Recycling is the process of converting waste materials into new materials and objects. This concept often includes the recovery of energy from waste materials. The recyclability of a material depends on its ability to reacquire the properties it had in its original state. It is an alternative to "conventional" waste disposal that can save material and help lower greenhouse gas emissions. It can also prevent the waste of potentially useful materials and reduce the consumption of fresh raw materials, reducing energy use, air pollution and water pollution.

Bottled water is drinking water packaged in plastic or glass water bottles. Bottled water may be carbonated or not, with packaging sizes ranging from small single serving bottles to large carboys for water coolers. The consumption of bottled water is influenced by factors such as convenience, taste, perceived safety, and concerns over the quality of municipal tap water. Concerns about the environmental impact of bottled water, including the production and disposal of plastic bottles, have led to calls for more sustainable practices in the industry.

Packaging is the science, art and technology of enclosing or protecting products for distribution, storage, sale, and use. Packaging also refers to the process of designing, evaluating, and producing packages. Packaging can be described as a coordinated system of preparing goods for transport, warehousing, logistics, sale, and end use. Packaging contains, protects, preserves, transports, informs, and sells. In many countries it is fully integrated into government, business, institutional, industrial, and for personal use.

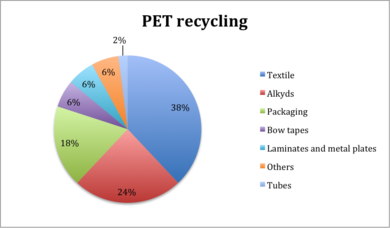

Although PET is used in several applications, as of 2022 only bottles are collected at a substantial scale. The main motivations have been either cost reduction or recycle content of retail goods. An increasing amount is recycled back into bottles, the rest goes into fibres, film, thermoformed packaging and strapping. After sorting, cleaning and grinding, 'bottle flake' is obtained, which is then processed by either:

SIG Group AG is a Swiss multinational corporation and one of the biggest manufacturers in the packaging industry.

Plastic wrap, cling film, Saran wrap, cling wrap, Glad wrap or food wrap is a thin plastic film typically used for sealing food items in containers to keep them fresh over a longer period of time. Plastic wrap, typically sold on rolls in boxes with a cutting edge, clings to many smooth surfaces and can thus remain tight over the opening of a container without adhesive. Common plastic wrap is roughly 0.0005 inches thick. The trend has been to produce thinner plastic wrap, particularly for household use, so now the majority of brands on shelves around the world are 8, 9 or 10 μm thick.

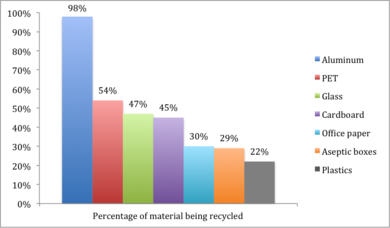

Plastic recycling is the processing of plastic waste into other products. Recycling can reduce dependence on landfill, conserve resources and protect the environment from plastic pollution and greenhouse gas emissions. Recycling rates lag behind those of other recoverable materials, such as aluminium, glass and paper. From the start of plastic production through to 2015, the world produced around 6.3 billion tonnes of plastic waste, only 9% of which has been recycled and only ~1% has been recycled more than once. Of the remaining waste, 12% was incinerated and 79% was either sent to landfills or lost to the environment as pollution.

TerraCycle is a private U.S.-based recycling business headquartered in Trenton, New Jersey. It primarily runs a volunteer-based recycling platform to collect non-recyclable pre-consumer and post-consumer waste on behalf of corporate donors, municipalities, and individuals to turn it into raw material to be used in new products. TerraCycle also manages Loop, a consumer-products shopping service with reusable packaging.

Food packaging is a packaging system specifically designed for food and represents one of the most important aspects among the processes involved in the food industry, as it provides protection from chemical, biological and physical alterations. The main goal of food packaging is to provide a practical means of protecting and delivering food goods at a reasonable cost while meeting the needs and expectations of both consumers and industries. Additionally, current trends like sustainability, environmental impact reduction, and shelf-life extension have gradually become among the most important aspects in designing a packaging system.

