Related Research Articles

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2010, taxes collected by federal, state, and municipal governments amounted to 24.8% of GDP. In the OECD, only Chile and Mexico are taxed less as a share of their GDP.

The Department of the Treasury (USDT) is the national treasury of the federal government of the United States where it serves as an executive department. The department oversees the Bureau of Engraving and Printing, and the U.S. Mint; these two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The Department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

The national debt of the United States is the total debt, or unpaid borrowed funds, carried by the federal government of the United States, which is measured as the face value of the currently outstanding Treasury securities that have been issued by the Treasury and other federal government agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. A deficit year increases the debt, while a surplus year decreases the debt as more money is received than spent.

The General Services Administration (GSA) is an independent agency of the United States government established in 1949 to help manage and support the basic functioning of federal agencies. GSA supplies products and communications for U.S. government offices, provides transportation and office space to federal employees, and develops government-wide cost-minimizing policies and other management tasks.

The Federal Ministry of Finance, abbreviated BMF, is the cabinet-level finance ministry of Germany, with its seat at the Detlev-Rohwedder-Haus in Berlin and a secondary office in Bonn. The current Federal Minister of Finance is Olaf Scholz (SPD).

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips. The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns.

The Joint Committee on Taxation (JCT) is a Committee of the U.S. Congress established under the Internal Revenue Code at 26 U.S.C. § 8001.

Salisbury Township School District is a small, suburban, public school district located in Lehigh County, Pennsylvania, in the United States. It serves Salisbury Township. The District is one of the 500 public school districts of Pennsylvania. The district encompasses approximately 11 square miles (28 km2). According to 2000 federal census data, it serves a resident population of 13,498. By 2010, The US Census Bureau reported that Salisbury Township School District's resident population was 13,505 people. In 2009, the district residents’ per capita income was $28,073, while the median family income was $62,534. In the Commonwealth, the median family income was $49,501 and the United States median family income was $49,445, in 2010. By 2013, the median household income in the United States rose to $52,100. The educational attainment levels for the Salisbury Township School District population were 91.0% high school graduates and 28.9% college graduates.

The Pennsylvania State Treasurer is the head of the Pennsylvania Treasury Department, an independent department of state government. The state treasurer is elected every four years. Treasurers are limited to two consecutive terms.

The Wisconsin Department of Revenue (DOR) is an agency of the Wisconsin state government responsible for the administration of all tax laws, as well as valuing property and overseeing the wholesale distribution of alcoholic beverages and enforcement of liquor laws. The Department also administers the state's unclaimed property program and the state lottery.

The Internal Revenue Service (IRS) is the revenue service of the United States federal government. The government agency is a bureau of the Department of the Treasury, and is under the immediate direction of the Commissioner of Internal Revenue, who is appointed to a five-year term by the President of the United States. The IRS is responsible for collecting taxes and administering the Internal Revenue Code, the main body of federal statutory tax law of the United States. The duties of the IRS include providing tax assistance to taxpayers and pursuing and resolving instances of erroneous or fraudulent tax filings. The IRS has also overseen various benefits programs, and enforces portions of the Affordable Care Act.

Randolph Evernghim Paul (1890–1956) was a name partner of the international law firm of Paul, Weiss, Rifkind, Wharton & Garrison and was a lawyer specializing in tax law. He is credited as "an architect of the modern tax system."

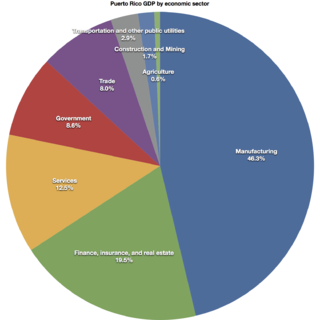

As of 2012, the real estate industry in Puerto Rico constituted about 14.8% of the gross domestic product of Puerto Rico, about 1% of all of the employee compensation on the island and, together with finance and insurance (FIRE), about 3.7% of all the employment on the jurisdiction.

A Delaware statutory trust (DST) is a legally recognized trust that is set up for the purpose of business, but not necessarily in the U.S. state of Delaware. It may also be referred to as an Unincorporated Business Trust or UBO.

Fiscal policy refers to the "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures. Fiscal measures are frequently used in tandem with monetary policy to achieve certain goals." In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there have been improvements in the last few years.

The Ministry of Finance, abbreviated MOF, is a ministry of the Government of Malaysia that is charged with the responsibility for government expenditure and revenue raising. The ministry's role is to develop economic policy and prepare the Malaysian federal budget. The Ministry of Finance also oversees financial legislation and regulation. Each year in October, the Minister of Finance presents the Malaysian federal budget to the Parliament.

The administrative structure of the government of the Empire of Japan on the eve of the Second World War broadly consisted of the Cabinet, the civil service, local and prefectural governments, the governments-general of Chosen (Korea) and Formosa (Taiwan) and the colonial offices. It underwent several changes during the wartime years, and was entirely reorganized when the Empire of Japan was officially dissolved in 1947.

In Malaysia, federal budgets are presented annually by the Government of Malaysia to identify proposed government revenues and spending and forecast economic conditions for the upcoming year, and its fiscal policy for the forward years. The federal budget includes the government's estimates of revenue and spending and may outline new policy initiatives. Federal budgets are usually released in October, before the start of the fiscal year. All of the Malaysian states also present budgets. Since state finances are dependent on money from the federal government, these budgets are usually released after the federal one.

References

- 1 2 3 4 5 6 7 8 Annual Report of the Director of the Bureau of the Budget to the President. United States Bureau of the Budget. 1922. Retrieved 22 July 2017.

- ↑ "Annual Report by President Heitt". National Real Estate and Building Journal. 23. June 19, 1922. Retrieved 23 July 2017.

- ↑ ""Uncle Sam Preparing Standard Lease"". National Real Estate and Building Journal. 23. December 4, 1922. Retrieved 23 July 2017.

- 1 2 "Executive Orders, Harry S. Truman, EXECUTIVE ORDER No. 10287 REVOKING EXECUTIVE ORDER No. 8304 OF JANUARY 14, 1939 AND ABOLISHING THE FEDERAL REAL ESTATE BOARD, Nevada". trumanlibrary.org. Retrieved 23 July 2017.

- 1 2 "Message to Congress Establishing the Federal Real Estate Board". The American Presidency Project. Retrieved 22 July 2017.

- 1 2 3 4 5 Hall, R. Clifford (November 1943). "INTRODUCTION TO THE FEDERAL REAL ESTATE BOARD REPORT". Proceedings of the Annual Conference on Taxation under the Auspices of the National Tax Association. National Tax Association. 36. JSTOR 23405074.

- ↑ "Public Papers, Harry S. Truman, Veto of Bill for the Relief of the City of Reno, Nevada". trumanlibrary.org. Retrieved 23 July 2017.

- ↑ United States Government Manual. Washington D.C.: Division of Public Inquiries – Office of War Information. 1945. Retrieved 23 July 2017.