Economics is a social science that studies the production, distribution, and consumption of goods and services.

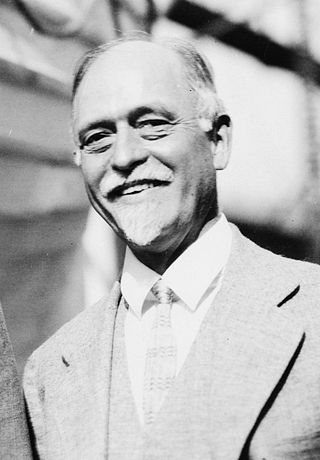

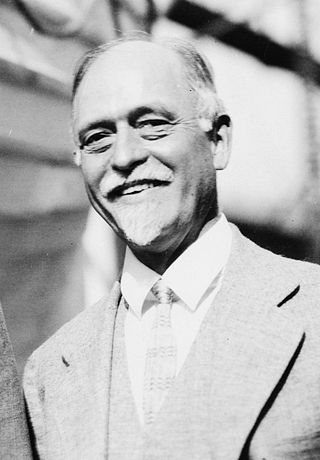

Joseph Alois Schumpeter was an Austrian political economist. He served briefly as Finance Minister of Austria in 1919. In 1932, he emigrated to the United States to become a professor at Harvard University, where he remained until the end of his career, and in 1939 obtained American citizenship.

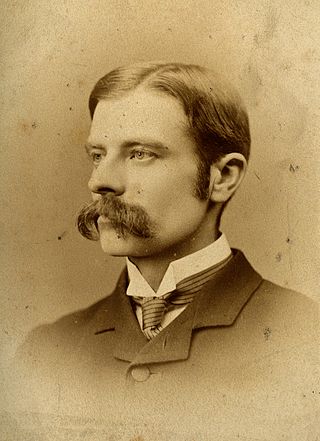

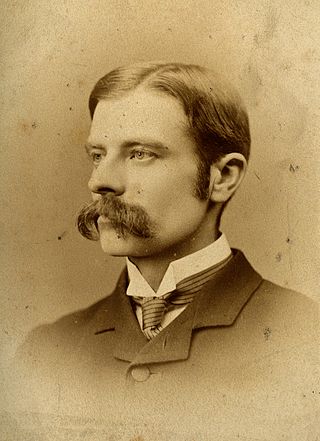

Arthur Cecil Pigou was an English economist. As a teacher and builder of the School of Economics at the University of Cambridge, he trained and influenced many Cambridge economists who went on to take chairs of economics around the world. His work covered various fields of economics, particularly welfare economics, but also included business cycle theory, unemployment, public finance, index numbers, and measurement of national output. His reputation was affected adversely by influential economic writers who used his work as the basis on which to define their own opposing views. He reluctantly served on several public committees, including the Cunliffe Committee and the 1919 Royal Commission on income tax.

The German historical school of economics. was an approach to academic economics and to public administration that emerged in the 19th century in Germany, and held sway there until well into the 20th century. The professors involved compiled massive economic histories of Germany and Europe. Numerous Americans were their students. The school was opposed by theoretical economists. Prominent leaders included Gustav von Schmoller (1838–1917), and Max Weber (1864–1920) in Germany, and Joseph Schumpeter (1883–1950) in Austria and the United States.

Monetary economics is the branch of economics that studies the different theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

Irving Fisher was an American economist, statistician, inventor, eugenicist and progressive social campaigner. He was one of the earliest American neoclassical economists, though his later work on debt deflation has been embraced by the post-Keynesian school. Joseph Schumpeter described him as "the greatest economist the United States has ever produced", an assessment later repeated by James Tobin and Milton Friedman.

Catallactics is a theory of the way the free market system reaches exchange ratios and prices. It aims to analyse all actions based on monetary calculation and trace the formation of prices back to the point where an agent makes his or her choices. It explains prices as they are, rather than as they "should" be. The laws of catallactics are not value judgments, but aim to be exact, empirical, and of universal validity. It was used extensively by the Austrian School economist Ludwig von Mises.

Francis Ysidro Edgeworth was an Anglo-Irish philosopher and political economist who made significant contributions to the methods of statistics during the 1880s. From 1891 onward, he was appointed the founding editor of The Economic Journal.

Hermann Heinrich Gossen was a German economist who is often regarded as the first to elaborate, in detail, a general theory of marginal utility.

Heterodox economics is a broad, relative term referring to schools of economic thought which are not commonly perceived as belonging to mainstream economics. There is no absolute definition of what constitutes heterodox economic thought, as it is defined in constrast to the most prominent, influential or popular schools of thought in a given time and place.

Gottfried Haberler was an Austrian-American economist. He worked in particular on international trade. One of his major contributions was reformulating the Ricardian idea of comparative advantage in a neoclassical framework, abandoning the labor theory of value for an opportunity cost concept.

David Ernest William Laidler is an English/Canadian economist who has been one of the foremost scholars of monetarism. He published major economics journal articles on the topic in the late 1960s and early 1970s. His book, The Demand for Money, was published in four editions from 1969 through 1993, initially setting forth the stability of the relationship between income and the demand for money and later taking into consideration the effects of legal, technological, and institutional changes on the demand for money. The book has been translated into French, Spanish, Italian, Japanese, and Chinese.

Edwin Cannan was a British economist and historian of economic thought. He taught at the London School of Economics from 1895 to 1926.

In the history of economic thought, a school of economic thought is a group of economic thinkers who share or shared a mutual perspective on the way economies function. While economists do not always fit within particular schools, particularly in the modern era, classifying economists into schools of thought is common. Economic thought may be roughly divided into three phases: premodern, early modern and modern. Systematic economic theory has been developed primarily since the beginning of what is termed the modern era.

James Bonar was a Scottish civil servant, political economist and historian of economic thought.

Herbert Somerton Foxwell, FBA was an English economist.

Costantino Bresciani-Turroni was an Italian economist and statistician. He was the last internationally known representative of Italy’s classical school of economics, which flourished in the early part of the century and continued to exert its influence between the world wars.

George Cyril Allen, published as G. C. Allen, was a British economist and academic. He was Brunner Professor of Economic Science at the University of Liverpool from 1933 to 1947, and then Professor of Political Economy at University College London from 1947 to 1967. He wrote on Japanese and British industrial policy.

Charles Franklin Dunbar was an American economist. He held the first Chair of Political Economy at the Harvard University in 1871.

Richard Sidney Sayers was a British economist and historian specialized in the history of banking. He played an important role with regard to the development of monetary economics and the direction of British central banking.