Related Research Articles

Semiconductor device fabrication is the process used to manufacture semiconductor devices, typically integrated circuits (ICs) such as computer processors, microcontrollers, and memory chips that are present in everyday electrical and electronic devices. It is a multiple-step photolithographic and physio-chemical process during which electronic circuits are gradually created on a wafer, typically made of pure single-crystal semiconducting material. Silicon is almost always used, but various compound semiconductors are used for specialized applications.

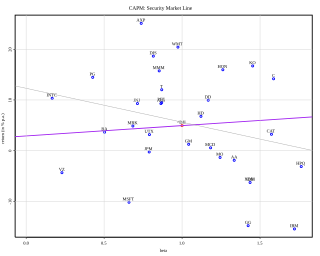

In finance, the capital asset pricing model (CAPM) is a model used to determine a theoretically appropriate required rate of return of an asset, to make decisions about adding assets to a well-diversified portfolio.

The weighted average cost of capital (WACC) is the rate that a company is expected to pay on average to all its security holders to finance its assets. The WACC is commonly referred to as the firm's cost of capital. Importantly, it is dictated by the external market and not by management. The WACC represents the minimum return that a company must earn on an existing asset base to satisfy its creditors, owners, and other providers of capital, or they will invest elsewhere.

The Modigliani–Miller theorem is an influential element of economic theory; it forms the basis for modern thinking on capital structure. The basic theorem states that in the absence of taxes, bankruptcy costs, agency costs, and asymmetric information, and in an efficient market, the enterprise value of a firm is unaffected by how that firm is financed. This is not to be confused with the value of the equity of the firm. Since the value of the firm depends neither on its dividend policy nor its decision to raise capital by issuing shares or selling debt, the Modigliani–Miller theorem is often called the capital structure irrelevance principle.

Taiwan Semiconductor Manufacturing Company Limited is a Taiwanese multinational semiconductor contract manufacturing and design company. It is the world's most valuable semiconductor company, the world's largest dedicated independent ("pure-play") semiconductor foundry, and its country's largest company, with headquarters and main operations located in the Hsinchu Science Park in Hsinchu, Taiwan. It is majority owned by foreign investors, and the central government of Taiwan is the largest shareholder.

The semiconductor industry is the aggregate of companies engaged in the design and fabrication of semiconductors and semiconductor devices, such as transistors and integrated circuits. It formed around 1960, once the fabrication of semiconductor devices became a viable business. The industry's annual semiconductor sales revenue has since grown to over $481 billion, as of 2018. The semiconductor industry is in turn the driving force behind the wider electronics industry, with annual power electronics sales of £135 billion as of 2011, annual consumer electronics sales expected to reach $2.9 trillion by 2020, tech industry sales expected to reach $5 trillion in 2019, and e-commerce with over $29 trillion in 2017. In 2019, 32.4% of the semiconductor market segment was for networks and communications devices.

The foundry model is a microelectronics engineering and manufacturing business model consisting of a semiconductor fabrication plant, or foundry, and an integrated circuit design operation, each belonging to separate companies or subsidiaries.

Fabless manufacturing is the design and sale of hardware devices and semiconductor chips while outsourcing their fabrication to a specialized manufacturer called a semiconductor foundry. These foundries are typically, but not exclusively, located in the United States, China, and Taiwan. Fabless companies can benefit from lower capital costs while concentrating their research and development resources on the end market. Some fabless companies and pure play foundries may offer integrated-circuit design services to third parties.

In economics and accounting, the cost of capital is the cost of a company's funds, or from an investor's point of view is "the required rate of return on a portfolio company's existing securities". It is used to evaluate new projects of a company. It is the minimum return that investors expect for providing capital to the company, thus setting a benchmark that a new project has to meet.

In finance, the beta is a statistic that measures the expected increase or decrease of an individual stock price in proportion to movements of the Stock market as a whole. Beta can be used to indicate the contribution of an individual asset to the market risk of a portfolio when it is added in small quantity. It is referred to as an asset's non-diversifiable risk, systematic risk, or market risk. Beta is not a measure of idiosyncratic risk.

Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation techniques are used by financial market participants to determine the price they are willing to pay or receive to effect a sale of the business. In addition to estimating the selling price of a business, the same valuation tools are often used by business appraisers to resolve disputes related to estate and gift taxation, divorce litigation, allocate business purchase price among business assets, establish a formula for estimating the value of partners' ownership interest for buy-sell agreements, and many other business and legal purposes such as in shareholders deadlock, divorce litigation and estate contest.

Integrated circuit design, or IC design, is a sub-field of electronics engineering, encompassing the particular logic and circuit design techniques required to design integrated circuits, or ICs. ICs consist of miniaturized electronic components built into an electrical network on a monolithic semiconductor substrate by photolithography.

In the microelectronics industry, a semiconductor fabrication plant is a factory for semiconductor device fabrication.

Valuation using discounted cash flows is a method of estimating the current value of a company based on projected future cash flows adjusted for the time value of money. The cash flows are made up of those within the “explicit” forecast period, together with a continuing or terminal value that represents the cash flow stream after the forecast period. In several contexts, DCF valuation is referred to as the "income approach".

In financial economics, finance, and accounting, the earnings response coefficient, or ERC, is the estimated relationship between equity returns and the unexpected portion of companies' earnings announcements.

The following outline is provided as an overview of and topical guide to finance:

Multi-project chip (MPC), and multi-project wafer (MPW) semiconductor manufacturing arrangements allow customers to share mask and microelectronics wafer fabrication cost between several designs or projects.

In corporate finance, Hamada’s equation is an equation used as a way to separate the financial risk of a levered firm from its business risk. The equation combines the Modigliani–Miller theorem with the capital asset pricing model. It is used to help determine the levered beta and, through this, the optimal capital structure of firms. It was named after Robert Hamada, the Professor of Finance behind the theory.

Returns-based style analysis is a statistical technique used in finance to deconstruct the returns of investment strategies using a variety of explanatory variables. The model results in a strategy's exposures to asset classes or other factors, interpreted as a measure of a fund or portfolio manager's investment style. While the model is most frequently used to show an equity mutual fund’s style with reference to common style axes, recent applications have extended the model’s utility to model more complex strategies, such as those employed by hedge funds.

References

- ↑ Law, Jonathan (2014). Dictionary of Finance and Banking. Oxford: Oxford University Press Print Publication. ISBN 9780199664931.

- ↑ Cox, Larry A.; Griepentrog, Gary L. (1988). "The Pure-Play Cost of Equity for Insurance Divisions". The Journal of Risk and Insurance. 55 (3): 442–452. doi:10.2307/253253. JSTOR 253253.

- ↑ R, Fuller; H, Kerr (1981). "Estimating the Divisional Cost of Capital: An Analysis of the Pure-Play Technique". Journal of Finance. 36 (5): 997–1009. doi:10.1111/j.1540-6261.1981.tb01071.x.

- ↑ Brown, Clair; Linden, Greg (2011). Chips and change : how crisis reshapes the semiconductor industry (1st ed.). Cambridge, Mass.: MIT Press. ISBN 9780262516822.

- ↑ Mutschler, Ann Steffora (2008). "Pure-play foundries comprise 84% of market, IC Insights says". Electronics News. Australia: Reed Business Information Pty Ltd, a division of Reed Elsevier Inc.

- 1 2 Kim, Eonsoo; Nam, Dae-il; Stimpert, J.L. (2004). "The Applicability of Porter's Generic Strategies in the Digital Age: Assumptions, Conjectures, and Suggestions". Journal of Management. 30 (5): 580. doi:10.1016/j.jm.2003.12.001. S2CID 2925596.