Fiat S.p.A., or Fabbrica Italiana Automobili Torino, was an Italian holding company whose original and core activities were in the automotive industry, and that was succeeded by Fiat Chrysler Automobiles NV (FCA). The Fiat Group contained many brands such as Ferrari, Maserati, Fiat, Alfa Romeo, the Chrysler Group, and many more. On 29 January 2014, it was announced that Fiat S.p.A. was to be merged into a new Netherlands-based holding company Fiat Chrysler Automobiles NV (FCA), taking place before the end of 2014. Fiat Chrysler Automobiles became the new owner of Fiat Group. On 1 August 2014, Fiat S.p.A. received necessary shareholder approval to proceed with the merger. The merger became effective 12 October 2014.

Avaya LLC, often shortened to Avaya and formerly Avaya Inc., is an American multinational technology company headquartered in Morristown, New Jersey, that provides cloud communications and workstream collaboration services. The company's platform includes unified communications and contact center services. In 2019, the company provided services to 220,000 customer locations in 190 countries.

Debt restructuring is a process that allows a private or public company or a sovereign entity facing cash flow problems and financial distress to reduce and renegotiate its delinquent debts to improve or restore liquidity so that it can continue its operations.

Digicel is a Jamaican-based Caribbean mobile phone network and home entertainment provider operating in 25 markets worldwide.

Trump Entertainment Resorts, Inc. was a gambling and hospitality company. The company previously owned and operated the now-demolished Trump Plaza and Trump World's Fair, the now-closed Trump Marina, Trump Casino & Hotel in Gary, Indiana, Trump 29 in Coachella, California, and Trump Taj Mahal in Atlantic City. It was founded in 1995 as Trump Hotels & Casino Resorts by Donald Trump, who after 2004 held only a minority ownership. The company filed for bankruptcy in 2004, 2009 and 2014. It became a subsidiary of Icahn Enterprises in 2016. Since then, all of the company's properties have been closed and sold.

Dynegy Inc. is an electric company based in Houston, Texas. It owns and operates a number of power stations in the U.S., all of which are natural gas-fueled or coal-fueled. Dynegy was acquired by Vistra Corp on April 9, 2018. The company is located at 601 Travis Street in Downtown Houston. The company was founded in 1984 as Natural Gas Clearinghouse. It was originally an energy brokerage, buying and selling natural gas supplies. It changed its name to NGC Corporation in 1995 after entering the electrical power generation business.

A bailout is the provision of financial help to a corporation or country which otherwise would be on the brink of bankruptcy. A bailout differs from the term bail-in under which the bondholders or depositors of global systemically important financial institutions (G-SIFIs) are forced to participate in the recapitalization process but taxpayers are not. Some governments also have the power to participate in the insolvency process; for instance, the U.S. government intervened in the General Motors bailout of 2009–2013. A bailout can, but does not necessarily, avoid an insolvency process. The term bailout is maritime in origin and describes the act of removing water from a sinking vessel using a bucket.

The Argentine debt restructuring is a process of debt restructuring by Argentina that began on January 14, 2005, and allowed it to resume payment on 76% of the US$82 billion in sovereign bonds that defaulted in 2001 at the depth of the worst economic crisis in the nation's history. A second debt restructuring in 2010 brought the percentage of bonds under some form of repayment to 93%, though ongoing disputes with holdouts remained. Bondholders who participated in the restructuring settled for repayments of around 30% of face value and deferred payment terms, as well as warrants that paid investors based on annual economic growth as part of the same offer, and began to be paid punctually; the value of their nearly worthless bonds also began to rise. The remaining 7% of bondholders were later repaid 25% less than they were demanding, after centre-right and US-aligned leader Mauricio Macri came to power in 2015.

Cerberus Capital Management, L.P. is an American global alternative investment firm with assets across credit, private equity, and real estate strategies. The firm is based in New York City, and run by Steve Feinberg, who co-founded Cerberus in 1992, with William L. Richter, who serves as a senior managing director. The firm has affiliate and advisory offices in the United States, Europe and Asia.

Monaco is a recreational vehicle (RV) brand, manufactured in Decatur, Indiana, and wholly owned by REV Recreation Group. Monaco holds a portfolio of Class A diesel motorhomes. REV Recreation Group is a subsidiary of REV Group.

Beginning in the latter half of 2008, a global-scale recession adversely affected the economy of the United States. A combination of several years of declining automobile sales and scarce availability of credit led to a more widespread crisis in the United States auto industry in the years of 2008 and 2009.

