Reliance Industries Limited is an Indian multinational conglomerate, headquartered in Mumbai. Its businesses include energy, petrochemicals, natural gas, retail, telecommunications, mass media, and textiles. Reliance is the largest public company in India by market capitalisation and revenue, and the 100th largest company worldwide. It is India's largest private tax payer and largest exporter, accounting for 7% of India's total merchandise exports. The company has relatively little free cash flow and high corporate debt.

The Mumbai High Field, formerly called the Bombay High Field, is an offshore oilfield 176 km (109 mi) off the west coast of Mumbai, in Gulf of Cambay region of India, in about 75 m (246 ft) of water. The oil operations are run by India's Oil and Natural Gas Corporation (ONGC).

The Tangguh gas field is a gas field lies in Berau Gulf and Bintuni Bay, in the province of West Papua, Indonesia. The natural gas field contains over 500 billion cubic metres of proven natural gas reserves, with estimates of potential reserves reaching over 800 billion cubic metres.

Jio-bp, or legally Reliance BP Mobility Limited, formally known as Reliance Petroleum is an Indian petroleum company that specializes in oil and energy, owned by Mukesh Ambani of Reliance Industries Limited (RIL), one of India's largest private sector companies. It is based in Ahmedabad, Gujarat, India and has interests in the downstream oil business. RPL was merged with Reliance Industries Limited on 29 September 2009.

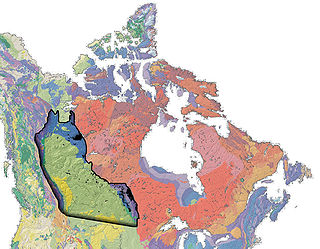

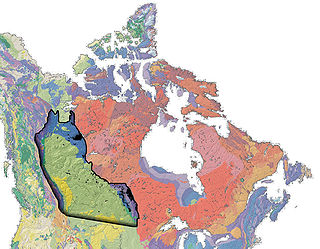

The Western Canadian Sedimentary Basin (WCSB) underlies 1.4 million square kilometres (540,000 sq mi) of Western Canada including southwestern Manitoba, southern Saskatchewan, Alberta, northeastern British Columbia and the southwest corner of the Northwest Territories. This vast sedimentary basin consists of a massive wedge of sedimentary rock extending from the Rocky Mountains in the west to the Canadian Shield in the east. This wedge is about 6 kilometres (3.7 mi) thick under the Rocky Mountains, but thins to zero at its eastern margins. The WCSB contains one of the world's largest reserves of petroleum and natural gas and supplies much of the North American market, producing more than 450 million cubic metres per day of gas in 2000. It also has huge reserves of coal. Of the provinces and territories within the WCSB, Alberta has most of the oil and gas reserves and almost all of the oil sands.

The Oil and Natural Gas Corporation Limited (ONGC) is an Indian central public sector undertaking under the ownership of Ministry of Petroleum and Natural Gas, Government of India. The company is headquartered in New Delhi. ONGC was founded on 14 August 1956 by the Government of India. It is the largest government-owned-oil and gas explorer and producer in the country and produces around 70 percent of India's domestic production of crude oil and around 84 percent of natural gas. In November 2010, the Government of India conferred the Maharatna status to ONGC.

The South Pars/North Dome field is a natural-gas condensate field located in the Persian Gulf. It is by far the world's largest natural gas field, with ownership of the field shared between Iran and Qatar. According to the International Energy Agency (IEA), the field holds an estimated 1,800 trillion cubic feet of in-situ natural gas and some 50 billion barrels of natural gas condensates. On the list of natural gas fields it has almost as much recoverable reserves as all the other fields combined. It has significant geostrategic influence.

Peak gas is the point in time when the maximum global natural gas production rate will be reached, after which the rate of production will enter its terminal decline. Although demand is peaking in the United States and Europe, it continues to rise globally due to consumers in Asia, especially China. Natural gas is a fossil fuel formed from plant matter over the course of millions of years. Natural gas derived from fossil fuels is a non-renewable energy source; however, methane can be renewable in other forms such as biogas. Peak coal was in 2013, and peak oil is forecast to occur before peak gas. One forecast is for natural gas demand to peak in 2035.

The Bakken Formation is a rock unit from the Late Devonian to Early Mississippian age occupying about 200,000 square miles (520,000 km2) of the subsurface of the Williston Basin, underlying parts of Montana, North Dakota, Saskatchewan and Manitoba. The formation was initially described by geologist J. W. Nordquist in 1953. The formation is entirely in the subsurface, and has no surface outcrop. It is named after Henry O. Bakken (1901–1982), a farmer in Tioga, North Dakota, who owned the land where the formation was initially discovered while drilling for oil.

The Tupi oil field is a large oil field located in the Santos Basin, 250 kilometres (160 mi) off the coast of Rio de Janeiro, Brazil. The field was originally nicknamed in honor of the Tupi people and later named after the mollusc, however it was also ambiguously similar to the name of former Brazilian president Luiz Inacio Lula da Silva. It is considered to be the Western Hemisphere's largest oil discovery of the last 30 years.

