Related Research Articles

VSO is a not-for-profit international development organization charity with a vision for "a fair world for everyone" and a mission to "create lasting change through volunteering". VSO delivers development impact through a blended volunteer model consisting of international, national, and community volunteers working together to develop the systems and conditions for positive social change. In 2022–23, VSO worked in 35 countries in Africa and Asia.

A capital market is a financial market in which long-term debt or equity-backed securities are bought and sold, in contrast to a money market where short-term debt is bought and sold. Capital markets channel the wealth of savers to those who can put it to long-term productive use, such as companies or governments making long-term investments. Financial regulators like Securities and Exchange Board of India (SEBI), Bank of England (BoE) and the U.S. Securities and Exchange Commission (SEC) oversee capital markets to protect investors against fraud, among other duties.

A municipal bond, commonly known as a muni, is a bond issued by state or local governments, or entities they create such as authorities and special districts. In the United States, interest income received by holders of municipal bonds is often, but not always, exempt from federal and state income taxation. Typically, only investors in the highest tax brackets benefit from buying tax-exempt municipal bonds instead of taxable bonds. Taxable equivalent yield calculations are required to make fair comparisons between the two categories.

An International Finance Facility (IFF) is a bond issued against the security of donor government guarantees to maintain future aid flows for the purpose of international development.

Sukuk is the Arabic name for financial certificates, also commonly referred to as "sharia compliant" bonds. Sukuk are defined by the AAOIFI as "securities of equal denomination representing individual ownership interests in a portfolio of eligible existing or future assets." The Fiqh academy of the OIC legitimized the use of sukuk in February 1988.

Sir Ronald Mourad Cohen is an Egyptian-born British businessman and political figure. He is the chairman of The Portland Trust and Bridges Ventures. He has been described as "the father of British venture capital" and "the father of social investment".

The following outline is provided as an overview of and topical guide to finance:

Aga Khan Education Services (AKES) is one of the agencies of the Aga Khan Development Network (AKDN) supporting activities in the field of education. The others are the Aga Khan Foundation (AKF), the Aga Khan University (AKU), the University of Central Asia (UCA), and the Aga Khan Trust for Culture (AKTC).

Social finance is a category of financial services that aims to leverage private capital to address challenges in areas of social and environmental need. Having gained popularity in the aftermath of the 2007–2008 financial crisis, it is notable for its public benefit focus. Mechanisms of creating shared social value are not new; however, social finance is conceptually unique as an approach to solving social problems while simultaneously creating economic value. Unlike philanthropy, which has a similar mission-motive, social finance secures its own sustainability by being profitable for investors. Capital providers lend to social enterprises, who in turn, by investing borrowed funds in socially beneficial initiatives, deliver investors measurable social returns in addition to traditional financial returns on their investment.

Social Finance is a not for profit consultancy organisation that partners with governments, service providers, the voluntary sector and the financial community to find better ways of tackling social problems in the UK and globally. Founded in 2007, they have helped pioneer a series of programmes to improve outcomes for individuals with complex needs. Their innovations include the Social Impact Bonds (SIB) model which has mobilised more than £500 million globally in areas such as offender rehabilitation, children and family, homelessness and housing, young people at risk of becoming NEET, mental health and employment, loneliness and social isolation, and domestic violence.

The Portland Trust was established to promote peace and stability between Israelis and Palestinians through economic development. It works with a range of partners to help develop the Palestinian private sector and relieve poverty through entrepreneurship in Israel. It facilitates sustainable economic development through catalysing initiatives to build quality employment and thriving private sectors. Their work advances the growth of strong societies in Israel and Palestine based on socio-economic mobility and inclusion for minorities and marginalised groups.

A social impact bond (SIB), also known as pay-for-success financing, pay-for-success bond (US), social benefit bond (Australia), pay-for-benefit bond (Australia), social outcomes contract (UK), social impact partnership (Europe), social impact contract (Europe), or simply a social bond, is a type of outcomes-based contracting, whereby a contractor typically attempts to effect a policy of government but does not get paid by the government unless specified goals are achieved. The term was invented by Geoff Mulgan, chief executive of the Young Foundation. The first SIB was launched by UK-based Social Finance Ltd. in September 2010.

