The economy of Benin remains underdeveloped and dependent on subsistence agriculture and cotton. Cotton accounts for 40% of Benin's GDP and roughly 80% of official export receipts. There is also production of textiles, palm products, and cocoa beans. Maize (corn), beans, rice, peanuts, cashews, pineapples, cassava, yams, and other various tubers are grown for local subsistence. Benin began producing a modest quantity of offshore oil in October 1982. Production ceased in recent years but exploration of new sites is ongoing.

The CFA franc is the name of two currencies used by 210 million people in fourteen African countries: the West African CFA franc, used in eight West African countries, and the Central African CFA franc, used in six Central African countries. Although separate, the two CFA franc currencies have always been at parity and are effectively interchangeable. The ISO currency codes are XAF for the Central African CFA franc and XOF for the West African CFA franc.

A central bank, reserve bank, national bank, or monetary authority is an institution that manages the currency and monetary policy of a country or monetary union. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base. Many central banks also have supervisory or regulatory powers to ensure the stability of commercial banks in their jurisdiction, to prevent bank runs, and in some cases also to enforce policies on financial consumer protection and against bank fraud, money laundering, or terrorism financing. Central banks play a crucial role in macroeconomic forecasting, which is essential for guiding monetary policy decisions, especially during times of economic turbulence.

The economy of Senegal is driven by mining, construction, tourism, fishing and agriculture, which are the main sources of employment in rural areas, despite abundant natural resources in iron, zircon, gas, gold, phosphates, and numerous oil discoveries recently. Senegal's economy gains most of its foreign exchange from fish, phosphates, groundnuts, tourism, and services. As one of the dominant parts of the economy, the agricultural sector of Senegal is highly vulnerable to environmental conditions, such as variations in rainfall and climate change, and changes in world commodity prices.

The economy of Togo has struggled greatly. The International Monetary Fund (IMF) ranks it as the tenth poorest country in the world, with development undercut by political instability, lowered commodity prices, and external debts. While industry and services play a role, the economy is dependent on subsistence agriculture, with industrialization and regional banking suffering major setbacks.

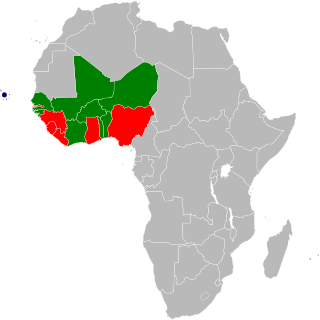

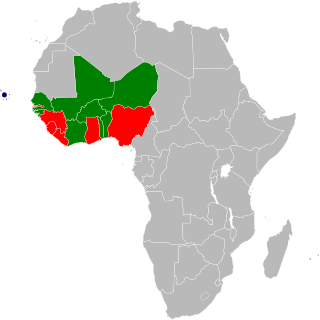

The Economic Community of West African States is a regional political and economic union of fifteen countries of West Africa. Collectively, the countries comprise an area of 5,114,162 km2 (1,974,589 sq mi) and have an estimated population of over 424.34 million.

The Federal Reserve Act was passed by the 63rd United States Congress and signed into law by President Woodrow Wilson on December 23, 1913. The law created the Federal Reserve System, the central banking system of the United States.

The Eastern Caribbean Central Bank (ECCB) is a supranational central bank that serves Anguilla, Antigua and Barbuda, Dominica, Grenada, Montserrat, Saint Kitts and Nevis, Saint Lucia, and Saint Vincent and the Grenadines, all members of the Organisation of Eastern Caribbean States (OECS) that use the ECCB-issued Eastern Caribbean Dollar as their currency. The ECCB was established in 1983, succeeding the British Caribbean Currency Board (1950–1965) and the Eastern Caribbean Currency Authority (1965–1983). It is also in charge of bank supervision within its geographical remit.

The eco is the name for the proposed common currency of the Economic Community of West African States (ECOWAS). Plans originally called for the West African Monetary Zone (WAMZ) states to introduce the currency first, which would eventually be merged with the Euro-pegged CFA franc which is used by the French-speaking West African region within the West African Economic and Monetary Union (UEMOA). This will also enable the UEMOA states to gain complete fiscal and monetary independence from France. The UEMOA states have alternatively proposed to reform the CFA franc into the eco first, which could then be extended to all ECOWAS states.

The Federal Reserve Bank of St. Louis is one of 12 regional Reserve Banks that, along with the Board of Governors in Washington, D.C., make up the United States' central bank. Missouri is the only state to have two main Federal Reserve Banks.

The African Economic Community (AEC) is an organization of African Union states establishing grounds for mutual economic development among the majority of African states. The stated goals of the organization include the creation of free trade areas, customs unions, a single market, a central bank, and a common currency thus establishing an economic and monetary union.

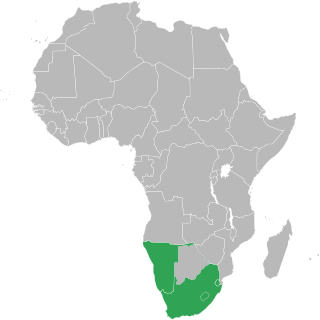

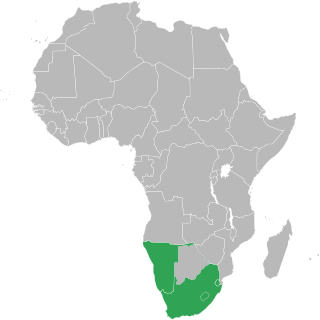

The Common Monetary Area (CMA) links South Africa, Namibia, Lesotho and Eswatini into a monetary union. The Southern African Customs Union (SACU) includes all CMA members in addition to Botswana, which replaced the rand with the pula in 1976 as a means of establishing an independent monetary policy. The CMA facilitates trade and promotes economic development between its member states.

The West African CFA franc is the currency used by eight independent states in West Africa which make up the West African Economic and Monetary Union: Benin, Burkina Faso, Côte d'Ivoire, Guinea-Bissau, Mali, Niger, Senegal and Togo. These eight countries had a combined population of 105.7 million people in 2014, and a combined GDP of US$128.6 billion as of 2018.

Money is any item or verifiable record that is generally accepted as payment for goods and services and repayment of debts, such as taxes, in a particular country or socio-economic context. The primary functions which distinguish money are: medium of exchange, a unit of account, a store of value and sometimes, a standard of deferred payment.

The Central Bank of the United Arab Emirates is the state institution responsible for managing the currency, monetary policy, banking and insurance regulation in the United Arab Emirates.

The African Monetary Union (AMU) is the proposed creation of an economic and monetary union for the countries of the African Union, administered by the African Central Bank. Such a union would call for the creation of a new unified currency, similar to the euro; the hypothetical currency is sometimes referred to as the afro or afriq. The single African currency is to be composed of currency units made up of regional union reserve bank currency units of which are made up country specific currencies.

The Khaleeji was a proposed name for a common currency of the member states of the Gulf Cooperation Council (GCC).

A customs and monetary union is a type of trade bloc which is composed of a customs union and a currency union. The participant countries have both common external trade policy and share a single currency.

The ECOWAS Bank for Investment and Development(EBID) is a leading regional investment and development bank, owned by the fifteen Economic Community of West African States (ECOWAS) Member States.