Tetra Pak is a Swedish multinational food packaging and processing company headquartered in Switzerland. The company offers packaging, filling machines and processing for dairy, beverages, cheese, ice cream and prepared food, including distribution tools like accumulators, cap applicators, conveyors, crate packers, film wrappers, line controllers and straw applicators.

A plastic bottle is a bottle constructed from high-density or low density plastic. Plastic bottles are typically used to store liquids such as water, soft drinks, motor oil, cooking oil, medicine, shampoo, milk, ink, etc. They come in a range of sizes, from very small bottles to large carboys. Consumer blow molded containers often have integral handles or are shaped to facilitate grasping.

Upcycling, also known as creative reuse, is the process of transforming by-products, waste materials, useless, or unwanted products into new materials or products perceived to be of greater quality, such as artistic value or environmental value.

Sustainable packaging is the development and use of packaging which results in improved sustainability. This involves increased use of life cycle inventory (LCI) and life cycle assessment (LCA) to help guide the use of packaging which reduces the environmental impact and ecological footprint. It includes a look at the whole of the supply chain: from basic function, to marketing, and then through to end of life (LCA) and rebirth. Additionally, an eco-cost to value ratio can be useful The goals are to improve the long term viability and quality of life for humans and the longevity of natural ecosystems. Sustainable packaging must meet the functional and economic needs of the present without compromising the ability of future generations to meet their own needs. Sustainability is not necessarily an end state but is a continuing process of improvement.

Disposable food packaging comprises disposable products often found in fast-food restaurants, take-out restaurants and catering establishments. Typical products are foam food containers, plates, bowls, cups, utensils, doilies and tray papers. These products can be made from a number of materials including plastics, paper, bioresins, wood and bamboo.

Plastics are a wide range of synthetic or semi-synthetic materials that use polymers as a main ingredient. Their plasticity makes it possible for plastics to be molded, extruded or pressed into solid objects of various shapes. This adaptability, plus a wide range of other properties, such as being lightweight, durable, flexible, and inexpensive to produce, has led to their widespread use. Plastics typically are made through human industrial systems. Most modern plastics are derived from fossil fuel-based chemicals like natural gas or petroleum; however, recent industrial methods use variants made from renewable materials, such as corn or cotton derivatives.

Brazil's overall recycling rate is 4%, according to Abrelpe but differs a lot from city to city. Brazil has no structured municipal recycling programs. Only 6.4% of Brazilian municipalities have official waste recycling programs and more than 70% of Brazilians do not separate their recyclable materials into proper bins. The recovery of recyclable material is largely left to waste pickers, who earn a living by collecting recyclables and selling them to private recycling companies.

A retort pouch or retortable pouch is a type of food packaging made from a laminate of flexible plastic and metal foils. It allows the sterile packaging of a wide variety of food and drink handled by aseptic processing and is used as an alternative to traditional industrial canning methods. Retort pouches are used in baby and toddler food, camping food, field rations, fish products, instant noodles, space food sports nutrition and brands such as Capri-Sun and Tasty Bite.

Plastic containers are containers made exclusively or partially of plastic. Plastic containers are ubiquitous either as single-use or reuseable/durable plastic cups, plastic bottles, plastic bags, foam food containers, Tupperware, plastic tubes, clamshells, cosmetic containers, up to intermediate bulk containers and various types of containers made of corrugated plastic. The entire packaging industry heavily depends on plastic containers or containers with some plastic content, besides paperboard and other materials. Food storage nowadays relies mainly on plastic food storage containers.

Packaging waste, the part of the waste that consists of packaging and packaging material, is a major part of the total global waste, and the major part of the packaging waste consists of single-use plastic food packaging, a hallmark of throwaway culture. Notable examples for which the need for regulation was recognized early, are "containers of liquids for human consumption", i.e. plastic bottles and the like. In Europe, the Germans top the list of packaging waste producers with more than 220 kilos of packaging per capita.

Multi-layered packaging are multilayer or composite materials using innovative technologies aimed to give barrier properties, strength and storage stability to food items, new materials as well as hazardous materials.