The United States Department of Veterans Affairs (VA) is a Cabinet-level executive branch department of the federal government charged with providing lifelong healthcare services to eligible military veterans at the 170 VA medical centers and outpatient clinics located throughout the country. Non-healthcare benefits include disability compensation, vocational rehabilitation, education assistance, home loans, and life insurance. The VA also provides burial and memorial benefits to eligible veterans and family members at 135 national cemeteries.

Workers' compensation or workers' comp is a form of insurance providing wage replacement and medical benefits to employees injured in the course of employment in exchange for mandatory relinquishment of the employee's right to sue his or her employer for the tort of negligence. The trade-off between assured, limited coverage and lack of recourse outside the worker compensation system is known as "the compensation bargain.” One of the problems that the compensation bargain solved is the problem of employers becoming insolvent as a result of high damage awards. The system of collective liability was created to prevent that and thus to ensure security of compensation to the workers.

The Occupational Safety and Health Act of 1970 is a US labor law governing the federal law of occupational health and safety in the private sector and federal government in the United States. It was enacted by Congress in 1970 and was signed by President Richard Nixon on December 29, 1970. Its main goal is to ensure that employers provide employees with an environment free from recognized hazards, such as exposure to toxic chemicals, excessive noise levels, mechanical dangers, heat or cold stress, or unsanitary conditions. The Act created the Occupational Safety and Health Administration (OSHA) and the National Institute for Occupational Safety and Health (NIOSH).

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

The Sedition Act of 1918 was an Act of the United States Congress that extended the Espionage Act of 1917 to cover a broader range of offenses, notably speech and the expression of opinion that cast the government or the war effort in a negative light or interfered with the sale of government bonds.

The United States Shipping Board (USSB) was established as an emergency agency by the 1916 Shipping Act, on September 7, 1916. The United States Shipping Board's task was to increase the number of US ships supporting the World War I efforts. The program ended on March 2, 1934.

The United States Senate Committee on Finance is a standing committee of the United States Senate. The Committee concerns itself with matters relating to taxation and other revenue measures generally, and those relating to the insular possessions; bonded debt of the United States; customs, collection districts, and ports of entry and delivery; deposit of public moneys; general revenue sharing; health programs under the Social Security Act and health programs financed by a specific tax or trust fund; national social security; reciprocal trade agreements; tariff and import quotas, and related matters thereto; and the transportation of dutiable goods. It is considered to be one of the most powerful committees in Congress.

The United States Senate Committee on Veterans' Affairs deals with oversight of United States veterans problems and issues.

Crop insurance is insurance purchased by agricultural producers and subsidized by a country's government to protect against either the loss of their crops due to natural disasters, such as hail, drought, and floods ("crop-yield insurance", or the loss of revenue due to declines in the prices of agricultural commodities.

The National Asylum for Disabled Volunteer Soldiers was established on March 3, 1865, in the United States by Congress to provide care for volunteer soldiers who had been disabled through loss of limb, wounds, disease, or injury during service in the Union forces in the American Civil War. Initially, the Asylum, later called the Home, was planned to have three branches: in the Northeast, in the central area north of the Ohio River, and in what was then considered the Northwest, the present upper Midwest.

Rupert Lee Blue was an American physician and soldier. He was the fourth Surgeon General of the United States from 1912 to 1920. He served as president of the American Medical Association in 1916–17.

Edwin Emil Witte was an economist who focused on social insurance issues for the state of Wisconsin and for the Committee on Economic Security. While the executive director of the President's Committee on Economic Security under U.S. President Franklin D. Roosevelt, he developed during 1934 the policies and the legislation that became the Social Security Act of 1935. Because of this he is sometimes called "the father of Social Security".

Irving McNeil Ives was an American politician and founding dean of the Cornell University School of Industrial and Labor Relations. A Republican, he served as a United States Senator from New York from 1947 to 1959. He was previously a member of the New York State Assembly for sixteen years, serving as Minority Leader (1935), Speaker (1936), and Majority Leader (1937–1946). A liberal Republican, he was known as a specialist in labor and civil rights legislation. Ives voted in favor of the Civil Rights Act of 1957.

