Related Research Articles

Rent-seeking is the act of growing one's existing wealth by manipulating the social or political environment without creating new wealth. Rent-seeking activities have negative effects on the rest of society. They result in reduced economic efficiency through misallocation of resources, stifled competition, reduced wealth creation, lost government revenue, heightened income inequality, risk of growing corruption and cronyism, decreased public trust in institutions and potential national decline.

Economic inequality is an umbrella term for a) income inequality or distribution of income, b) wealth inequality or distribution of wealth, and c) consumption inequality. Each of these can be measured between two or more nations, within a single nation, or between and within sub-populations.

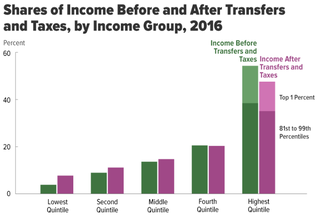

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world.

Michael Jay Boskin is the T. M. Friedman Professor of Economics and senior fellow at Stanford University's Hoover Institution. He also is chief executive officer and president of Boskin & Co., an economic consulting company.

Optimal tax theory or the theory of optimal taxation is the study of designing and implementing a tax that maximises a social welfare function subject to economic constraints. The social welfare function used is typically a function of individuals' utilities, most commonly some form of utilitarian function, so the tax system is chosen to maximise the aggregate of individual utilities. Tax revenue is required to fund the provision of public goods and other government services, as well as for redistribution from rich to poor individuals. However, most taxes distort individual behavior, because the activity that is taxed becomes relatively less desirable; for instance, taxes on labour income reduce the incentive to work. The optimization problem involves minimizing the distortions caused by taxation, while achieving desired levels of redistribution and revenue. Some taxes are thought to be less distorting, such as lump-sum taxes and Pigouvian taxes, where the market consumption of a good is inefficient, and a tax brings consumption closer to the efficient level.

Alberto Francesco Alesina was an Italian economist who was the Nathaniel Ropes Professor of Political Economy at Harvard University from 2003 until his death in 2020. He was known principally as an economist of politics and culture, and was famed for his usage of economic tools to study social and political issues. He was described as having “almost single-handedly” established the modern field of political economy, and as a likely contender for the Nobel Memorial Prize in Economic Sciences.

Income inequality has fluctuated considerably in the United States since measurements began around 1915, moving in an arc between peaks in the 1920s and 2000s, with a 30-year period of relatively lower inequality between 1950 and 1980.

James Michael "Jim" Poterba, FBA is an American economist who is the Mitsui Professor of Economics at the Massachusetts Institute of Technology, and current National Bureau of Economic Research (NBER) president and chief executive officer.

Redistribution of income and wealth is the transfer of income and wealth from some individuals to others through a social mechanism such as taxation, welfare, public services, land reform, monetary policies, confiscation, divorce or tort law. The term typically refers to redistribution on an economy-wide basis rather than between selected individuals.

Emmanuel Saez is a French, naturalized American economist who is Professor of Economics at the University of California, Berkeley. His work, done with Thomas Piketty and Gabriel Zucman, includes tracking the incomes of the poor, middle class and rich around the world. Their work shows that top earners in the United States have taken an increasingly larger share of overall income over the last three decades, with almost as much inequality as before the Great Depression. He recommends much higher marginal tax rates, of up to 70% or 90%. He received the John Bates Clark Medal in 2009, a MacArthur "Genius" Fellowship in 2010, and an honorary degree from Harvard University in 2019.

Thomas Piketty is a French economist who is a professor of economics at the School for Advanced Studies in the Social Sciences, associate chair at the Paris School of Economics and Centennial Professor of Economics in the International Inequalities Institute at the London School of Economics.

Nadarajan "Raj" Chetty is an Indian-American economist and the William A. Ackman Professor of Public Economics at Harvard University. Some of Chetty's recent papers have studied equality of opportunity in the United States and the long-term impact of teachers on students' performance. Offered tenure at the age of 28, Chetty became one of the youngest tenured faculty in the history of Harvard's economics department. He is a recipient of the John Bates Clark Medal and a 2012 MacArthur Fellow. Currently, he is also an advisory editor of the Journal of Public Economics. In 2020, he was awarded the Infosys Prize in Economics, the highest monetary award recognizing achievements in science and research, in India.

Optimal capital income taxation is a subarea of optimal tax theory which studies the design of taxes on capital income such that a given economic criterion like utility is optimized.

Julia Cagé is a French economist specializing in development economics, political economy, and economic history.

Camille Landais is a French economist who currently works as Professor of economics at the London School of Economics. His research focuses on public finance and labour economics. In 2016, Landais was awarded the Prize of Best Young Economist of France for his research on the relationship between changes in inequality and fiscal and social policy.

World Inequality Database (WID), previously The World Wealth and Income Database, also known as WID.world, is an extensive, open and accessible database "on the historical evolution of the world distribution of income and wealth, both within countries and between countries".