A green bond is a fixed-income financial instruments (bond) which is used to fund projects that have positive environmental benefits. When referring to climate change mitigation projects they are also known as climate bonds. Green bonds follow the Green Bond Principles stated by the International Capital Market Association (ICMA), and the proceeds from the issuance of which are to be used for the pre-specified types of projects. The categories of eligible green projects include for example: Renewable energy, energy efficiency, pollution prevention and control, environmentally sustainable management of living natural resources and land use, terrestrial and aquatic biodiversity, clean transportation, climate change adaptation.

Educate Girls is a non-profit organization in India, established in 2007, founded by Safeena Husain, that works towards girls' education in India's rural and educationally backward areas by mobilising communities.

Development impact bonds (DIBs) are a performance-based investment instrument intended to finance development programmes in low resource countries, which are built off the model of social impact bond (SIB) model. In general, the model works the same: an investor provides upfront funding to the implementer of a program. An evaluator measures the results of the implementer's program. If these results hit a target set before the implementation period, an outcome payer agrees to provide investors a return on their capital. This ensures that investors are not simply engaging in concessionary lending. The first social impact bond was originated by Social Finance UK in 2010, supported by the Rockefeller Foundation, structured to reduce recidivism among inmates from Peterborough Prison.

Ajata "AJ" Mediratta is an American investor who has worked in financial markets, particularly in fixed income emerging markets and in sovereign debt restructurings. He is a president at Greylock Capital Management, LLC, an alternative asset investment adviser. Mediratta is active in Greylock Capital's investment activity and debt restructuring efforts globally.

Muhammed Aziz Khan is a Bangladeshi industrialist, founder and chairman of the Summit Group, one of the largest conglomerates in Bangladesh, whose power projects generate nearly 20% of Bangladesh's electricity. Khan has led Summit Group from starting as Bangladesh's first private sector power producer to a diversified group with investments across power, energy trading, port, telecommunications, hospitality and real estate. He is the 42nd richest person in Singapore.

Social entrepreneurship in South Asia involves business activities that have a social benefit, often for people at the bottom of the pyramid. It is an emerging area of entrepreneurship that is supported by both the public sector and the private sector.

Public–private partnerships are cooperative arrangements between two or more public and private sectors, typically of a long-term nature. In the United States, they mostly took the form of toll roads concessions, community post offices and urban renewal projects. In recent years, there has been interest in expanding P3s to multiple infrastructure projects, such as schools, universities, government buildings, waste and water. Reasons for expanding public-private partnership in the United States were initially cost-cutting and concerns about Public debt. In the early 2000s, P3s were implemented sporadically by different States and municipalities with little federal guidance. During Obama's second term, multiple policies were adopted to facilitate P3 projects, and Congress passed bills in that direction with overwhelming bipartisan support. My Brother's Keeper Challenge is an example of a public–private partnership. Some Private-public partnerships were carried out without incident, while others have attracted much controversy.

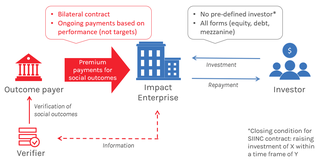

The Social Impact Incentives (SIINC) model is a blended finance instrument introduced for the first time in 2016. In the SIINC model, enterprises are provided with time-limited premium payments for achieving social impact, thus aligning profitability with their social impact and enabling them to attract growth capital. The SIINC agreement is a bilateral contract between an outcome funder and an enterprise; an independent verifier assesses the impact performance and clears payments for disbursement; the investment between the enterprise and its investor is arranged via a separate contract.

References

- ↑ "Home". British Asian Trust.

- ↑ "World's Largest Education Development Impact Bond Launched In India". BW Education. Retrieved 2019-04-10.

- ↑ "Prince Charles launches education impact bond for India". The Economic Times. 2018-02-07. Retrieved 2019-04-10.

- ↑ "Ambassadors". British Asian Trust.

- ↑ "Governance". British Asian Trust.