Fundraising

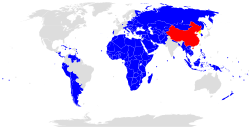

The first stage of the China-CEE Fund was announced in 2012 with a scale of US$500 million by then Chinese Prime Minister Wen Jiabao as part of "Twelve Measures for Promoting Friendly Cooperation with Central and Eastern European Countries". [2]

The groundwork was laid in November 2017 for Fund II during the China-CEE Summit in Budapest. Chinese Prime Minister Li Keqiang announced additional funding for the second phase of the fund. Other investors joined and contributed to Fund II and in April 2018 the total raised was US$800 million. The investors were Export Import Bank of China, Magyar Eximbank, Silk Road Fund and CEE Equity Partners. [3] Fund II's investor adviser is CEE Equity Partners.

This page is based on this

Wikipedia article Text is available under the

CC BY-SA 4.0 license; additional terms may apply.

Images, videos and audio are available under their respective licenses.

Acquisition of Energy 21 a.s., an operator of solar power plants in the Czech Republic, by the first stage of the fund from Mid-Europa Partners and Darby Private Equity for an undisclosed amount. [4]

Acquisition of Energy 21 a.s., an operator of solar power plants in the Czech Republic, by the first stage of the fund from Mid-Europa Partners and Darby Private Equity for an undisclosed amount. [4]  Acquisition by Fund II of 15 grain silos and logistics hubs in Romania from the Brise Group for €60 million in 2019. [5]

Acquisition by Fund II of 15 grain silos and logistics hubs in Romania from the Brise Group for €60 million in 2019. [5]