ICICI Bank Limited is an Indian multinational bank and financial services company headquartered in Mumbai with a registered office in Vadodara. It offers a wide range of banking and financial services for corporate and retail customers through various delivery channels and specialized subsidiaries in the areas of investment banking, life, non-life insurance, venture capital and asset management.

Canara Bank is an Indian public sector bank based in Bangalore, India. Established in 1906 at Mangalore by Ammembal Subba Rao Pai. The bank was nationalized in 1969. Canara Bank also has offices in London, Dubai and New York.

Kotak Mahindra Bank Limited is an Indian banking and financial services company headquartered in Mumbai. It offers banking products and financial services for corporate and retail customers in the areas of personal finance, investment banking, life insurance, and wealth management. As of December 2023, the bank has 1,869 branches and 3,239 ATMs, including branches in GIFT City and DIFC (Dubai).

HDFC Bank Limited is an Indian banking and financial services company, headquartered in Mumbai. It is India's largest private sector bank by assets and the world's tenth-largest bank by market capitalization as of May 2024

Amazon Pay is an online payments processing service owned by Amazon. Launched in 2007, Amazon Pay uses the consumer base of Amazon.com and focuses on giving users the option to pay with their Amazon accounts on external merchant websites. As of October 2024, the service was available to businesses based in 18 countries: Austria, Belgium, Cyprus, Denmark, France, Germany, Hungary, the Republic of Ireland, Italy, Japan, Luxembourg, Netherlands, Portugal, Spain, Sweden, Switzerland, United Kingdom, and the United States.

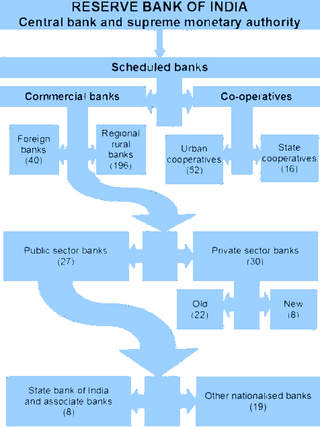

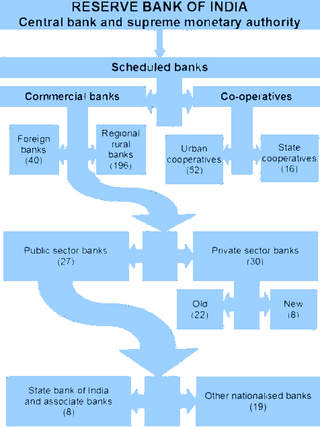

Scheduled Banks in India refer to those banks which have been included in the Second Schedule of Reserve Bank of India Act, 1934. Reserve Bank of India (RBI) in turn includes only those banks in this Schedule which satisfy all the criteria laid down vide section 42(6)(a) of the said Act. Banks not under this Schedule are called Non-Scheduled Banks

National Payments Corporation of India (NPCI) is an Indian public sector company that operates retail payments and settlement systems in India. The organization is an initiative of the Reserve Bank of India (RBI) and the Indian Banks' Association (IBA) under the provisions of the Payment and Settlement Systems Act, 2007, for creating a robust payment and settlement infrastructure in India.

Infibeam Avenues Limited is an Indian fintech company that provides digital payment services, eCommerce platforms, digital lending, data cloud storage and omnichannel enterprise software to businesses across industries in India and globally.

MobiKwik is an Indian financial technology company, founded in 2009 that provides a mobile phone-based payment system and digital wallet. In 2013 the Reserve Bank of India authorized the company's use of the MobiKwik wallet, and in May 2016 the company began providing small loans to consumers as part of its service.

Payments banks are a new model of banks, conceptualised by the Reserve Bank of India (RBI), which cannot issue credit. These banks can accept a restricted deposit, which is currently limited to ₹200,000 per customer and may be increased further. These banks cannot issue loans and credit cards. Both current account and savings accounts can be operated by such banks. Payments banks can issue ATM cards or debit cards and provide online or mobile banking. Bharti Airtel set up India's first payments bank, Airtel Payments Bank.

Paytm is an Indian multinational financial technology company, that specializes in digital payments and financial services, based in Noida, India. Paytm was founded in 2010 by Vijay Shekhar Sharma under One97 Communications. The company offers mobile payment services to consumers and enables merchants to receive payments through QR code payment, Soundbox, Android-based-payment terminal, and online payment gateway. In partnership with financial institutions, Paytm also offers financial services such as microcredit and buy now, pay later to its consumers and merchants.

Unified Payments Interface (UPI) is an Indian instant payment system as well as protocol developed by the National Payments Corporation of India (NPCI) in 2016. The interface facilitates inter-bank peer-to-peer (P2P) and person-to-merchant (P2M) transactions. It is used on mobile devices to instantly transfer funds between two bank accounts. The mobile number of the device is required to be registered with the bank. The UPI ID of the recipient can be used to transfer money. It runs as an open source application programming interface (API) on top of the Immediate Payment Service (IMPS), and is regulated by the Reserve Bank of India (RBI). Indian Banks started making their UPI-enabled apps available on Google Play on 25 August 2016.

National Common Mobility Card (NCMC) is an open-loop, inter-operable transport card conceived by the Ministry of Housing and Urban Affairs under Prime Minister Narendra Modi's ‘One Nation, One Card' vision. It was launched on 4 March 2019. The transport card enables the user to pay for travel, toll tax, retail shopping and withdraw money.

BHIM is an Indian state-owned mobile payment app developed by the National Payments Corporation of India (NPCI), based on the Unified Payments Interface (UPI). Launched on 30 December 2016, it is intended to facilitate e-payments directly through banks and encourage cashless transactions. The application supports all Indian banks which use UPI, which is built over the Immediate Payment Service (IMPS) infrastructure and allows the user to instantly transfer money between 170 member banks of any two parties. It can be used on all mobile devices.

Airtel Payments Bank is an Indian payments bank with its headquarters in New Delhi. The company is a subsidiary of Bharti Airtel. On 5 January 2022, it was granted the scheduled bank status by the Reserve Bank of India under the second schedule of RBI Act, 1934.

Paytm Payments Bank (PPBL) was an Indian payments bank, founded in 2017 and headquartered in Noida. In the same year, it received the license to run a payments bank from the Reserve Bank of India and was launched in November 2017. In 2021, the bank received a scheduled bank status from the RBI.

A QR code payment is a mobile payment method where payment is performed by scanning a QR code from a mobile app. This is an alternative to doing electronic funds transfer at point of sale using a payment terminal. This avoids a lot of the infrastructure traditionally associated with electronic payments such as payment cards, payment networks, payment terminal and merchant accounts.

IDFC First Bank is an Indian private sector bank based in Mumbai. Founded in 2015 as a banking subsidiary of IDFC Limited, it shifted focus from infrastructure financing to retail banking in the years after its 2018 merger with Capital First. In 2024, the bank took over the parent company IDFC Limited in a reverse merger.

Open Network for Digital Commerce (ONDC) is a public technology initiative launched by the Department for Promotion of Industry and Internal Trade (DPIIT), Government of India to foster decentralized open e-commerce model and is led by a private non-profit Section 8 company. It was incorporated on 31 December 2021 with initial investment from Quality Council of India and Protean eGov Technologies Limited.

Coinswitch is an Indian cryptocurrency exchange and trading platform headquartered in Bangalore, Karnataka. Founded in 2017, the platform enables users to trade Virtual Digital Assets (VDAs) with Indian Rupees. In October 2021, Coinswitch secured $260 million in Series C funding, valuing the company at $1.9 billion.