In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the "underlying." Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation or getting access to otherwise hard-to-trade assets or markets.

Some of the more common derivatives include forwards, futures, options, swaps, and variations of these such as synthetic collateralized debt obligations and credit default swaps. Most derivatives are traded over-the-counter (off-exchange) or on an exchange such as the New York Stock Exchange, while most insurance contracts have developed into a separate industry. In the United States, after the financial crisis of 2007–2009, there has been increased pressure to move derivatives to trade on exchanges.

Derivatives are one of the three main categories of financial instruments, the other two being stocks and debt. The oldest example of a derivative in history, attested to by Aristotle, is thought to be a contract transaction of olives, entered into by ancient Greek philosopher Thales, who made a profit in the exchange. Bucket shops, outlawed a century ago, are a more recent historical example.

In finance, a bond is an instrument of indebtedness of the bond issuer to the holders. The most common types of bonds include municipal bonds and corporate bonds.

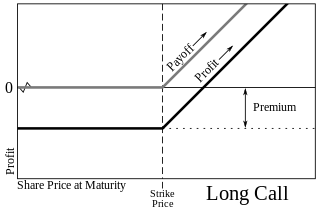

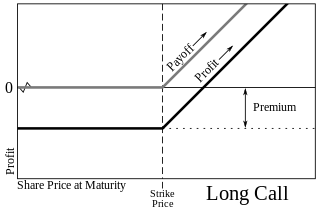

A call option, often simply labeled a "call", is a financial contract between two parties, the buyer and the seller of this type of option. The buyer of the call option has the right, but not the obligation, to buy an agreed quantity of a particular commodity or financial instrument from the seller of the option at a certain time for a certain price. The seller is obligated to sell the commodity or financial instrument to the buyer if the buyer so decides. The buyer pays a fee for this right. The term "call" comes from the fact that the owner has the right to "call the stock away" from the seller.

In finance, a put or put option is a stock market device which gives the owner the right, but not the obligation, to sell an asset, at a specified price, by a predetermined date to a given party. The purchase of a put option is interpreted as a negative sentiment about the future value of the

underlying stock. The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index.

In finance, a warrant is a security that entitles the holder to buy the underlying stock of the issuing company at a fixed price called exercise price until the expiry date.

An interest rate cap is a type of interest rate derivative in which the buyer receives payments at the end of each period in which the interest rate exceeds the agreed strike price. An example of a cap would be an agreement to receive a payment for each month the LIBOR rate exceeds 2.5%.

In finance, the style or family of an option is the class into which the option falls, usually defined by the dates on which the option may be exercised. The vast majority of options are either European or American (style) options. These options—as well as others where the payoff is calculated similarly—are referred to as "vanilla options". Options where the payoff is calculated differently are categorized as "exotic options". Exotic options can pose challenging problems in valuation and hedging.

In finance, a futures contract is a standardized forward contract, a legal agreement to buy or sell something at a predetermined price at a specified time in the future, between parties not known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price the parties agree to buy and sell the asset for is known as the forward price. The specified time in the future—which is when delivery and payment occur—is known as the delivery date. Because it is a function of an underlying asset, a futures contract is a derivative product.

In finance, an equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded.

In mathematical finance, the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. The name is used because the most common of these sensitivities are denoted by Greek letters. Collectively these have also been called the risk sensitivities, risk measures or hedge parameters.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

A swaption is an option granting its owner the right but not the obligation to enter into an underlying swap. Although options can be traded on a variety of swaps, the term "swaption" typically refers to options on interest rate swaps.

A swap is a derivative in which two counterparties exchange cash flows of one party's financial instrument for those of the other party's financial instrument. The benefits in question depend on the type of financial instruments involved. For example, in the case of a swap involving two bonds, the benefits in question can be the periodic interest (coupon) payments associated with such bonds. Specifically, two counterparties agree to exchange one stream of cash flows against another stream. These streams are called the legs of the swap. The swap agreement defines the dates when the cash flows are to be paid and the way they are accrued and calculated. Usually at the time when the contract is initiated, at least one of these series of cash flows is determined by an uncertain variable such as a floating interest rate, foreign exchange rate, equity price, or commodity price.

In finance, a foreign exchange option is a derivative financial instrument that gives the right but not the obligation to exchange money denominated in one currency into another currency at a pre-agreed exchange rate on a specified date. See Foreign exchange derivative.

In finance, margin is collateral that the holder of a financial instrument has to deposit with a counterparty to cover some or all of the credit risk the holder poses for the counterparty. This risk can arise if the holder has done any of the following:

The owner of an option contract has the right to exercise it, and thus require that the financial transaction specified by the contract is to be carried out immediately between the two parties, whereupon the option contract is terminated. When exercising a call option, the owner of the option purchases the underlying shares at the strike price from the option seller, while for a put option, the owner of the option sells the underlying to the option seller, again at the strike price.

In finance, a collar is an option strategy that limits the range of possible positive or negative returns on an underlying to a specific range. A collar strategy is used as one of the ways to hedge against possible losses and it represents long put options financed with short call options.

In finance, an option is a contract which gives the buyer the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price prior to or on a specified date, depending on the form of the option. The strike price may be set by reference to the spot price of the underlying security or commodity on the day an option is taken out, or it may be fixed at a discount or at a premium. The seller has the corresponding obligation to fulfill the transaction – to sell or buy – if the buyer (owner) "exercises" the option. An option that conveys to the owner the right to buy at a specific price is referred to as a call; an option that conveys the right of the owner to sell at a specific price is referred to as a put. Both are commonly traded, but the call option is more frequently discussed.

Puttable bond is a bond with an embedded put option. The holder of the puttable bond has the right, but not the obligation, to demand early repayment of the principal. The put option is exercisable on one or more specified dates.

A foreign exchange derivative is a financial derivative whose payoff depends on the foreign exchange rate(s) of two currencies. These instruments are commonly used for currency speculation and arbitrage or for hedging foreign exchange risk.