The recorded history of Iceland began with the settlement by Viking explorers and the people they enslaved from Western Europe, particularly in modern-day Norway and the British Isles, in the late ninth century. Iceland was still uninhabited long after the rest of Western Europe had been settled. Recorded settlement has conventionally been dated back to 874, although archaeological evidence indicates Gaelic monks from Ireland, known as papar according to sagas, may have settled Iceland earlier.

The demographics of Iceland include population density, education level, health of the populace, economic status, religious affiliations and other aspects of the population.

The Scandinavian Monetary Union was a monetary union formed by Denmark and Sweden on 5 May 1873, with Norway joining in 1875. It established a common currency unit, the krone/krona, based on the gold standard. It was one of the few tangible results of the Scandinavian political movement of the 19th century. The union ended during World War I.

Jón Sigurðsson was the leader of the 19th century Icelandic independence movement.

Icelandic Canadians are Canadian citizens of Icelandic ancestry, or Iceland-born people who reside in Canada.

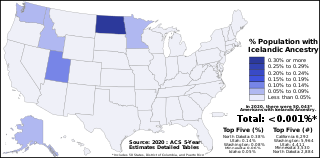

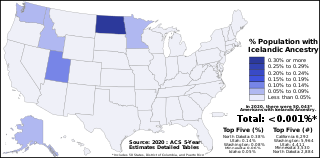

Icelandic Americans are Americans of Icelandic descent or Iceland-born people who reside in the United States. Icelandic immigrants came to the United States primarily in the period 1873–1905 and after World War II. There are more than 40,000 Icelandic Americans according to the 2000 U.S. census, and most live in the Upper Midwest. The United States is home to the second largest Icelandic diaspora community in the world after Canada.

Björgólfur Guðmundsson is an Icelandic businessman and former chairman and owner of West Ham United. Björgólfur was Iceland's second wealthiest businessman worth more than a billion dollars — his son, Björgólfur Thor Björgólfsson being the first. He was at one time the majority owner and chairman of the now nationalised Icelandic bank Landsbanki, the second largest company in Iceland. He was ranked by Forbes magazine in March 2008 as the 1014th-richest person in the world, with a net worth of $1.1 billion. In December of the same year Forbes revalued his net worth to $0, and on 31 July 2009 he was declared bankrupt by the Icelandic courts with debts of almost £500 million.

The Danish state bankruptcy of 1813 was a domestic economic crisis that began in January 1813 and had consequential effects until 1818. As Denmark–Norway struggled with the financial burden that the Napoleonic Wars had on the economy, the devaluation of the currency had negative effects on merchants, citizens and businesses alike.

The Icelandic financial crisis was a major economic and political event in Iceland between 2008 and 2010. It involved the default of all three of the country's major privately owned commercial banks in late 2008, following problems in refinancing their short-term debt and a run on deposits in the Netherlands and the United Kingdom. Relative to the size of its economy, Iceland's systemic banking collapse was the largest of any country in economic history. The crisis led to a severe recession and the 2009 Icelandic financial crisis protests.

The Icelandic Independence movement was the collective effort made by Icelanders to achieve self-determination and independence from the Kingdom of Denmark throughout the 19th and early 20th century.

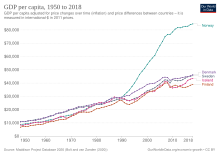

The economic history of Sweden, since the Iron Age, has been characterized by extensive foreign trade based on a small number of export and import commodities, often derived from the widely available raw materials iron ore and wood. An industrial expansion in the latter half of the 19th century transformed the society on many levels. Natural-resource-rich regions benefited from the First Industrial Revolution. A growth surge in Sweden later benefited virtually the whole country during the Second Industrial Revolution. It fostered a broad export-oriented engineering industry with companies such as LM Ericsson, Asea, Alfa Laval, Aga, Electrolux, SKF and Volvo reaching well established positions on the global market and becoming drivers of GDP growth. In addition to engineering, the pulp and paper, steel, and chemical industries developed to reach international prominence. By the 1970s, Sweden had become one of the wealthiest nations of the world. The growth slowed down during the following decades, which were characterized by public deficits and structural change.

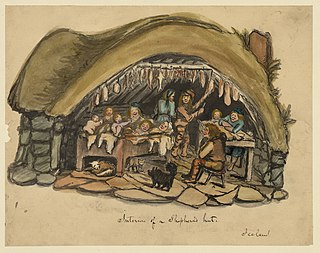

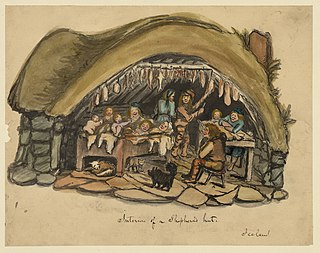

The Icelandic vistarband was a requirement that all landless people be employed on a farm. A person who did not own or lease property had to find a position as a laborer in the home of a farmer. The custom was for landless people to contract themselves to a farmer for one year at a time. The vistarband was in effect from 1490 until the beginning of the 20th century in various forms. Iceland had an unusually large percentage of the population in this kind of bondage—generally about 25% of the population during the 19th century.

Guðmundur "Gordon" Sigurjónsson was an Icelandic athlete and trainer. A well known wrestler in his home country, he was part of a group of Icelanders that showcased Glíma at the 1908 Summer Olympics. He was later a coach for the Canadian Winnipeg Falcons that won the first ever gold medal in Ice hockey at the 1920 Summer Olympics.

Gustav III of Sweden's coffee experiment was a purported twin study ordered by the king to study the health effects of coffee. The authenticity of the event has been questioned. The primitive medical study, supposedly conducted in the second half of the 18th century, failed to prove that coffee was a dangerous beverage.

Throughout the Cold War, the nation of Iceland was a member of the North Atlantic Treaty Organization (NATO) and allied with the United States, hosting a US military presence in Keflavík Air Base from 1951 to 2006.

Jón Jónsson Aðils was an Icelandic historian. He has been described as "Iceland's most prolific historian of the early twentieth century." Historians and political scientists argue that Aðils strongly shaped Icelandic nationalist discourse, and that his influence still affects Icelandic discourse on sovereignty issues, such as European integration.

Nikulás Ottenson was an Icelandic scholar, who spent most of his life in Canada. His book collection is now the Nikulás Ottenson Collection of Icelandic Books and Manuscripts, Special Collections, Milton S. Eisenhower Library, The Johns Hopkins University.

The Famine of 1867–1869 was the last famine in Sweden, and the last major famine in Northern Europe.

The Treaty of Artlenburg was agreed between Duke Henry of Saxony and the people of Gotland in 1161. Thanks to its position in the Baltic Sea, Gotland was a very profitable emporium in the 12th and 13th centuries. The Treaty of Artlenburg allowed the Gotlanders special trade privileges in Henry's domains, in return for liberties for Henry's own subjects within Gotland.

Reykjavík was one of the multi-member constituencies of the Althing, the national legislature of Iceland. The constituency was established in 1844 when the Althing was converted into a consultative assembly. It was abolished in 2003 when the constituency was split into two constituencies following the re-organisation of constituencies across Iceland. Reykjavík was conterminous with the municipality of Reykjavík.