A stock market, equity market, or share market is the aggregation of buyers and sellers of stocks, which represent ownership claims on businesses; these may include securities listed on a public stock exchange, as well as stock that is only traded privately, such as shares of private companies which are sold to investors through equity crowdfunding platforms. Investment is usually made with an investment strategy in mind.

In financial mathematics, the put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to a single forward contract at this strike price and expiry. This is because if the price at expiry is above the strike price, the call will be exercised, while if it is below, the put will be exercised, and thus in either case one unit of the asset will be purchased for the strike price, exactly as in a forward contract.

Day trading is a form of speculation in securities in which a trader buys and sells a financial instrument within the same trading day, so that all positions are closed before the market closes for the trading day to avoid unmanageable risks and negative price gaps between one day's close and the next day's price at the open. Traders who trade in this capacity are generally classified as speculators. Day trading contrasts with the long-term trades underlying buy-and-hold and value investing strategies. Day trading may require fast trade execution, sometimes as fast as milli-seconds in scalping, therefore direct-access day trading software is often needed.

A market maker or liquidity provider is a company or an individual that quotes both a buy and a sell price in a tradable asset held in inventory, hoping to make a profit on the bid–ask spread, or turn. The benefit to the firm is that it makes money from doing so; the benefit to the market is that this helps limit price variation (volatility) by setting a limited trading price range for the assets being traded.

The bid–ask spread is the difference between the prices quoted for an immediate sale (ask) and an immediate purchase (bid) for stocks, futures contracts, options, or currency pairs in some auction scenario. The size of the bid–ask spread in a security is one measure of the liquidity of the market and of the size of the transaction cost. If the spread is 0 then it is a frictionless asset.

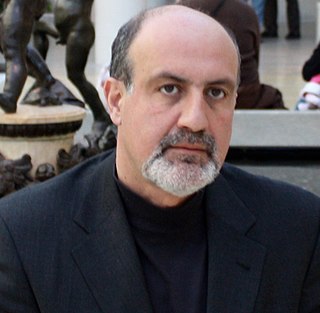

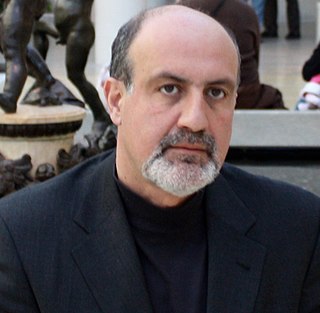

Nassim Nicholas Taleb is a Lebanese-American essayist, mathematical statistician, former option trader, risk analyst, and aphorist whose work concerns problems of randomness, probability, and uncertainty. The Sunday Times called his 2007 book The Black Swan one of the 12 most influential books since World War II.

Liquidity risk is a financial risk that for a certain period of time a given financial asset, security or commodity cannot be traded quickly enough in the market without impacting the market price.

Triangular arbitrage is the act of exploiting an arbitrage opportunity resulting from a pricing discrepancy among three different currencies in the foreign exchange market. A triangular arbitrage strategy involves three trades, exchanging the initial currency for a second, the second currency for a third, and the third currency for the initial. During the second trade, the arbitrageur locks in a zero-risk profit from the discrepancy that exists when the market cross exchange rate is not aligned with the implicit cross exchange rate. A profitable trade is only possible if there exist market imperfections. Profitable triangular arbitrage is very rarely possible because when such opportunities arise, traders execute trades that take advantage of the imperfections and prices adjust up or down until the opportunity disappears.

The Small-Order Execution System (SOES) was a system to facilitate clearing trades of low volume on NASDAQ. It has been phased out and is no longer necessary.

Algorithmic trading is a method of executing orders using automated pre-programmed trading instructions accounting for variables such as time, price, and volume. This type of trading attempts to leverage the speed and computational resources of computers relative to human traders. In the twenty-first century, algorithmic trading has been gaining traction with both retail and institutional traders. It is widely used by investment banks, pension funds, mutual funds, and hedge funds that may need to spread out the execution of a larger order or perform trades too fast for human traders to react to. A study in 2019 showed that around 92% of trading in the Forex market was performed by trading algorithms rather than humans.

A financial quotation refers to specific market data relating to a security or commodity. While the term quote specifically refers to the bid price or ask price of an instrument, it may be more generically used to relate to the last price which the security traded at. This may refer to both exchange-traded and over-the-counter financial instruments.

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders.

In financial markets, implementation shortfall is the difference between the decision price and the final execution price for a trade. This is also known as the "slippage". Agency trading is largely concerned with minimizing implementation shortfall and finding liquidity.

In finance, a calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. These individual purchases, known as the legs of the spread, vary only in expiration date; they are based on the same underlying market and strike price.

Scalping, when used in reference to trading in securities, commodities and foreign exchange, may refer to either

- a legitimate method of arbitrage of small price gaps created by the bid–ask spread, or

- a fraudulent form of market manipulation.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

Payment for order flow (PFOF) is the compensation that a stockbroker receives from a market maker in exchange for the broker routing its clients' trades to that market maker. It is a controversial practice that has been called a "kickback" by its critics. Policymakers supportive of PFOF and several people in finance who have a favorable view of the practice have defended it for helping develop new investment apps, low-cost trading, and more efficient execution.

High-frequency trading (HFT) is a type of algorithmic financial trading characterized by high speeds, high turnover rates, and high order-to-trade ratios that leverages high-frequency financial data and electronic trading tools. While there is no single definition of HFT, among its key attributes are highly sophisticated algorithms, co-location, and very short-term investment horizons. HFT can be viewed as a primary form of algorithmic trading in finance. Specifically, it is the use of sophisticated technological tools and computer algorithms to rapidly trade securities. HFT uses proprietary trading strategies carried out by computers to move in and out of positions in seconds or fractions of a second.

Matchbook FX was an internet-based electronic communication network for trading currency online in the Spot-FX or foreign exchange market. It operated between 1999 and 2002.

MT4 ECN Bridge is a technology that allows a user to access interbank foreign exchange market through the MetaTrader 4 (MT4) electronic trading platform. MT4 was designed to allow trading between a broker and its clients and so did not provide for passing orders through to wholesale forex market via electronic communication networks (ECNs). In response a number of third party software companies developed Straight-through processing bridging software to allow the MT4 server to pass orders placed by clients directly to an ECN and feed trade confirmations back automatically.