Extreme poverty is the most severe type of poverty, defined by the United Nations (UN) as "a condition characterized by severe deprivation of basic human needs, including food, safe drinking water, sanitation facilities, health, shelter, education and information. It depends not only on income but also on access to services". Historically, other definitions have been proposed within the United Nations.

In ancient times, Maldives were renowned for cowries, coir rope, dried tuna fish, ambergris (maavaharu) and coco de mer (tavakkaashi). Local and foreign trading ships used to load these products in the Maldives and bring them abroad.

Quality of life (QOL) is defined by the World Health Organization as "an individual's perception of their position in life in the context of the culture and value systems in which they live and in relation to their goals, expectations, standards and concerns".

Poverty is a state or condition in which one lacks the financial resources and essentials for a certain standard of living. Poverty can have diverse social, economic, and political causes and effects. When evaluating poverty in statistics or economics there are two main measures: absolute poverty compares income against the amount needed to meet basic personal needs, such as food, clothing, and shelter; relative poverty measures when a person cannot meet a minimum level of living standards, compared to others in the same time and place. The definition of relative poverty varies from one country to another, or from one society to another.

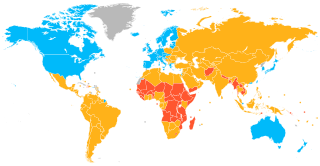

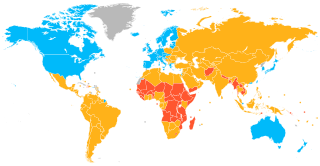

A developing country is a sovereign state with a less developed industrial base and a lower Human Development Index (HDI) relative to other countries. However, this definition is not universally agreed upon. There is also no clear agreement on which countries fit this category. The terms low and middle-income country (LMIC) and newly emerging economy (NEE) are often used interchangeably but refers only to the economy of the countries. The World Bank classifies the world's economies into four groups, based on gross national income per capita: high, upper-middle, lower-middle, and low income countries. Least developed countries, landlocked developing countries and small island developing states are all sub-groupings of developing countries. Countries on the other end of the spectrum are usually referred to as high-income countries or developed countries.

The poverty threshold, poverty limit, poverty line, or breadline is the minimum level of income deemed adequate in a particular country. The poverty line is usually calculated by estimating the total cost of one year's worth of necessities for the average adult. The cost of housing, such as the rent for an apartment, usually makes up the largest proportion of this estimate, so economists track the real estate market and other housing cost indicators as a major influence on the poverty line. Individual factors are often used to account for various circumstances, such as whether one is a parent, elderly, a child, married, etc. The poverty threshold may be adjusted annually. In practice, like the definition of poverty, the official or common understanding of the poverty line is significantly higher in developed countries than in developing countries.

The heavily indebted poor countries (HIPC) are a group of 39 developing countries with high levels of poverty and debt overhang which are eligible for special assistance from the International Monetary Fund (IMF) and the World Bank.

Slum clearance, slum eviction or slum removal is an urban renewal strategy used to transform low income settlements with poor reputation into another type of development or housing. This has long been a strategy for redeveloping urban communities; for example slum clearance plans were required in the United Kingdom in the Housing Act 1930, while the Housing Act of 1937 encouraged similar clearance strategies in the United States. Frequently, but not always, these programs were paired with public housing or other assistance programs for the displaced communities.

In economics, a cycle of poverty or poverty trap is caused by self-reinforcing mechanisms that cause poverty, once it exists, to persist unless there is outside intervention. It can persist across generations, and when applied to developing countries, is also known as a development trap.

From 1947 to 2017, the Indian economy was premised on the concept of planning. This was carried through the Five-Year Plans, developed, executed, and monitored by the Planning Commission (1951–2014) and the NITI Aayog (2015–2017). With the prime minister as the ex-officio chairman, the commission has a nominated deputy chairman, who holds the rank of a cabinet minister. Montek Singh Ahluwalia is the last deputy chairman of the commission. The Twelfth Plan completed its term in March 2017. Prior to the Fourth Plan, the allocation of state resources was based on schematic patterns rather than a transparent and objective mechanism, which led to the adoption for the Gadgil formula in 1969. Revised versions of the formula have been used since then to determine the allocation of central assistance for state plans. The new government led by Narendra Modi, elected in 2014, announced the dissolution of the Planning Commission, and its replacement by a think tank called the NITI Aayog.

A fragile state or weak state is a country characterized by weak state capacity or weak state legitimacy leaving citizens vulnerable to a range of shocks. The World Bank, for example, deems a country to be ‘fragile’ if it (a) is eligible for assistance from the International Development Association (IDA), (b) has had a UN peacekeeping mission in the last three years, and (c) has received a ‘governance’ score of less than 3.2. A more cohesive definition of the fragile state might also note a state's growing inability to maintain a monopoly on force in its declared territory. While a fragile state might still occasionally exercise military authority or sovereignty over its declared territory, its claim grows weaker as the logistical mechanisms through which it exercises power grow weaker.

A mortgage loan or simply mortgage, in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

Mortgage discrimination or mortgage lending discrimination is the practice of banks, governments or other lending institutions denying loans to one or more groups of people primarily on the basis of race, ethnic origin, sex or religion.

The Climate Investment Funds (CIF) was established in 2008 as a multilateral fund in order to finance pilot projects in developing countries at the request of the G8 and G20. The CIF administers a collection of programs with a view to helping nations fight the impacts of climate change and accelerate their shift to a low-carbon economy. Through contributions from 14 donor countries, CIF supports more than 350 projects in 72 low and middle-income countries on the frontlines of the climate crisis.

Beulah Federal Credit Union is a faith based financial institution that is owned and operated by the Beulah Church of the Nazarene in Brooklyn, New York. It received its charter from the National Credit Union Administration (NCUA) on October 19, 2007, with the mission to serve the church's 933 members. It also received NCUA low-income designation, which enables it to accept deposits from non-members and to qualify for loans and technical assistance through the NCUA Community Development Revolving Loan Fund Program.

The social safety net (SSN) consists of non-contributory assistance existing to improve lives of vulnerable families and individuals experiencing poverty and destitution. Examples of SSNs are previously-contributory social pensions, in-kind and food transfers, conditional and unconditional cash transfers, fee waivers, public works, and school feeding programs.

Despite India's 50% increase in GDP since 2013, more than one third of the world's malnourished children live in India. Among these, half of the children under three years old are underweight.

Licus Vallis is an ancient river valley in the Mare Tyrrhenum quadrangle of Mars, located at 2.9°S 233.9°W. It is 219.1 km (136.1 mi) long and was named after an ancient name for modern river Lech in Germany and Austria.

Credit unions in the United States served 100 million members, comprising 43.7% of the economically active population, in 2014. U.S. credit unions are not-for-profit, cooperative, tax-exempt organizations. The clients of the credit unions become partners of the financial institution and their presence focuses in certain neighborhoods because they center their services in one specific community. As of March 2020, the largest American credit union was Navy Federal Credit Union, serving U.S. Department of Defense employees, contractors, and families of servicepeople, with over $125 billion in assets and over 9.1 million members. Total credit union assets in the U.S. reached $1 trillion as of March 2012. Approximately 236,000 people were directly employed by credit unions per data derived from the 2012 National Credit Union Administration (NCUA) Credit Union Directory. As of 2019, there were 5,236 federally insured credit unions with 120.4 million members, and deposits of $1.22 trillion.

Social protection, as defined by the United Nations Research Institute for Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people's well-being. Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, and old age. It is one of the targets of the United Nations Sustainable Development Goal 10 aimed at promoting greater equality.