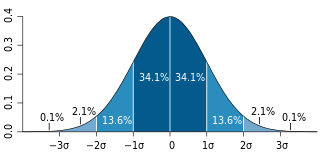

In statistics, the standard deviation is a measure of the amount of variation or dispersion of a set of values. A low standard deviation indicates that the values tend to be close to the mean of the set, while a high standard deviation indicates that the values are spread out over a wider range.

Investment is traditionally defined as the "commitment of resources to achieve later benefits". If an investment involves money, then it can be defined as a "commitment of money to receive more money later". From a broader viewpoint, an investment can be defined as "to tailor the pattern of expenditure and receipt of resources to optimise the desirable patterns of these flows". When expenditure and receipts are defined in terms of money, then the net monetary receipt in a time period is termed as cash flow, while money received in a series of several time periods is termed as cash flow stream. Investment science is the application of scientific tools for investments.

Modern portfolio theory (MPT), or mean-variance analysis, is a mathematical framework for assembling a portfolio of assets such that the expected return is maximized for a given level of risk. It is a formalization and extension of diversification in investing, the idea that owning different kinds of financial assets is less risky than owning only one type. Its key insight is that an asset's risk and return should not be assessed by itself, but by how it contributes to a portfolio's overall risk and return. It uses the variance of asset prices as a proxy for risk.

In finance, the Sharpe ratio measures the performance of an investment such as a security or portfolio compared to a risk-free asset, after adjusting for its risk. It is defined as the difference between the returns of the investment and the risk-free return, divided by the standard deviation of the investment returns. It represents the additional amount of return that an investor receives per unit of increase in risk.

The Sortino ratio measures the risk-adjusted return of an investment asset, portfolio, or strategy. It is a modification of the Sharpe ratio but penalizes only those returns falling below a user-specified target or required rate of return, while the Sharpe ratio penalizes both upside and downside volatility equally. Though both ratios measure an investment's risk-adjusted return, they do so in significantly different ways that will frequently lead to differing conclusions as to the true nature of the investment's return-generating efficiency.

In finance, a portfolio is a collection of investments.

The upside-potential ratio is a measure of a return of an investment asset relative to the minimal acceptable return. The measurement allows a firm or individual to choose investments which have had relatively good upside performance, per unit of downside risk.

Investment management is the professional asset management of various securities, including shareholdings, bonds, and other assets, such as real estate, to meet specified investment goals for the benefit of investors. Investors may be institutions, such as insurance companies, pension funds, corporations, charities, educational establishments, or private investors, either directly via investment contracts or, more commonly, via collective investment schemes like mutual funds, exchange-traded funds, or REITs.

Alpha is a measure of the active return on an investment, the performance of that investment compared with a suitable market index. An alpha of 1% means the investment's return on investment over a selected period of time was 1% better than the market during that same period; a negative alpha means the investment underperformed the market. Alpha, along with beta, is one of two key coefficients in the capital asset pricing model used in modern portfolio theory and is closely related to other important quantities such as standard deviation, R-squared and the Sharpe ratio.

The information ratio measures and compares the active return of an investment compared to a benchmark index relative to the volatility of the active return. It is defined as the active return divided by the tracking error. It represents the additional amount of return that an investor receives per unit of increase in risk. The information ratio is simply the ratio of the active return of the portfolio divided by the tracking error of its return, with both components measured relative to the performance of the agreed-on benchmark.

In finance, tracking error or active risk is a measure of the risk in an investment portfolio that is due to active management decisions made by the portfolio manager; it indicates how closely a portfolio follows the index to which it is benchmarked. The best measure is the standard deviation of the difference between the portfolio and index returns.

The ulcer index is a stock market risk measure or technical analysis indicator devised by Peter Martin in 1987, and published by him and Byron McCann in their 1989 book The Investors Guide to Fidelity Funds. It is a measure of downwards volatility, the amount of drawdown or retracement over a period.

The following outline is provided as an overview of and topical guide to finance:

Simply stated, Post-Modern Portfolio Theory (PMPT) is an extension of the traditional Modern Portfolio Theory (MPT) of Markowitz and Sharpe. Both theories provide analytical methods for rational investors to use diversification to optimize their investment portfolios. The essential difference between PMPT and MPT is that PMPT emphasizes the return that must be earned on an investment in order to meet future, specified obligations, MPT is concened only with the absolute return vis-a-vis the risk-free rate.

The risk–return spectrum is the relationship between the amount of return gained on an investment and the amount of risk undertaken in that investment. The more return sought, the more risk that must be undertaken.

The bias ratio is an indicator used in finance to analyze the returns of investment portfolios, and in performing due diligence.

In statistics, dispersion is the extent to which a distribution is stretched or squeezed. Common examples of measures of statistical dispersion are the variance, standard deviation, and interquartile range. For instance, when the variance of data in a set is large, the data is widely scattered. On the other hand, when the variance is small, the data in the set is clustered.

Portfolio optimization is the process of selecting the best portfolio, out of the set of all portfolios being considered, according to some objective. The objective typically maximizes factors such as expected return, and minimizes costs like financial risk. Factors being considered may range from tangible to intangible.

The Penalized Present Value (PPV) is a method of capital budgeting under risk, where the value of the investment is "penalized" as a function of its risk. It was developed by Fernando Gómez-Bezares in the 1980s

Modigliani risk-adjusted performance (also known as M2, M2, Modigliani–Modigliani measure or RAP) is a measure of the risk-adjusted returns of some investment portfolio. It measures the returns of the portfolio, adjusted for the risk of the portfolio relative to that of some benchmark (e.g., the market). We can interpret the measure as the difference between the scaled excess return of our portfolio P and that of the market, where the scaled portfolio has the same volatility as the market. It is derived from the widely used Sharpe ratio, but it has the significant advantage of being in units of percent return (as opposed to the Sharpe ratio – an abstract, dimensionless ratio of limited utility to most investors), which makes it dramatically more intuitive to interpret.