Sovereign immunity, or crown immunity, is a legal doctrine whereby a sovereign or state cannot commit a legal wrong and is immune from civil suit or criminal prosecution, strictly speaking in modern texts in its own courts. State immunity is a similar, stronger doctrine, that applies to foreign courts.

Tribal sovereignty in the United States is the concept of the inherent authority of Indigenous tribes to govern themselves within the borders of the United States.

Citizen Potawatomi Nation is a federally recognized tribe of Potawatomi people located in Oklahoma. The Potawatomi are traditionally an Algonquian-speaking Eastern Woodlands tribe. They have 29,155 enrolled tribal members, of whom 10,312 live in the state of Oklahoma.

Duro v. Reina, 495 U.S. 676 (1990), was a United States Supreme Court case in which the Court concluded that Indian tribes could not prosecute Indians who were members of other tribes for crimes committed by those nonmember Indians on their reservations. The decision was not well received by the tribes, because it defanged their criminal codes by depriving them of the power to enforce them against anyone except their own members. In response, Congress amended a section of the Indian Civil Rights Act, 25 U.S.C. § 1301, to include the power to "exercise criminal jurisdiction over all Indians" as one of the powers of self-government.

College Savings Bank v. Florida Prepaid Postsecondary Education Expense Board, 527 U.S. 666 (1999), was a decision by the Supreme Court of the United States relating to the doctrine of sovereign immunity.

In United States law, the federal government as well as state and tribal governments generally enjoy sovereign immunity, also known as governmental immunity, from lawsuits. Local governments in most jurisdictions enjoy immunity from some forms of suit, particularly in tort. The Foreign Sovereign Immunities Act provides foreign governments, including state-owned companies, with a related form of immunity—state immunity—that shields them from lawsuits except in relation to certain actions relating to commercial activity in the United States. The principle of sovereign immunity in US law was inherited from the English common law legal maxim rex non potest peccare, meaning "the king can do no wrong." In some situations, sovereign immunity may be waived by law.

United States v. Lara, 541 U.S. 193 (2004), was a United States Supreme Court landmark case which held that both the United States and a Native American (Indian) tribe could prosecute an Indian for the same acts that constituted crimes in both jurisdictions. The Court held that the United States and the tribe were separate sovereigns; therefore, separate tribal and federal prosecutions did not violate the Double Jeopardy Clause.

Santa Clara Pueblo v. Martinez, 436 U.S. 49 (1978), was a landmark case in the area of federal Indian law involving issues of great importance to the meaning of tribal sovereignty in the contemporary United States. The Supreme Court sustained a law passed by the governing body of the Santa Clara Pueblo that explicitly discriminated on the basis of sex. In so doing, the Court advanced a theory of tribal sovereignty that weighed the interests of tribes sufficient to justify a law that, had it been passed by a state legislature or Congress, would have almost certainly been struck down as a violation of equal protection.

C & L Enterprises, Inc. v. Citizen Band, Potawatomi Indian Tribe of Oklahoma, 532 U.S. 411 (2001), was a United States Supreme Court case in which the Court held that the tribe waived its sovereign immunity when it agreed to a contract containing an arbitration agreement.

City of Sherrill v. Oneida Indian Nation of New York, 544 U.S. 197 (2005), was a Supreme Court of the United States case in which the Court held that repurchase of traditional tribal lands 200 years later did not restore tribal sovereignty to that land. Justice Ruth Bader Ginsburg wrote the majority opinion.

Okla. Tax Commission v. Citizen Band, Potawatomi Indian Tribe of Okla., 498 U.S. 505 (1991), was a case in which the Supreme Court of the United States held that the tribe was not subject to state sales taxes on sales made to tribal members, but that they were liable for taxes on sales to non-tribal members.

Cherokee Nation of Oklahoma v. Leavitt, 543 U.S. 631 (2005), was a United States Supreme Court case in which the Court held that a contract with the Federal Government to reimburse the tribe for health care costs was binding, despite the failure of Congress to appropriate funds for those costs.

The United States was the first jurisdiction to acknowledge the common law doctrine of aboriginal title. Native American tribes and nations establish aboriginal title by actual, continuous, and exclusive use and occupancy for a "long time." Individuals may also establish aboriginal title, if their ancestors held title as individuals. Unlike other jurisdictions, the content of aboriginal title is not limited to historical or traditional land uses. Aboriginal title may not be alienated, except to the federal government or with the approval of Congress. Aboriginal title is distinct from the lands Native Americans own in fee simple and occupy under federal trust.

Merrion v. Jicarilla Apache Tribe, 455 U.S. 130 (1982), was a case in which the Supreme Court of the United States holding that an Indian tribe has the authority to impose taxes on non-Indians that are conducting business on the reservation as an inherent power under their tribal sovereignty.

The following outline is provided as an overview of and topical guide to United States federal Indian law and policy:

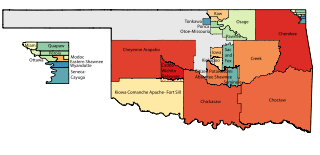

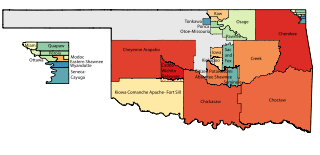

Oklahoma Tribal Statistical Area is a statistical entity identified and delineated by federally recognized American Indian tribes in Oklahoma as part of the U.S. Census Bureau's 2010 Census and ongoing American Community Survey. Many of these areas are also designated Tribal Jurisdictional Areas, areas within which tribes will provide government services and assert other forms of government authority. They differ from standard reservations, such as the Osage Nation of Oklahoma, in that allotment was broken up and as a consequence their residents are a mix of native and non-native people, with only tribal members subject to the tribal government. At least five of these areas, those of the so-called five civilized tribes of Cherokee, Choctaw, Chickasaw, Creek and Seminole, which cover 43% of the area of the state, are recognized as reservations by federal treaty, and thus not subject to state law or jurisdiction for tribal members.

Wagnon v. Prairie Band Potawatomi Indians, 546 U.S. 95 (2005), was a case in which the Supreme Court of the United States held that a state's non-discriminatory fuel tax imposed on off-reservation distributors does not pose an affront to a tribe's sovereignty.

Oklahoma Tax Commission v. Sac & Fox Nation, 508 U.S. 114 (1993), was a case in which the Supreme Court of the United States held that absent explicit congressional direction to the contrary, it must be presumed that a State does not have jurisdiction to tax tribal members who live and work in Indian country, whether the particular territory consists of a formal or informal reservation, allotted lands, or dependent Indian communities.

Michigan v. Bay Mills Indian Community, 572 U.S. 782 (2014), was a United States Supreme Court case examining whether a federal court has jurisdiction over activity that violates the Indian Gaming Regulatory Act but takes place off Indian lands, and, if so, whether tribal sovereign immunity prevents a state from suing in federal court. In a 5–4 decision, the Court held that the State of Michigan's suit against Bay Mills is barred by tribal immunity.

United States v. Antelope, 430 U.S. 641 (1977), was a United States Supreme Court case in which the Court held that American Indians convicted on reservation land were not deprived of the equal protection of the laws; (a) the federal criminal statutes are not based on impermissible racial classifications but on political membership in an Indian tribe or nation; and (b) the challenged statutes do not violate equal protection. Indians or non-Indians can be charged with first-degree murder committed in a federal enclave.