Related Research Articles

The primary market is the part of the capital market that deals with the issuance and sale of securities to purchasers directly by the issuer, with the issuer being paid the proceeds. A primary market means the market for new issues of securities, as distinguished from the secondary market, where previously issued securities are bought and sold. A market is primary if the proceeds of sales go to the issuer of the securities sold. Buyers buy securities that were not previously traded.

A security is a tradable financial asset. The term commonly refers to any form of financial instrument, but its legal definition varies by jurisdiction. In some countries and languages people commonly use the term "security" to refer to any form of financial instrument, even though the underlying legal and regulatory regime may not have such a broad definition. In some jurisdictions the term specifically excludes financial instruments other than equities and fixed income instruments. In some jurisdictions it includes some instruments that are close to equities and fixed income, e.g., equity warrants.

An initial public offering (IPO) or stock launch is a public offering in which shares of a company are sold to institutional investors and usually also to retail (individual) investors. An IPO is typically underwritten by one or more investment banks, who also arrange for the shares to be listed on one or more stock exchanges. Through this process, colloquially known as floating, or going public, a privately held company is transformed into a public company. Initial public offerings can be used to raise new equity capital for companies, to monetize the investments of private shareholders such as company founders or private equity investors, and to enable easy trading of existing holdings or future capital raising by becoming publicly traded.

In finance, being short in an asset means investing in such a way that the investor will profit if the value of the asset falls. This is the opposite of a more conventional "long" position, where the investor will profit if the value of the asset rises.

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment houses, whereby they guarantee payment in case of damage or financial loss and accept the financial risk for liability arising from such guarantee. An underwriting arrangement may be created in a number of situations including insurance, issues of security in a public offering, and bank lending, among others. The person or institution that agrees to sell a minimum number of securities of the company for commission is called the underwriter.

The secondary market, also called the aftermarket and follow on public offering, is the financial market in which previously issued financial instruments such as stock, bonds, options, and futures are bought and sold. The initial sale of the security by the issuer to a purchaser, who pays proceeds to the issuer, is the primary market. All sales after the initial sale of the security are sales in the secondary market. Whereas the term primary market refers to the market for new issues of securities, and "[a] market is primary if the proceeds of sales go to the issuer of the securities sold," the secondary market in contrast is the market created by the later trading of such securities.

Gross spread refers to the fees that underwriters receive for arranging and underwriting an offering of debt or equity securities. The gross spread for an initial public offering (IPO) can be higher than 10% while the gross spread on a debt offering can be as low as 0.05%.

Security market is a component of the wider financial market where securities can be bought and sold between subjects of the economy, on the basis of demand and supply. Security markets encompasses stock markets, bond markets and derivatives markets where prices can be determined and participants both professional and non professional can meet.

A rights issue or rights offer is a dividend of subscription rights to buy additional securities in a company made to the company's existing security holders. When the rights are for equity securities, such as shares, in a public company, it can be a non-dilutive pro rata way to raise capital. Rights issues are typically sold via a prospectus or prospectus supplement. With the issued rights, existing security-holders have the privilege to buy a specified number of new securities from the issuer at a specified price within a subscription period. In a public company, a rights issue is a form of public offering.

A bought deal is financial underwriting contract often associated with an initial public offering or public offering. It occurs when an underwriter, such as an investment bank or a syndicate, purchases securities from an issuer before a preliminary prospectus is filed. The underwriter acts as principal rather than agent and thus actually "goes long" in the security. The bank negotiates a price with the issuer.

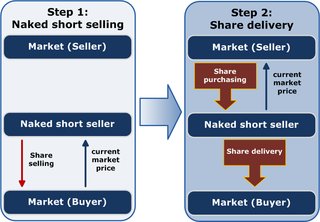

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

A red herring prospectus, as a first or preliminary prospectus, is a document submitted by a company (issuer) as part of a public offering of securities. Most frequently associated with an initial public offering (IPO), this document, like the previously submitted Form S-1 registration statement, must be filed with the Securities and Exchange Commission (SEC).

The underwriting spread is the difference between the amount paid by the underwriting group in a new issue of securities and the price at which securities are offered for sale to the public. It is the underwriter's gross profit margin, usually expressed in points per unit of sale. Spreads may vary widely and are influenced by the underwriter's expectation of market demand for the securities offered for sale, interest rates, and so on.

A special purpose acquisition company, also known as a "blank check company", is a shell corporation listed on a stock exchange with the purpose of acquiring a private company, thus making the private company public without going through the initial public offering process, which often carries significant procedural and regulatory burdens. According to the U.S. Securities and Exchange Commission (SEC), SPACs are created specifically to pool funds to finance a future merger or acquisition opportunity within a set timeframe; these opportunities usually have yet to be identified while raising funds.

A follow-on offering, also known as a follow-on public offering (FPO), is a type of public offering of stock that occurs subsequent to the company's initial public offering (IPO).

Book building is a systematic process of generating, capturing, and recording investor demand for shares. Usually, the issuer appoints a major investment bank to act as a major securities underwriter or bookrunner.

Stocks consist of all the shares by which ownership of a corporation or company is divided. A single share of the stock means fractional ownership of the corporation in proportion to the total number of shares. This typically entitles the shareholder (stockholder) to that fraction of the company's earnings, proceeds from liquidation of assets, or voting power, often dividing these up in proportion to the amount of money each stockholder has invested. Not all stock is necessarily equal, as certain classes of stock may be issued, for example, without voting rights, with enhanced voting rights, or with a certain priority to receive profits or liquidation proceeds before or after other classes of shareholders.

Regulation S-K is a prescribed regulation under the US Securities Act of 1933 that lays out reporting requirements for various SEC filings used by public companies. Companies are also often called issuers, filers or registrants.

The technology company Facebook, Inc., held its initial public offering (IPO) on Friday, May 18, 2012. The IPO was one of the biggest in technology and Internet history, with a peak market capitalization of over $104 billion.

Following is a glossary of stock market terms.

References

- 1 2 3 4 "Excerpt from Current Issues and Rulemaking Projects Outline (November 14, 2000)". www.sec.gov. Retrieved 2021-05-30.

- ↑ Martin, Alexander, "Line Raises IPO Price Range to Meet Strong Demand" Wall Street Journal, July 4, 2016. Retrieved 2016-07-04.

- 1 2 "Greenshoe Options: An IPO's Best Friend". Investopedia. Retrieved 2021-05-30.

- ↑ "Company history". Stride Rite. Stride Rite Children's Group LLC. 2012. Archived from the original on 27 May 2012. Retrieved 21 May 2012.

- ↑ "Regulation M, Rule 104". University of Cincinnati, College of Law. Archived from the original on November 16, 2011.

- ↑ "Presentation on securities law" (PDF). WilmerHale. January 11, 2005. p. 2.[ dead link ]

- ↑ Wilhelm Jr., William (1999). Secondary Market Price Stabilization of Initial Public Offerings. Chestnut Hill: Wallace E. Carroll School of Management. p. 3.

- ↑ Wilhelm Jr., William (1999). Secondary Market Price Stabilization of Initial Public Offerings. Chestnut Hill: Wallace E. Carroll School of Management. p. 4.

- ↑ "Overallotment / Greenshoe Option - Selling Additional Shares in an IPO". Corporate Finance Institute. Retrieved 2021-05-30.

- ↑ "Facebook's IPO Sputters". Wall Street Journal. 2012-05-19. ISSN 0099-9660 . Retrieved 2021-05-30.