Anthracite, also known as hard coal and black coal, is a hard, compact variety of coal that has a submetallic lustre. It has the highest carbon content, the fewest impurities, and the highest energy density of all types of coal and is the highest ranking of coals.

Dynegy Inc. is an electric company based in Houston, Texas. It owns and operates a number of power stations in the U.S., all of which are natural gas-fueled or coal-fueled. Dynegy was acquired by Vistra Corp on April 9, 2018. The company is located at 601 Travis Street in Downtown Houston. The company was founded in 1984 as Natural Gas Clearinghouse. It was originally an energy brokerage, buying and selling natural gas supplies. It changed its name to NGC Corporation in 1995 after entering the electrical power generation business.

Duke Energy Corporation is an American electric power and natural gas holding company headquartered in Charlotte, North Carolina.

Massey Energy Company was a coal extractor in the United States with substantial operations in West Virginia, Kentucky and Virginia. By revenue, it was the fourth largest producer of coal in the United States and the largest coal producer in Central Appalachia. By coal production weight, it was the sixth largest producer of coal in the United States.

Consol Energy Inc. is an American energy company with interests in coal headquartered in the suburb of Cecil Township, in the Southpointe complex, just outside Pittsburgh, Pennsylvania. In 2017, Consol formed two separate entities: CNX Resources Corporation and CONSOL Energy Inc. While CNX Resources Corp. focuses on natural gas, spin-off Consol Mining Corporation, now Consol Energy Inc. focuses on coal. In 2010, Consol was the leading producer of high-BTU bituminous coal in the United States and the U.S.'s largest underground coal mining company. The company employs more than 1,600 people.

The Surface Mining Control and Reclamation Act of 1978 (SMCRA) is the primary federal law that regulates the environmental effects of coal mining in the United States.

International Coal Group, Inc. (ICG), is a company headquartered in Teays Valley, West Virginia that was incorporated in May 2004 by WL Ross & Co for the sole purpose of acquiring certain assets of Horizon. ICG eventually operated 12 mining complexes in Northern and Central Appalachia and one complex in the Illinois Basin. In November 2005, ICG had a stock offering on the New York Stock Exchange. In 2011 ICG became a subsidiary of Arch Coal, Inc in 2011.

Peabody Energy is a coal mining company headquartered in St. Louis, Missouri. Its primary business consists of the mining, sale, and distribution of coal, which is purchased for use in electricity generation and steelmaking. Peabody also markets, brokers, and trades coal through offices in China, Australia, and the United States.

Mechel is one of Russia's mining and metals companies, comprising producers of coal, iron ore in concentrate, steel, rolled steel products. Headquartered in Moscow, it sells its products in Russia and overseas, and is formally known as Public Joint Stock Company Mechel.

Patriot Coal Corporation was a coal-mining company based in St. Louis, Missouri in the United States. The company is a spin-off of most of the Eastern U.S. operations of Peabody Energy.

Arch Resources, previously known as Arch Coal, is an American coal mining and processing company. The company mines, processes, and markets bituminous and sub-bituminous coal with low sulfur content in the United States. Arch Resources is the second-largest supplier of coal in the United States, behind Peabody Energy. As of 2011 the company supplied 15% of the domestic market. Demand comes mainly from generators of electricity.

Coal reserves in Canada rank 13th largest in the world at approximately 10 billion tons, 0.6% of the world total. This represents more energy than all of the oil and gas in the country combined. The coal industry generates CDN$5 billion annually. Most of Canada's coal mining occurs in the West of the country. British Columbia operates 9 coal mines, Alberta nine, Saskatchewan three and New Brunswick one. Nova Scotia operates several small-scale mines, Westray having closed following the 1992 disaster there.

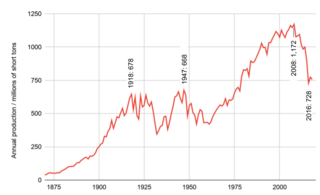

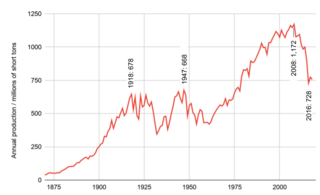

Coal mining is an industry in transition in the United States. Production in 2019 was down 40% from the peak production of 1,171.8 million short tons in 2008. Employment of 43,000 coal miners is down from a peak of 883,000 in 1923. Generation of electricity is the largest user of coal, being used to produce 50% of electric power in 2005 and 27% in 2018. The U.S. is a net exporter of coal. U.S. coal exports, for which Europe is the largest customer, peaked in 2012. In 2015, the U.S. exported 7.0 percent of mined coal.

Foundation Coal Holdings, Inc. was a large American coal mining company. Until its July 31, 2009 merger with Alpha Natural Resources to form the third largest American coal company, the company was publicly traded on the New York Stock Exchange under the symbol FCL. With corporate offices in Linthicum Heights, Maryland, the former Foundation Coal operates coal mines in Pennsylvania, West Virginia and Wyoming, and was, prior to its merger with Alpha Natural Resources, the fourth-largest American coal producer by tonnage.

Walter Energy, Inc. was a publicly traded "pure play" metallurgical coal producer for the global steel industry. The company also produced natural gas, steam coal and industrial coal, anthracite, metallurgical coke, and coal bed methane gas. Corporate and U.S. headquarters were located in Birmingham, Alabama, and its Canadian & UK headquarters in Vancouver, British Columbia. Walter Energy filed for bankruptcy in 2015 and its assets were purchased by Warrior Met Coal.

The Upper Big Branch Mine disaster occurred on April 5, 2010 roughly 1,000 feet (300 m) underground in Raleigh County, West Virginia at Massey Energy's Upper Big Branch coal mine located in Montcoal. Twenty-nine out of thirty-one miners at the site were killed. The coal dust explosion occurred at 3:27 pm. The accident was the worst in the United States since 1970, when 38 miners were killed at Finley Coal Company's No. 15 and 16 mines in Hyden, Kentucky. A state funded independent investigation later found Massey Energy directly responsible for the blast.

Coal mining in Wyoming has long been a significant part of the state's economy. Wyoming has been the largest producer of coal in the United States since 1986, and in 2018, coal mines employed approximately 1% of the state’s population. In 2013, there were 17 active coal mines in Wyoming, which produced 388 million short tons, 39 percent of all the coal mined in the US, and more than three times the production of second-place West Virginia. Market forces, including the low price of natural gas from the fracking boom—coal's main competition—contributed to the steep drop in coal production in the 2000s as electricity generation switched from coal to gas.

The Wyoming Department of Environmental Quality (DEQ) founded in 1973, is a Wyoming state agency to protect, conserve and enhance the environment of Wyoming "through a combination of monitoring, permitting, inspection, enforcement and restoration/remediation activities". It consists of 6 divisions and since 1992, the Environmental Quality Council (EQC), a separate operating agency of 7 governor-appointed members.

American Consolidated Natural Resources, previously known as Murray Energy, is a US-based coal mining company. It is the fourth largest coal producer in the country, and the largest privately-owned coal company. Founded in 1988 by Robert E. Murray, the company filed for bankruptcy in 2019. The company gained notoriety following the collapse of the Crandall Canyon Mine in 2007, following a number of citations and fines for safety practices at the site.

Alpha Metallurgical Resources, formerly Contura Energy, is a leading coal supplier with underground and surface coal mining complexes across Northern and Central Appalachia. Contura owns large coal basins in Pennsylvania, Virginia and West Virginia which supply both metallurgical coal to produce steel and thermal coal to generate power.