The Department of the Treasury (USDT) is an executive department and the treasury of the United States federal government. Established by an Act of Congress in 1789 to manage government revenue, the Treasury prints all paper currency and mints all coins in circulation through the Bureau of Engraving and Printing and the United States Mint, respectively; collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy.

In economics and political science, fiscal policy is the use of government revenue collection and expenditure (spending) to influence the economy. According to Keynesian economics, when the government changes the levels of taxation and government spending, it influences aggregate demand and the level of economic activity. Fiscal policy is often used to stabilize the economy over the course of the business cycle.

Tertiary education fees in Australia are payable for courses at tertiary education institutions. The central government, also known as the Commonwealth government, provides loans and subsidies to relieve the cost of tertiary education for some students. Some students are supported by the government and are required to pay only part of the cost of tuition, called the "student contribution", and the government pays the balance. Some government supported students can defer payment of their contribution as a HECS-HELP loan. Other domestic students are full fee-paying and do not receive direct government contribution to the cost of their education. Some domestic students in full fee courses can obtain a FEE-HELP loan from the Australian government up to a lifetime limit of $150,000 for medicine, dentistry and veterinary science programs and $104,440 for all other programs.

Economic interventionism is an economic policy perspective favoring government intervention in the market process to correct the market failures and promote the general welfare of the people. An economic intervention is an action taken by a government or international institution in a market economy in an effort to impact the economy beyond the basic regulation of fraud and enforcement of contracts and provision of public goods. Economic intervention can be aimed at a variety of political or economic objectives, such as promoting economic growth, increasing employment, raising wages, raising or reducing prices, promoting income equality, managing the money supply and interest rates, increasing profits, or addressing market failures.

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries.

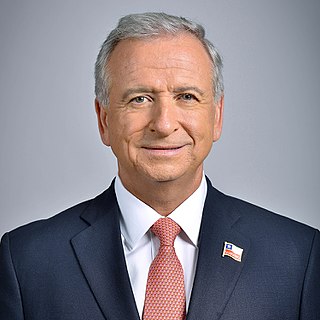

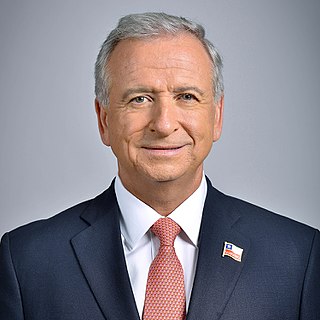

The Treasurer of Australia is the minister in the Government of Australia responsible for government expenditure and revenue raising. The Treasurer plays a key role in the economic policy of the government. The current holder of the position is Josh Frydenberg, whose term began on 24 August 2018.

Austerity is a political-economic term referring to policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. Austerity measures are used by governments that find it difficult to pay their debts. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures, which is assumed to make the payment of debt easier. Austerity measures also demonstrate a government's fiscal discipline to creditors and credit rating agencies.

Government debt contrasts to the annual government budget deficit, which is a flow variable that equals the difference between government receipts and spending in a single year. The debt is a stock variable, measured at a specific point in time, and it is the accumulation of all prior deficits.

A balanced budget amendment is a constitutional rule requiring that a state cannot spend more than its income. It requires a balance between the projected receipts and expenditures of the government.

Nicolas Desmaretz, marquis de Maillebois was a Controller-General of Finances during the reign of Louis XIV of France.

In economics, the debt-to-GDP ratio is the ratio between a country's government debt and its gross domestic product (GDP). A low debt-to-GDP ratio indicates an economy that produces and sells goods and services sufficient to pay back debts without incurring further debt. Geopolitical and economic considerations – including interest rates, war, recessions, and other variables – influence the borrowing practices of a nation and the choice to incur further debt.

The United States federal budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that the U.S. is facing a series of long-term financial challenges, as the population of the country ages and healthcare costs continue growing faster than the economy, leading to the debt held by the public exceeding GDP by 2030. The United States has the largest external debt in the world and the 14th largest government debt as % of GDP in the world.

Fiscal conservatism is a political-economic philosophy regarding fiscal policy and fiscal responsibility advocating low taxes, reduced government spending and minimal government debt. Free trade, deregulation of the economy, lower taxes, and privatization are the defining qualities of fiscal conservatism. Fiscal conservatism follows the same philosophical outlook of classical liberalism and economic liberalism. The term has its origins in the era of the New Deal during the 1930s as a result of the policies initiated by reform or modern liberals, when many classical liberals started calling themselves conservatives as they did not wish to be identified with what was passing for liberalism.

The Ministry of Finance of Chile is the cabinet-level administrative office in charge of managing the financial affairs, fiscal policy, and capital markets of Chile; planning, directing, coordinating, executing, controlling and informing all financial policies formulated by the President of Chile.

The phrase Bush tax cuts refers to changes to the United States tax code passed originally during the presidency of George W. Bush and extended during the presidency of Barack Obama, through:

The Guano Era refers to a period of stability and prosperity in Peru during the mid-19th century. It was sustained on the substantial revenues generated by the export of guano and the strong leadership of president Ramón Castilla. The starting date for the guano era is commonly considered to be 1845, the year in which Castilla started his first administration. It ended shortly after the war between Spain and Peru in 1866.

Fiscal policy refers to the "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures. Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals." In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there have been improvements in the last few years.

The external debt is the amount of debt a country owes to foreign or international creditors. The debtors can be the government, corporations or citizens of that country. The estimated Philippines foreign debt under the Aquino administration in early 2016 was US$77,319,196,000.

The Japanese public debt exceeded one quadrillion yen or about US$10.46 trillion in 2013, more than twice the country's annual gross domestic product. By 2015, the figure rose to US$11.06 trillion. As the country adopted key economic initiatives, this figure start to dip so that by the end of December 2017, the debt stood at US$9.94 trillion.

The Peruvian nitrate monopoly was a state-owned enterprise over the mining and sale of saltpeter created by the government of Peru in 1875 and operated by the Peruvian Nitrate Company. Peru intended for the monopoly to capitalize on the world market's high demand for nitrates, thereby increasing the country's fiscal revenues and supplementing the financial role that guano sales had provided for the nation during the Guano Era (1840s-1860s).