The New Freedom was Woodrow Wilson's campaign platform in the 1912 presidential election, and also refers to the progressive programs enacted by Wilson during his time as president. First expressed in his campaign speeches and promises, Wilson later wrote a 1913 book of the same name. After the 1918 midterm elections, Republicans took control of Congress and were mostly hostile to the New Freedom. As president, Wilson focused on various types of reform, such as the following:

- Tariff reform: This came through the passage of the Underwood Tariff Act of 1913, which lowered tariffs for the first time since 1857 and went against the protectionist lobby.

- Labor reform: This was achieved through measures such as the Eight Hour Law for Women of the District of Columbia, the Seaman’s Act, Workmen’s Compensation for Federal employees, the Federal Child Labor Bill, and the Adamson Act. During the 1912 campaign Wilson spoke in support of workers organizing into unions while endorsing "the betterment of men in this occupation and the other, the protection of women, the shielding of children, the bringing about of social justice.”

- Business reform: This was established through the passage of the Federal Trade Commission Act of 1914, which established the Federal Trade Commission to investigate and halt unfair and illegal business practices by issuing "cease and desist" orders, and the Clayton Antitrust Act.

- Agricultural reform: This was achieved through measures such as the Cotton Futures and Smith-Lever Acts of 1914, the Grain Standards and Warehouse Acts of 1916, and the Smith-Hughes Act of 1917.

- Banking reform: This came in 1913 through the creation of the Federal Reserve System and in 1916 through the passage of the Federal Farm Loan Act, which set up Farm Loan Banks to support farmers.

A credit bureau is a data collection agency that gathers account information from various creditors and provides that information to a consumer reporting agency in the United States, a credit reference agency in the United Kingdom, a credit reporting body in Australia, a credit information company (CIC) in India, Special Accessing Entity in the Philippines, and also to private lenders. It is not the same as a credit rating agency.

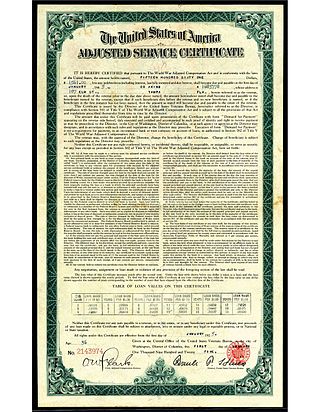

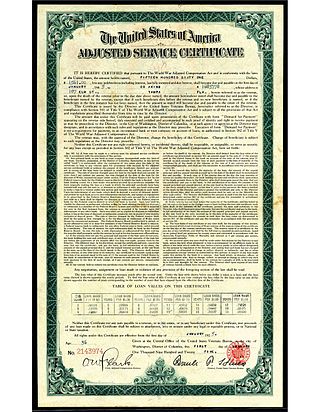

The World War Adjusted Compensation Act, or Bonus Act, was a United States federal law passed on May 19, 1924, that granted a benefit to veterans of American military service in World War I.

The Office of the Superintendent of Financial Institutions is an independent agency of the Government of Canada reporting to the Minister of Finance created "to contribute to public confidence in the Canadian financial system". It is the sole regulator of banks, and the primary regulator of insurance companies, trust companies, loan companies and pension plans in Canada.

The Office of Financial Institutions (OFI) is an agency of the United States federal government in the United States Department of the Treasury. OFI coordinates the department's efforts regarding financial institutions legislation and regulation, legislation affecting Federal agencies that regulate or insure financial institutions, and securities markets legislation and regulation. The office coordinates the department's efforts on financial education policy and ensuring the resiliency of the financial services sector in the wake of a terrorist attack.

Insurance in the United States refers to the market for risk in the United States, the world's largest insurance market by premium volume. According to Swiss Re, of the $6.861 trillion of global direct premiums written worldwide in 2021, $2.719 trillion (39.6%) were written in the United States.

The Nonadmitted and Reinsurance Reform Act of 2010 is a United States law regulating the sale of insurance in states where the insurer is usually not authorized to sell insurance. It prevents states other than the home state of a U.S. insurance company from imposing regulations or taxes on the sale of nonadmitted insurance.