The 2009 General Motors Chapter 11 sale of the assets of automobile manufacturer General Motors and some of its subsidiaries was implemented through Chapter 11, Title 11, United States Code in the United States bankruptcy court for the Southern District of New York. The United States government-endorsed sale enabled the NGMCO Inc. to purchase the continuing operational assets of the old GM. Normal operations, including employee compensation, warranties, and other customer services were uninterrupted during the bankruptcy proceedings. Operations outside of the United States were not included in the court filing.

Indiana State Police Pension Trust v. Chrysler LLC was a lawsuit brought in United States federal court June 2009 by several pension funds against Chrysler LLC and the United States Department of the Treasury, to block the planned sale of Chrysler LLC assets to a "New Chrysler" entity in the Chrysler bankruptcy.

The history of Chrysler involves engineering innovations, high finance, wide alternations of profits and losses, various mergers and acquisitions, and multinationalization. Chrysler, a large automobile manufacturer, was founded in the 1920s and continues under the name Stellantis North America.

Motors Liquidation Company (MLC), formerly General Motors Corporation, was the company left to settle past liability claims from Chapter 11 reorganization of American car manufacturer General Motors. It exited bankruptcy on March 31, 2011, only to be carved into four trusts; the first to settle the claims of unsecured creditors, the second to handle environmental response for MLC's remaining assets, a third to handle present and future asbestos-related claims, and a fourth for litigation claims.

The Companies' Creditors Arrangement Act is a statute of the Parliament of Canada that allows insolvent corporations owing their creditors in excess of $5 million to restructure their businesses and financial affairs.

Sun Indalex Finance, LLC v United Steelworkers, 2013 SCC 6, arising from the Ontario courts as Re Indalex Limited, is a decision of the Supreme Court of Canada that deals with the question of priorities of claims in proceedings under the Companies' Creditors Arrangement Act, and how they intersect with the fiduciary duties employers have as administrators of pension plans.

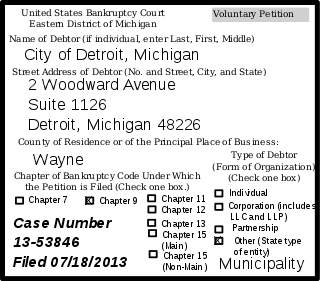

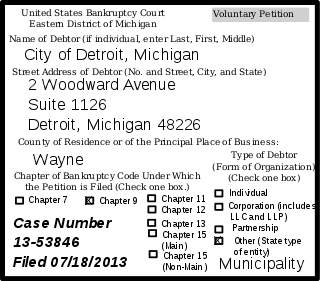

The city of Detroit, Michigan, filed for Chapter 9 bankruptcy on July 18, 2013. It is the largest municipal bankruptcy filing in U.S. history by debt, estimated at $18–20 billion, exceeding Jefferson County, Alabama's $4-billion filing in 2011. Detroit is also the largest city by population in U.S. history to file for Chapter 9 bankruptcy, more than twice as large as Stockton, California, which filed in 2012. While Detroit's population had declined from a peak of 1.8 million in 1950, its July 2013 population was reported by The New York Times as a city of 700,000.

Greylock Capital Management, LLC is a U.S. Securities and Exchange Commission registered alternative investment adviser that invests globally in high yield, undervalued, and distressed assets worldwide, particularly in emerging and frontier markets. The firm was founded in 2004 by Hans Humes from a portfolio of emerging market assets managed by Humes while at Van Eck Global. AJ Mediratta joined the firm in 2008 from Bear Stearns and serves as its president.

Financial Oversight and Management Bd. for Puerto Rico v. Aurelius Investment, LLC, 590 U.S. ___ (2020), was a United States Supreme Court case in which the Court held that appointments to the Financial Oversight and Management Board for Puerto Rico are not subject to the restrictions in the Appointments Clause of the U.S. Constitution. The Court held that all officers of the United States are subject to the Appointments Clause even if their duties relate to Puerto Rico. However, the power they exercise must be primarily federal in nature for the Clause to apply. If the officer exercises powers primarily of a local nature, even if created by federal law, then the officer is not "of the United States" and is exempt from compliance with the Clause. As members of the Board are primarily concerned with the governance of Puerto Rico, even though their decisions have potentially nationwide consequences, their powers are primarily local in nature and need not be appointed in compliance with the Clause.