level of a national economy through the System of Integrated Environmental and Economic Accounting, a satellite system to the National Accounts of Countries.

Environmental policy is the commitment of an organization or government to the laws, regulations, and other policy mechanisms concerning environmental issues. These issues generally include air and water pollution, waste management, ecosystem management, maintenance of biodiversity, the management of natural resources, wildlife and endangered species. For example, concerning environmental policy, the implementation of an eco-energy-oriented policy at a global level to address the issues of global warming and climate changes could be addressed. Policies concerning energy or regulation of toxic substances including pesticides and many types of industrial waste are part of the topic of environmental policy. This policy can be deliberately taken to influence human activities and thereby prevent undesirable effects on the biophysical environment and natural resources, as well as to make sure that changes in the environment do not have unacceptable effects on humans.

Renewable energy commercialization involves the deployment of three generations of renewable energy technologies dating back more than 100 years. First-generation technologies, which are already mature and economically competitive, include biomass, hydroelectricity, geothermal power and heat. Second-generation technologies are market-ready and are being deployed at the present time; they include solar heating, photovoltaics, wind power, solar thermal power stations, and modern forms of bioenergy. Third-generation technologies require continued R&D efforts in order to make large contributions on a global scale and include advanced biomass gasification, hot-dry-rock geothermal power, and ocean energy. In 2019, nearly 75% of new installed electricity generation capacity used renewable energy and the International Energy Agency (IEA) has predicted that by 2025, renewable capacity will meet 35% of global power generation.

Energy subsidies are measures that keep prices for customers below market levels, or for suppliers above market levels, or reduce costs for customers and suppliers. Energy subsidies may be direct cash transfers to suppliers, customers, or related bodies, as well as indirect support mechanisms, such as tax exemptions and rebates, price controls, trade restrictions, and limits on market access.

The following outline is provided as an overview of and topical guide to economics:

Green growth is a concept in economic theory and policymaking used to describe paths of economic growth that are environmentally sustainable. It is based on the understanding that as long as economic growth remains a predominant goal, a decoupling of economic growth from resource use and adverse environmental impacts is required. As such, green growth is closely related to the concepts of green economy and low-carbon or sustainable development. A main driver for green growth is the transition towards sustainable energy systems. Advocates of green growth policies argue that well-implemented green policies can create opportunities for employment in sectors such as renewable energy, green agriculture, or sustainable forestry.

The Economics of Ecosystems and Biodiversity (TEEB) was a study led by Pavan Sukhdev from 2007 to 2011. It is an international initiative to draw attention to the global economic benefits of biodiversity. Its objective is to highlight the growing cost of biodiversity loss and ecosystem degradation and to draw together expertise from the fields of science, economics and policy to enable practical actions. TEEB aims to assess, communicate and mainstream the urgency of actions through its five deliverables—D0: science and economic foundations, policy costs and costs of inaction, D1: policy opportunities for national and international policy-makers, D2: decision support for local administrators, D3: business risks, opportunities and metrics and D4: citizen and consumer ownership.

The economics of climate change mitigation is a contentious part of climate change mitigation – action aimed to limit the dangerous socio-economic and environmental consequences of climate change.

Fossil fuel subsidies are energy subsidies on fossil fuels. They may be tax breaks on consumption, such as a lower sales tax on natural gas for residential heating; or subsidies on production, such as tax breaks on exploration for oil. Or they may be free or cheap negative externalities; such as air pollution or climate change due to burning gasoline, diesel and jet fuel. Some fossil fuel subsidies are via electricity generation, such as subsidies for coal-fired power stations.

Green industrial policy (GIP) is strategic government policy that attempts to accelerate the development and growth of green industries to transition towards a low-carbon economy. Green industrial policy is necessary because green industries such as renewable energy and low-carbon public transportation infrastructure face high costs and many risks in terms of the market economy. Therefore, they need support from the public sector in the form of industrial policy until they become commercially viable. Natural scientists warn that immediate action must occur to lower greenhouse gas emissions and mitigate the effects of climate change. Social scientists argue that the mitigation of climate change requires state intervention and governance reform. Thus, governments use GIP to address the economic, political, and environmental issues of climate change. GIP is conducive to sustainable economic, institutional, and technological transformation. It goes beyond the free market economic structure to address market failures and commitment problems that hinder sustainable investment. Effective GIP builds political support for carbon regulation, which is necessary to transition towards a low-carbon economy. Several governments use different types of GIP that lead to various outcomes. The Green Industry plays a pivotal role in creating a sustainable and environmentally responsible future; By prioritizing resource efficiency, renewable energy, and eco-friendly practices, this industry significantly benefits society and the planet at large.