The economy of Zimbabwe relies on the tertiary sector of the economy, also known as the service sector of the economy, which makes up to 60% of total GDP as of 2017. Zimbabwe has the second largest, by percentage, informal economy in the world, with a score of 60.6%. Agriculture and mining largely contribute to exports. After continuous negative growth between 1997 and 2008, the economy of Zimbabwe has seen rapid but volatile growth, averaging 11% on an end-to-end basis.

A tourist attraction is a place of interest that tourists visit, typically for its inherent or an exhibited natural or cultural value, historical significance, natural or built beauty, offering leisure and amusement.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

Government spending or expenditure includes all government consumption, investment, and transfer payments. In national income accounting, the acquisition by governments of goods and services for current use, to directly satisfy the individual or collective needs of the community, is classed as government final consumption expenditure. Government acquisition of goods and services intended to create future benefits, such as infrastructure investment or research spending, is classed as government investment. These two types of government spending, on final consumption and on gross capital formation, together constitute one of the major components of gross domestic product.

The military budget of the United States is the largest portion of the discretionary federal budget allocated to the Department of Defense (DoD), or more broadly, the portion of the budget that goes to any military-related expenditures. The military budget pays the salaries, training, and health care of uniformed and civilian personnel, maintains arms, equipment and facilities, funds operations, and develops and buys new items. The budget funds five branches of the US military: the Army, Navy, Marine Corps, Air Force, and Space Force.

An Australian federal budget is a document that sets out the estimated revenues and expenditures of the Australian Treasury in the following financial year, proposed conduct of Australian government operations in that period, and its fiscal policy for the forward years. Budgets are called by the year in which they are presented to Parliament and relate to a financial year that commences on the following 1 July and ends on 30 June of the following year, so that the 2023 budget brought down in May 2023 relates to the 2023/24 financial year.

A balanced budget is a budget in which revenues are equal to expenditures. Thus, neither a budget deficit nor a budget surplus exists. More generally, it is a budget that has no budget deficit, but could possibly have a budget surplus. A cyclically balanced budget is a budget that is not necessarily balanced year-to-year but is balanced over the economic cycle, running a surplus in boom years and running a deficit in lean years, with these offsetting over time.

PAYGO is the practice in the United States of financing expenditures with funds that are currently available rather than borrowed.

The Union Budget of India, also referred to as the Annual Financial Statement in Article 112 of the Constitution of India, is the annual budget of the Republic of India set by Ministry of Finance for the following financial year, with the revenues to be gathered by Department of Revenue to identify planned government spending and expected government revenue and the expenditures gathered by Department of Expenditure of the public sector, to forecast economic conditions in compliance with government policy.

The state auditor of Minnesota is a constitutional officer in the executive branch of the U.S. state of Minnesota. Nineteen individuals have held the office of state auditor since statehood. The incumbent is Julie Blaha, a DFLer.

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

A government budget is a projection of the government's revenues and expenditure for a particular period of time often referred to as a financial or fiscal year, which may or may not correspond with the calendar year. Government revenues mostly include taxes while expenditures consist of government spending. A government budget is prepared by the government or other political entity. In most parliamentary systems, the budget is presented to the legislature and often requires approval of the legislature. Through this budget, the government implements economic policy and realizes its program priorities. Once the budget is approved, the use of funds from individual chapters is in the hands of government ministries and other institutions. Revenues of the state budget consist mainly of taxes, customs duties, fees and other revenues. State budget expenditures cover the activities of the state, which are either given by law or the constitution. The budget in itself does not appropriate funds for government programs, hence need for additional legislative measures. The word budget comes from the Old French bougette.

A fiscal year is used in government accounting, which varies between countries, and for budget purposes. It is also used for financial reporting by businesses and other organizations. Laws in many jurisdictions require company financial reports to be prepared and published on an annual basis but generally with the reporting period not aligning with the calendar year. Taxation laws generally require accounting records to be maintained and taxes calculated on an annual basis, which usually corresponds to the fiscal year used for government purposes. The calculation of tax on an annual basis is especially relevant for direct taxes, such as income tax. Many annual government fees—such as council tax and license fees, are also levied on a fiscal year basis, but others are charged on an anniversary basis.

The Stabilization fund of the Russian Federation was a sovereign wealth fund established based on a resolution of the Government of Russia on 1 January 2004, as a part of the federal budget to balance the federal budget at the time of when oil price falls below a cut-off price, currently set at US$27 per barrel.

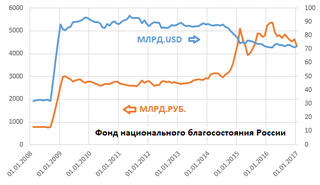

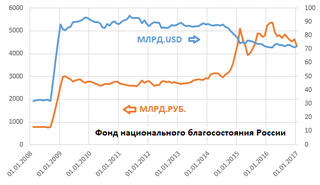

The Russian National Wealth Fund is Russia's sovereign wealth fund. It was created after the Stabilization Fund of the Russian Federation was split into two separate investment funds on 30 January 2008.

The Cabinet of Zimbabwe is the executive body that forms the government of Zimbabwe together with the President of Zimbabwe. The Cabinet is composed of the President, the Vice-Presidents, and ministers appointed by the President. Until 1987, the Cabinet was chaired by the Prime Minister; it is now headed by the President.

Government spending in the United Kingdom, also referred to as public spending, is the total spent by Central Government departments and certain other bodies as authorised by Parliament through the Estimates process. It includes net spending by the three devolved governments: the Scottish Government, the Welsh Government and the Northern Ireland Executive.

The Budget of His Majesty's Government is an annual budget set by HM Treasury for the following financial year, with the revenues to be gathered by HM Revenue and Customs and the expenditures of the public sector, in compliance with government policy. The budget statement is one of two statements made by the Chancellor of the Exchequer in the House of Commons, with the Spring Statement being made the following year.

The federal budget of Russia is the leading element of the budget system of Russia. The federal budget is a major state financial plan for the fiscal year, which has the force of law after its approval by the Russian parliament and signed into law by the President of Russia. That the federal budget is the primary means of redistribution of national income and gross domestic product through it mobilized the financial resources necessary to regulate the country's economic development, social policy and the strengthening of the national defense. The share of federal budget accounts for a significant portion of the distribution process, which is the allocation of funds between sectors of the economy, manufacturing and industrial areas, regions of the country.

The 2024 Zimbabwe national budget is the Zimbabwe’s central government budget for the fiscal year 2024, which runs from January 1, 2024 upto December 31, 2024. Finance minister, Mthuli Ncube submitted the proposal for passing to the Zimbabwe’s tenth parliament on 30 November 2023.