Related Research Articles

Chemical Bank was a bank with headquarters in New York City from 1824 until 1996. At the end of 1995, Chemical was the third-largest bank in the U.S., with about $182.9 billion in assets and more than 39,000 employees around the world.

Marine Midland Bank was an American bank formerly headquartered in Buffalo, New York, with several hundred branches throughout the state of New York. In 1998, branches extended to Pennsylvania. It was acquired by HSBC in 1980, and changed its name to HSBC Bank USA in 1999. As a result of several transactions since the turn of the millennium, much of what was once Marine Midland is now part of KeyBank with the exception of Downstate New York and Pennsylvania, that is now part of Citizens Bank. Branches in Seattle are part of Cathay Bank.

J.P. Morgan & Co. is an American financial institution specialized in investment banking, asset management and private banking founded by financier J. P. Morgan in 1871. Through a series of mergers and acquisitions, the company is now a subsidiary of JPMorgan Chase, one of the largest banking institutions in the world. The company has been historically referred to as the "House of Morgan" or simply Morgan.

Manufacturers Hanover Corporation was an American bank holding company that was formed as parent of Manufacturers Hanover Trust Company, a large New York City bank formed through a merger in 1961. After 1969, Manufacturers Hanover Trust became a subsidiary of Manufacturers Hanover Corporation. Charles J. Stewart was the company's first president and chairman.

The Knickerbocker Trust was a bank based in New York City that was, at one time, among the largest banks in the United States. It was a central player in the Panic of 1907.

The Bank of United States, founded by Joseph S. Marcus in 1913 at 77 Delancey Street in New York City, was a New York City bank that failed in 1931. The bank run on its Bronx branch is said to have started the collapse of banking during the Great Depression.

The Manhattan Company was a New York bank and holding company established on September 1, 1799. The company merged with Chase National Bank in 1955 to form the Chase Manhattan Bank. It is the oldest of the predecessor institutions that eventually formed the current JPMorgan Chase & Co.

The American Surety Building is an office building and early skyscraper at Pine Street and Broadway in the Financial District of Manhattan in New York City, across from Trinity Church. The building was designed in a Neo-Renaissance style by Bruce Price with a later expansion by Herman Lee Meader. It is 388 feet (118 m) tall, with either 23 or 26 stories. It was one of Manhattan's first buildings with steel framing and curtain wall construction.

Bank of America Private Bank was founded in 1853 as the United States Trust Company of New York. It operated independently until 2000, when it was acquired by Charles Schwab, and Co. and subsequently sold to, and became a subsidiary of, Bank of America in 2007. Bank of America Private Bank provides investment management, wealth structuring, and credit and lending services to clients.

W.O.S. Thorne, more generally known as Oakleigh Thorne, was an American businessperson, a publisher of tax guides, a banker, and a philanthropist. Among his early ventures were the consolidation of brickyards on the Hudson River, and later he was president of the National Switch and Signal Company and Westinghouse Electric's vice president. In 1900 he came to New York City as vice president of the International Banking and Trust Company, becoming president. That company became the Trust Company of America, of which Thorne was serving as president. He helped the company survive a bank run during the Panic of 1907, securing the backing of J. Pierpont Morgan and European sources. He served as a director of Wells Fargo & Company from 1902 to 1918. In addition to his connection with Commerce Clearing House, Wells Fargo, and the Trust Company of America, Thorne was a director of the Corporation Trust Company and of the Bank of Millbrook. After purchasing Briarcliff Farms in 1918, he became a breeder of champion Angus cattle. He was inducted into the Angus Heritage Foundation Hall of Fame in 1934.

William L. Trenholm (1836–1901) was a United States Comptroller of the Currency from 1886 to 1889. In 1898, Trenholm was elected president of the North American Trust Company.

The New York Trust Company was a large trust and wholesale-banking business that specialized in servicing large industrial accounts. It merged with the Chemical Corn Exchange Bank and eventually the merged entity became Chemical Bank.

Roland Ray Conklin was an American financier and real estate mogul from Illinois. After graduating from the University of Illinois, Conklin formed a real estate partnership with Samuel M. Jarvis. The Jarvis-Conklin Mortgage and Trust Company developed neighborhoods in Kansas City, Cleveland, and Baltimore. After dissolving following the Panic of 1893, Conklin re-organized the company into the North American Trust Company. The new company was appointed the official bank of the United States in Cuba. Conklin founded several corporations there. He donated the funds for the Alma Mater at the University of Illinois in the 1910s.

Marcellus Hartley was an American arms dealer and merchant. He was appointed as an agent by the Union Army to purchase guns from Europe during the American Civil War. He later manufactured cartridges for breech-loading guns, owned the Remington Arms Company and diversified into other areas of commerce.

