Related Research Articles

The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole.

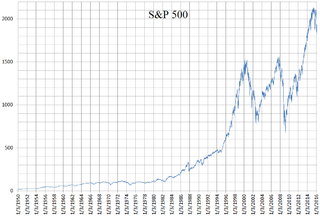

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

Singapore Exchange Limited is a Singapore-based exchange conglomerate, operating equity, fixed income, currency and commodity markets. It provides a range of listing, trading, clearing, settlement, depository and data services. SGX Group is also a member of the World Federation of Exchanges and the Asian and Oceanian Stock Exchanges Federation. it is ASEAN's second largest market capitalization after Indonesia Stock Exchange at US$609.653 billion as of September 2023.

Bursa Malaysia is the stock exchange in Malaysia. It is one of the largest bourses in ASEAN. It is based in Kuala Lumpur and was previously known as the Kuala Lumpur Stock Exchange (KLSE). It provides full integration of transactions, offering a wide range of currency exchange and related services, including trading, settlement, clearing and savings services.

BUX is a blue chip stock market index consisting up to 25 major Hungarian companies trading on the Budapest Stock Exchange. Prices are taken from the electronic Xetra trading system. According to the operator Budapest Stock Exchange, the BUX measures the performance of the Equities Prime Market's 12 to 25 largest Hungarian companies in terms of order book volume and market capitalization. It is the equivalent of the Dow Jones Industrial Average and DAX, the index shows the average price changing of the shares with the biggest market value and turnover in the equity section. Hereby this is the most important index number of the exchange trends.

The Stock Exchange of Thailand is the only stock exchange in Thailand. Founded on 30 April 1975, it is ASEAN's 3rd largest after Indonesia Stock Exchange and Singapore Exchange by market capitalization at US$489.95 billion as of November 2023. From 2015 to June 2020, it was the biggest IPO market in Southeast Asia in terms of accumulated raised fund at US$17.8 billion. It is also the region's most active bourse for 10 consecutive years with daily trading turnover normally exceeding US$2 billion.

The Russell 1000 Index is a U.S. stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. As of 31 December 2023, the stocks of the Russell 1000 Index had a weighted average market capitalization of $666.0 billion and a median market capitalization of $13.9 billion. As of 8 May 2020, components ranged in market capitalization from $1.8 billion to $1.4 trillion. The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the United Kingdom-based London Stock Exchange Group.

The Russell 3000 Index is a capitalization-weighted stock market index that seeks to be a benchmark of the entire U.S. stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in America as measured by total market capitalization, and represents approximately 97% of the American public equity market. The index was launched on January 1, 1984, and is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. The ticker symbol on most systems is ^RUA.

Jakarta Stock Exchange was a stock exchange based in Jakarta, Indonesia, before it merged with the Surabaya Stock Exchange to form the Indonesia Stock Exchange.

The Straits Times Index is a capitalisation-weighted measurement stock market index that is regarded as the benchmark index for the stock market in Singapore. It tracks the performance of the top 30 companies that are listed on the Singapore Exchange (SGX).

The Bucharest Stock Exchange is the stock exchange of Romania located in Bucharest. In 2023, the BVB's market capitalization increased by 52.7% to $64.9 billion. As of 2023, there were 85 companies listed on the BVB.

Indonesia Stock Exchange (IDX) is a stock exchange based in Jakarta, Indonesia. It was previously known as the Jakarta Stock Exchange (JSX) before its name changed in 2007 after merging with the Surabaya Stock Exchange (SSX). In recent years, the Indonesian Stock Exchange has seen the fastest membership growth in Asia. As of January 2024, the Indonesia Stock Exchange had 903 listed companies, and total stock investors were about 6.4 million, compared to 2.5 million at the end of 2019. Indonesia Market Capitalization accounted for 45.2% of its nominal GDP in December 2020. Founded on 30 November 2007, it is ASEAN's largest market capitalization at US$881 billion as of 19 September 2024.

The FTSE Bursa Malaysia KLCI, also known as the FBM KLCI, is a capitalisation-weighted stock market index, composed of the 30 largest companies on the Bursa Malaysia by market capitalisation that meet the eligibility requirements of the FTSE Bursa Malaysia Index Ground Rules. The index is jointly operated by FTSE and Bursa Malaysia.

CIMB Group Holdings Berhad is a Malaysian universal bank headquartered in Kuala Lumpur and operating in high growth economies in ASEAN. CIMB Group is an indigenous ASEAN investment bank. CIMB has a wide retail branch network with 1,080 branches across the region.

The S&P/ASX 300, or simply, ASX 300, is a stock market index of Australian stocks listed on the Australian Securities Exchange (ASX). The index is market-capitalisation weighted, meaning each company included is in proportion to the indexes total market value, and float-adjusted, meaning the index only considers shares available to public investors.

The FTSE Global Equity Index Series is a series of stock market indices provided by FTSE Group. It was launched in September 2003, and provides coverage of over 17,000 stocks in 48 countries, covering 98% of the world's investable market capitalization.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

References

- ↑ "Asean Exchanges". Archived from the original on 2011-04-12. Retrieved 2011-04-11.

- ↑ ASEAN Trading link goes ‘LIVE’ connecting bursa Malaysia and Singapore Exchange! Published: Tuesday, Sep 18, 2012. http://aseanexchanges.org/MediaCentre.aspx

- ↑ ASEAN Exchanges unveils key milestones in the development of the Asean Asset Class Published: Monday, Oct 15, 2012. http://aseanexchanges.org/MediaCentre.aspx

- ↑ "ASEAN moves a step closer to market integration - Mon, April 11 2011 - The Jakarta Post".

- ↑ "Monthly Reports | World Federation of Exchanges". Archived from the original on 2014-08-17. Retrieved 2015-06-11.

- ↑ "Home". aseanexchanges.org.