Katherine Cuff is a Canadian economist who currently serves as Professor of Economics at McMaster University. She holds the Canada Research Chair in Public Economic Theory and has been recognized as a McMaster University Scholar. Cuff also serves as Managing Editor of the Canadian Journal of Economics and editor of the FinanzArchiv.

Optimal labour income tax is a sub-area of optimal tax theory which refers to the study of designing a tax on individual labour income such that a given economic criterion like social welfare is optimized.

Ilyana Kuziemko is a professor of economics at Princeton University, where she has taught since 2014. She previously served as the David W. Zalaznick Associate Professor of Business at Columbia Business School from July 2013 to June 2014 and as associate professor from July 2012 to June 2013. From 2007 to 2012, she was an assistant professor of economics and public affairs at Princeton University and Woodrow Wilson School. She also served as a Deputy Assistant Secretary for Economic Policy at the U.S. Department of the Treasury from 2009 to 2010 under The Office of Microeconomic Analysis. During her tenure, she worked primarily on the development and early implementation of the Affordable Care Act.

Ufuk Akcigit is a Turkish economist. He is the Arnold C. Harberger Professor of Economics at the University of Chicago, the Kenneth C. Griffin Department of Economics since 2019. The same year, he also received the Max Planck-Humboldt Research Award for his achievements in the field of macroeconomics. In 2021, he was named John Simon Guggenheim Fellow and Econometric Society fellow for his work in Economics. In 2022, he received the Global Economy Prize in Economics from the Kiel Institute in Germany and the Sakıp Sabancı International Research Award.

References

- 1 2 3 "Striking a balance on taxes | MIT News". news.mit.edu. 22 May 2013. Retrieved 22 November 2018.

- ↑ "Lauréats | Fondation Maurice ALLAIS".

- ↑ "Stefanie Stantcheva" (PDF). scholar.harvard.edu. Retrieved 20 November 2018.

- 1 2 Stantcheva, Stefanie (2014). Optimal taxation with endogenous wages (PhD). MIT. hdl:1721.1/90133 . Retrieved 21 November 2018.

- 1 2 3 4 5 6 7 8 9 10 11 12 "Stefanie Stantcheva" (PDF).

- ↑ "Our pick of the decade's eight best young economists". The Economist. 18 December 2018. ISSN 0013-0613 . Retrieved 7 January 2019.

- 1 2 Cutler, David. "Interview with Bennett Prize Winner Stefanie Stantcheva".

- ↑ "Member Directory | American Academy of Arts and Sciences". www.amacad.org. Retrieved 22 January 2024.

- ↑ "Current Fellows". www.econometricsociety.org. Retrieved 22 January 2024.

- 1 2 3 4 5 "Home - Social Economics Lab".

- 1 2 Stefanie Stantcheva (8 November 2018). "The Tax and Transfer System" (PDF). Retrieved 22 November 2018.

- ↑ Alberto Alesina, Edoardo Teso (2018). "Intergenerational Mobility and Support for Redistribution". American Economic Review. 108 (2): 521–554. doi: 10.1257/aer.20162015 . S2CID 33408213.

- ↑ Alesina, Alberto; Miano, Armando; Stantcheva, Stefanie (2018). "[NEW!] Immigration and Redistribution". NBER Working Paper No. 24733.

- ↑ Kuziemko, Ilyana; Norton, Michael; Saez, Emmanuel; Stantcheva, Stefanie (2015). "How Elastic are Preferences for Redistribution: Evidence from Randomized Survey Experiments". American Economic Review. 105 (4): 1478–1508. doi:10.1257/aer.20130360. S2CID 217949116.

- ↑ Thomas Piketty, Emmanuel Saez and Stefanie Stantcheva: Optimal Taxation of Top Labor Incomes A Tale of Three Elasticities. American Economic Journal: Economic Policy, 2014, 6 (1), p. 230-271.

- ↑ Emmanuel Saez and Stefanie Stantcheva: A simpler theory of optimal capital taxation. Journal of Public Economics, 2018, 162, p. 120-142.

- ↑ "Taxation and Innovation". www.nber.org. Retrieved 11 December 2018.

- ↑ Ufuk Akcigit, Stefanie Stantcheva (2016). "Optimal Taxation and R&D Policies". NBER Working Paper No. 22908 [Revise and Resubmit at Econometrica].

- ↑ Akcigit, Ufuk; Grigsby, John R.; Nicholas, Tom; Stantcheva, Stefanie (2018). "[NEW!] Taxation and Innovation in the 20th Century". NBER Working Paper No. 24982.

- ↑ Akcigit, Ufuk; Grigsby, John; Nicholas, Tom; Stantcheva, Stefanie (16 October 2018). "Taxation and innovation in the 20th century". VoxEU.org. Retrieved 11 December 2018.

- ↑ Akcigit, Ufuk; Baslandze, Salome; Stantcheva, Stefanie (2016). "Taxation and the International Mobility of Inventors". American Economic Review. 106 (10): 2930–2981. doi: 10.1257/aer.20150237 . S2CID 210425123.

- ↑ Where does innovation come from? , retrieved 6 January 2024