A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. Minimum wage policies can vary significantly between countries or even within a country, with different regions, sectors, or age groups having their own minimum wage rates. These variations are often influenced by factors such as the cost of living, regional economic conditions, and industry-specific factors.

Mark Lunsford Pryor is an American attorney, politician and lobbyist who served as a United States Senator from Arkansas from 2003 to 2015. He previously served as Attorney General of Arkansas from 1999 to 2003 and in the Arkansas House of Representatives from 1991 to 1995. He is a member of the Democratic Party.

Overtime is the amount of time someone works beyond normal working hours. The term is also used for the pay received for this time. Normal hours may be determined in several ways:

Child labor laws in the United States address issues related to the employment and welfare of working children in the United States. The most sweeping federal law that restricts the employment and abuse of child workers is the Fair Labor Standards Act of 1938 (FLSA), which came into force during the Franklin D. Roosevelt administration. Child labor provisions under FLSA are designed to protect the educational opportunities of youth and prohibit their employment in jobs that are detrimental to their health and safety. FLSA restricts the hours that youth under 16 years of age can work and lists hazardous occupations too dangerous for young workers to perform.

The Congressional Progressive Caucus (CPC) is a congressional caucus affiliated with the Democratic Party in the United States Congress. The CPC represents the furthest left-leaning faction of the Democratic Party. It was founded in 1991 and has grown since then, becoming the largest Democratic caucus in the House of Representatives.

The Equal Pay Act of 1963 is a United States labor law amending the Fair Labor Standards Act, aimed at abolishing wage disparity based on sex. It was signed into law on June 10, 1963, by John F. Kennedy as part of his New Frontier Program. In passing the bill, Congress stated that sex discrimination:

The National Retail Federation (NRF) is the world's largest retail trade association. Its members include department stores, specialty, discount, catalog, Internet, and independent retailers, chain restaurants, grocery stores, and multi-level marketing companies. Members also include businesses that provide goods and services to retailers, such as vendors and technology providers. NRF represents the largest private-sector industry in the United States that contains over 3.8 million retail establishments, supporting more than 52 million employees contributing $2.6 trillion annually to GDP.

The Fair Minimum Wage Act of 2007 is a US Act of Congress that amended the Fair Labor Standards Act of 1938 to gradually raise the federal minimum wage from $5.15 per hour to $7.25 per hour. It was signed into law on May 25, 2007 as part of the U.S. Troop Readiness, Veterans' Care, Katrina Recovery, and Iraq Accountability Appropriations Act, 2007. The act raised the federal minimum wage in 3 increments: to $5.85 per hour 60 days after enactment, to $6.55 per hour a year later, and finally to $7.25 per hour two years later. In addition, the act provided for the Northern Mariana Islands and American Samoa to make the transition to the federal minimum wage on alternate timetables.

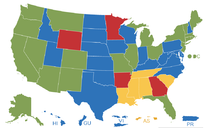

In the United States, the minimum wage is set by U.S. labor law and a range of state and local laws. The first federal minimum wage was instituted in the National Industrial Recovery Act of 1933, signed into law by President Franklin D. Roosevelt, but later found to be unconstitutional. In 1938, the Fair Labor Standards Act established it at $0.25 an hour. Its purchasing power peaked in 1968, at $1.60 In 2009, it was increased to $7.25 per hour, and has not been increased since.

In United States government contracting, a prevailing wage is defined as the hourly wage, usual benefits and overtime, paid to the majority of workers, laborers, and mechanics within a particular area. This is usually the union wage.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage. The Act was enacted by the 75th Congress and signed into law by President Franklin D. Roosevelt in 1938.

The Davis–Bacon Act of 1931 is a United States federal law that establishes the requirement for paying the local prevailing wages on public works projects for laborers and mechanics. It applies to "contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair of public buildings or public works".

The Wage and Hour Division (WHD) of the United States Department of Labor is the federal office responsible for enforcing federal labor laws. The Division was formed with the enactment of the Fair Labor Standards Act of 1938. The Wage and Hour mission is to promote and achieve compliance with labor standards to protect and enhance the welfare of the Nation's workforce. WHD protects over 144 million workers in more than 9.8 million establishments throughout the United States and its territories. The Wage and Hour Division enforces over 13 laws, most notably the Fair Labor Standards Act and the Family Medical Leave Act. In FY18, WHD recovered $304,000,000 in back wages for over 240,000 workers and followed up FY19, with a record-breaking $322,000,000 for over 300,000 workers.

The Paycheck Fairness Act is a proposed United States labor law that would add procedural protections to the Equal Pay Act of 1963 and the Fair Labor Standards Act as part of an effort to address the gender pay gap in the United States. A Census Bureau report published in 2008 stated that women's median annual earnings were 77.5% of men's earnings. Recently this has narrowed, as by 2018, this was estimated to have decreased to women earning 80-85% of men's earnings. One study suggests that when the data is controlled for certain variables, the residual gap is around 5-7%; the same study concludes that the residual is because "hours of work in many occupations are worth more when given at particular moments and when the hours are more continuous. That is, in many occupations, earnings have a nonlinear relationship with respect to hours."

Wage theft is the failing to pay wages or provide employee benefits owed to an employee by contract or law. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors; illegal deductions in pay; forcing employees to work "off the clock", not paying annual leave or holiday entitlements, or simply not paying an employee at all.

The tipped wage is base wage paid to an employee in the United States who receives a substantial portion of their compensation from tips. According to a common labor law provision referred to as a "tip credit", the employee must earn at least the state's minimum wage when tips and wages are combined or the employer is required to increase the wage to fulfill that threshold. This ensures that all tipped employees earn at least the minimum wage: significantly more than the tipped minimum wage.

The bill S. 256, long title "To amend Public Law 93–435 with respect to the Northern Mariana Islands, providing parity with Guam, the Virgin Islands, and American Samoa," is a bill that was introduced into the 113th United States Congress. S. 256 would convey to the government of the Commonwealth of the Northern Mariana Islands (CNMI) submerged lands surrounding such Islands and extending three geographical miles outward from their coastlines. It would also include the Commonwealth of the Northern Mariana Islands among the islands where the President may establish naval defensive sea areas and airspace reservations when necessary for national defense. Finally, it would amend the Fair Minimum Wage Act to provide for no Commonwealth of the Northern Mariana Islands minimum wage increases in 2013 and 2015.

The Fight for $15 is an American political movement advocating for the minimum wage to be raised to USD$15 per hour. The federal minimum wage was last set at $7.25 per hour in 2009. The movement has involved strikes by child care, home healthcare, airport, gas station, convenience store, and fast food workers for increased wages and the right to form a labor union. The "Fight for $15" movement started in 2012, in response to workers' inability to cover their costs on such a low salary, as well as the stressful work conditions of many of the service jobs which pay the minimum wage.

Initiative 77 was a voter-approved ballot initiative in Washington, D.C., to phase out the special minimum wage for tipped employees as part of the national Fight for $15 campaign. In the June 2018 primary election, D.C. voters approved Initiative 77 by a margin of 56% to 44%; however, the D.C. Council repealed the initiative in October before it could enter into force. In 2022, a nearly identical Initiative 82 was approved for the November 8, 2022 election.

The Raise the Wage Act is a proposed United States law that would increase the federal minimum wage to US$15. It has been introduced in each United States Congress since 2017.