Related Research Articles

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and minting coins, while the treasury executes currency circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

His Majesty's Treasury, occasionally referred to as the Exchequer, or more informally the Treasury, is a department of His Majesty's Government responsible for developing and executing the government's public finance policy and economic policy. The Treasury maintains the Online System for Central Accounting and Reporting (OSCAR), the replacement for the Combined Online Information System (COINS), which itemises departmental spending under thousands of category headings, and from which the Whole of Government Accounts (WGA) annual financial statements are produced.

The Federal Old-Age and Survivors Insurance Trust Fund and Federal Disability Insurance Trust Fund are trust funds that provide for payment of Social Security benefits administered by the United States Social Security Administration.

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

- The efficient allocation of available resources;

- The distribution of income among citizens; and

- The stability of the economy.

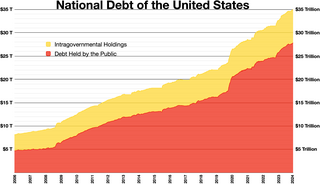

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

The treasurerof Australia, also known as the Federaltreasurer or simply the treasurer, is the minister of state of the Commonwealth of Australia charged with overseeing government revenue collection, federal expenditure and economic policy as the head of the Department of the Treasury. The current treasurer is Jim Chalmers, who was appointed by Prime Minister Anthony Albanese in May 2022 following the 2022 Australian federal election.

The Bureau of the Public Debt was an agency within the Fiscal Service of the United States Department of the Treasury. United States Secretary of the Treasury Timothy Geithner issued a directive that the Bureau be combined with the Financial Management Service to form the Bureau of the Fiscal Service in 2012.

The Financial Management Service was a bureau of the United States Department of the Treasury and provided several financial services for the federal government. On October 7, 2012, Secretary of the Treasury Timothy Geithner issued a directive merging the FMS with the Bureau of the Public Debt to form the new Bureau of the Fiscal Service.

The state auditor of Minnesota is a constitutional officer in the executive branch of the U.S. state of Minnesota. Nineteen individuals have held the office of state auditor since statehood. The incumbent is Julie Blaha, a DFLer.

The Under Secretary of the Treasury for Domestic Finance is a high-ranking position within United States Department of the Treasury that reports to, advises, and assists the Secretary of the Treasury and the Deputy Secretary of the Treasury. The under secretary leads the department's policy on the issues of domestic finance, fiscal policy, fiscal operations, government assets, government liabilities, and other related economic and fiscal matters.

Fund accounting is an accounting system for recording resources whose use has been limited by the donor, grant authority, governing agency, or other individuals or organisations or by law. It emphasizes accountability rather than profitability, and is used by Nonprofit organizations and by governments. In this method, a fund consists of a self-balancing set of accounts and each are reported as either unrestricted, temporarily restricted or permanently restricted based on the provider-imposed restrictions.

The State Treasurer of Oklahoma is the chief custodian of Oklahoma's cash deposits, monies from bond sales, and other securities and collateral and directs the investments of those assets. The treasurer provides for the safe and efficient operation of state government through effective banking, investment, and cash management. The state treasurer has the powers of a typical chief financial officer for a corporation.

The Department of Finance is the executive department of the Philippine government responsible for the formulation, institutionalization and administration of fiscal policies, management of the financial resources of the government, supervision of the revenue operations of all local government units, the review, approval and management of all public sector debt, and the rationalization, privatization and public accountability of corporations and assets owned, controlled or acquired by the government.

The Office of Financial Institutions (OFI) is an agency of the United States federal government in the United States Department of the Treasury. OFI coordinates the department's efforts regarding financial institutions legislation and regulation, legislation affecting Federal agencies that regulate or insure financial institutions, and securities markets legislation and regulation. The office coordinates the department's efforts on financial education policy and ensuring the resiliency of the financial services sector in the wake of a terrorist attack.

The Office of Financial Markets is an office of the United States federal government in the United States Department of the Treasury. OFM serves as the department's advisor on broad matters of domestic finance, financial markets, Federal, State and local finance, Federal Government credit policies, lending and privatization.

The New York City Department of Finance (DOF) is the revenue service, taxation agency and recorder of deeds of the government of New York City. Its Parking Violations Bureau is an administrative court that adjudicates parking violations, while its Sheriff's Office is the city's primary civil law enforcement agency.

According to statute, the Fiscal Assistant Secretary is appointed by the United States Secretary of the Treasury. The Fiscal Assistant Secretary is the highest ranking career official in the Department of the Treasury. The Fiscal Service, which the Fiscal Assistant Secretary heads, includes the Bureau of Government Financial Operations (which since 1984 has been known as the Financial Management Service and the Bureau of the Public Debt.

Fiscal policy are "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures". In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there were improvements in the last few years of the first decade of the 21st century.

The Ministry of Finance, abbreviated MOF, is a ministry of the Government of Malaysia that is charged with the responsibility for government expenditure and revenue raising. The ministry's role is to develop economic policy and prepare the Malaysian federal budget. The Ministry of Finance also oversees financial legislation and regulation. Each year in October, the Minister of Finance presents the Malaysian federal budget to the Parliament.

Finance Department is a department of Government of Punjab, Pakistan. The Finance Department is responsible for supervision and control of provincial finances, preparation of provincial budget, formulation of Financial Rules, management of public debt.