The petroleum industry of Ghana is regulated by the state-owned Ghana National Petroleum Corporation (GNPC) and administered by the state-owned Ghana Oil Company (GOIL).

According to the Iran Petroleum Ministry, the proved natural gas reserves of Iran are about 1,201 trillion cubic feet (34.0 trillion cubic metres) or about 17.8% of world's total reserves, of which 33% are as associated gas and 67% is in non associated gas fields. It has the world's second largest reserves after Russia. As it takes approximately 5,850 cubic feet (166 m3) of gas to equal the energy content of 1-barrel (0.16 m3) of oil, Iran's gas reserves represent the equivalent of about 205 billion barrels (3.26×1010 m3) of oil.

The Tamar gas field is a natural gas field in the Mediterranean Sea off the coast of Israel. The field is located in Israel's exclusive economic zone, roughly 80 kilometres (50 mi) west of Haifa in waters 1,700 metres (5,600 ft) deep. The Tamar field is considered to have proven reserves of 200 billion cubic metres of natural gas, while the adjoining Tamar South field has 23 billion cubic metres. Together, they may have an additional 84 BCM of "probable" reserves and up to 49 BCM of "possible" reserves. At the time of discovery, Tamar was the largest find of gas or oil in the Levant basin of the Eastern Mediterranean Sea and the largest discovery by Noble Energy. Since Tamar's discovery, large gas discoveries have been made in other analogous geological formations dating back to the Oligocene–Miocene epoch in the Levant basin. Because Tamar was the first such discovery, these gas containing presalt formations have become collectively known as Tamar sands.

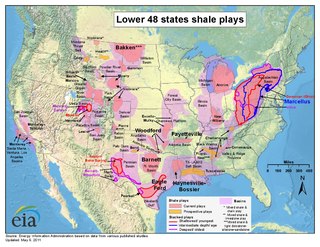

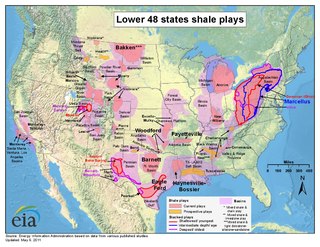

Shale gas in the United States is an available source of unconventional natural gas. Led by new applications of hydraulic fracturing technology and horizontal drilling, development of new sources of shale gas has offset declines in production from conventional gas reservoirs, and has led to major increases in reserves of U.S. natural gas. Largely due to shale gas discoveries, estimated reserves of natural gas in the United States in 2008 were 35% higher than in 2006.

Niko Resources is an India- and South East Asia-focused oil and gas exploration and production company that shares ownership of many exploration and development properties with Komodo Energy and Reliance Industries. Though it holds exploration rights to 37,000,000 acres (150,000 km2) of land in 7 countries production currently (2011) only takes place in India and Bangladesh. Major acquisitions include a $310 million November 18, 2009 purchase of Black Gold Energy followed by the 2010 $37.6 million acquisition of Voyager Energy which expanded its presence in Trinidad.

New Exploration Licensing Policy (NELP) was conceptualised by the Government of India, during 1997-98 to provide an equal platform to both Public and Private sector companies in exploration and production of hydrocarbons with Directorate General of Hydrocarbons (DGH) as a nodal agency for its implementation. It was introduced to boost the production of oil and natural gas and providing level playing field for both public and private players.

Cairn India was an Indian oil and gas exploration and production company, headquartered in Gurgaon, India. The company was merged with Vedanta Limited.

Pipeline Infrastructure Limited or East West Gas Pipeline(EWPL) is a project implemented to transport gas from Kakinada (Andhra Pradesh) to Bharuch (Gujarat) including various spurs and interconnects on the way. EWPL traverses through the Indian states of Andhra Pradesh, Telangana, Karnataka, Maharashtra and Gujarat. EWPL has been authorized as a common carrier pipeline. It is a wholly owned subsidiary of India Infrastructure Trust, which is owned by Brookfield Asset Management.

The East West Gas Pipeline supplies Natural gas to RIL's vast petrochemical complex at Gujarat and delivers gas to numerous customers via branch line connections along its length. The pipeline system features multiple compressor stations, numerous metering facilities at branch take-offs and an advanced control and communications network. The project is the first and largest privately owned cross-country pipeline in India and the backbone of India's burgeoning natural gas grid.

Rabi Narayan Bastia is an Indian geoscientist and the Global Head of Exploration at Lime Petroleum, Norway, known for his contributions in the hydrocarbon explorations at Krishna Godavari Basin (2002), at Mahanadi Basin (2003) and at Cauvery (2007). A non-executive director of Asian Oilfield Services Limited and the President at OilMax Energy, Bastia is a recipient of the Odisha Living Legend Award. The Government of India awarded him the fourth highest civilian honour of the Padma Shri, in 2007, for his contributions to Science and Technology.

The petroleum industry in India dates back to 1889 when the first oil deposits in the country were discovered near the town of Digboi in the state of Assam. The natural gas industry in India began in the 1960s with the discovery of gas fields in Assam and Maharashtra. As on 31 March 2018, India had estimated crude oil reserves of 594.49 million metric tonnes (Mt) and natural gas reserves of 1339.57 billion cubic metres of natural gas (BCM).