Consolidated National Bank of New York was a bank operating in New York City. Also referred to in the press as Consolidated National Bank, the institution was organized on July 1, 1902, with capital of $1 million. Wrote The New York Times, the bank was "founded with the idea of cornering the business of the Consolidated Exchange and its brokers." The bank opened for business at 57 Broadway on September 22, 1902, and a year later the bank took out a five-year lease at the Exchange Court Building. In 1906, the Consolidated Stock Exchange withdrew its deposits with the Consolidated National Bank. In 1909, the bank voted to acquire the assets of Oriental Bank and merge them with Consolidated, creating the National Reserve Bank. The Consolidated name was operative for a short time afterwards.

The Chatham Phenix National Bank and Trust Company was a bank in New York City connected with the Chatham Phenix Corporation. Its predecessor Chatham and Phenix National Bank was formed in 1911 when Chatham National Bank paid $1,880,000 to absorb the asset of the Phenix National Bank. The bank grew significantly as it absorbed smaller banking institutions, such as Mutual Alliance Trust Company and Century Bank in 1915, at which point Chatham and Phenix National Bank became the "first national bank to operate branches in the same city with the main bank."

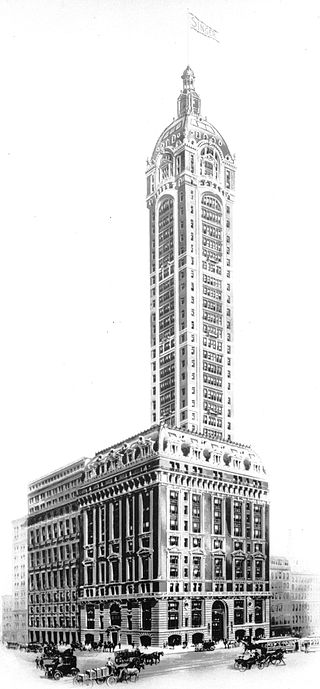

The Trust Company of America was a large company in New York City. Founded on May 23, 1899 in Albany, New York, its founding president was Ashbel P. Fitch and it was initially located in the Singer Building in Manhattan's Financial District. In 1907 the company absorbed the Colonial Trust Company, a commercial bank. During the Panic of 1907 it was the target of a bank run starting on October 23, 1907, which it survived with the backing of J. Pierpont Morgan and an infusion of gold from the Bank of England and other European sources. The company ultimately represented a consolidation of the North American Trust Company, the former Trust Company of America, the City Trust Company and the Colonial Trust Company. The Trust Company of America was absorbed by the Equitable Trust Company in the spring of 1912.

The Continental Bank and Trust Company of New York was a financial institution based in New York City, New York, United States. It was established in 1870 as the German-American Bank, which became the Continental Bank of New York. Originally in the Equitable Building at 120 Broadway, the bank was later headquartered at 50 Wall Street, 25 Broad Street, and starting in 1932 the Continental Bank Building It became known as the "brokers bank" for its collaboration with Wall Street brokers and investment banking interests. The institution was renamed the Continental Bank and Trust Company of New York around 1929, at which point it was involved in extending its business with acquisitions of commercial banking and fiduciary operations. Acquired banks included the Fidelity Trust Company in 1929, International Trust Company and Straus National Bank and Trust Company in 1931, and Industrial National Bank later that year. In 1947, the bank earned $804,000 in net profits. As of December 31, 1947, Continental had total resources of $202,000,000, and deposits of $188,000,000. It merged with the Chemical Bank and Trust Company in 1948.

The Astor Trust Company was a historic American banking organization. The firm merged with Bankers Trust in 1917.

The Metropolitan Trust Company of the City of New York was a trust company located in New York City that was founded in 1881. The trust company merged with the Chatham and Phenix National Bank in 1925 under the name of the Chatham Phenix National Bank and Trust Company of New York.

References

- 1 2 3 4 5 6 "A Place for Colonel Trenholm; Head of North American Trust Company -- W.S. Johnston Succeeds Him in American Surety". The New York Times . New York City, United States. January 20, 1898. Retrieved July 16, 2017.

- 1 2 3 4 "Trust Companies Combine; International Banking and Trust to Unite with North American". The New York Times . New York City, New York, United States. April 4, 1900. p. 11. Retrieved July 12, 2017.

- 1 2 "Trust Company Combination; The Holland and Century Now to be Absorbed by the North American". The New York Times . New York City, New York, United States. February 27, 1901. p. 12. Retrieved July 12, 2017.

- 1 2 3 4 5 "To Merge Trust Companies; Three Concerns with $50,000,000 in Deposits to Unite". The New York Times . New York City, New York, United States. April 12, 1905. p. 1. Retrieved July 12, 2017.

- ↑ "The Case of the North American Trust Company". The New York Times . New York City, United States. July 10, 1852. p. 1. Retrieved July 8, 2017.

- 1 2 3 "Trust Company Election; The North American Chooses Alvah Trowbridge as Its Leader. He Succeeds Col. Trenholdm - The New Head Brings to the Corporation Important Financial Interests -- No Friction". The New York Times . New York City, United States. May 27, 1899. p. 3. Retrieved July 16, 2017.

- ↑ "To Investigate Trust Company". The New York Times . New York City, United States. May 23, 1900. Retrieved July 16, 2017.