A conditional variance swap is a type of variance swap or swap derivative product that allows investors to take exposure to volatility in the price of an underlying security but only while the underlying security is within a pre-specified price range. This instrument can be useful for hedging complex volatility exposures, making a bet on the volatility levels contained in the skew of the underlying security's price, or buying/selling variance at more attractive levels given a view on the underlying security. [1]

Regular variance swap were introduced first, and became a popular instrument for hedging against the effect of volatility on option prices. Thus, the market for these securities became increasingly liquid, and pricing for these swaps became more efficient. However, investors noticed that to a certain extent the price levels for these variance swaps still deviated from the theoretical price that would have resulted from replicating the portfolio of options underlying the swaps using options pricing formulas such as the Black–Scholes model. This was partly because the construction of the replicating portfolio includes a relatively large contribution from out-of-the-money options, which can often be illiquid and result in a pricing discrepancy in the overall swap.

Conditional swaps mitigate this problem by limiting the hedge to strikes within an upper and lower level of the underlying security. Thus, the volatility exposure is limited to when the underlying security lies within this corridor. [1] Another problem in replicating variance swaps is that dealers rarely use a large collection of options over a large range to hedge a variance swap due to transaction costs and the cost of managing a large number of options. A conditional variance swap is attractive as it is easier to hedge and better fits the payoff profile of hedges used in practice.

In finance, a derivative is a contract that derives its value from the performance of an underlying entity. This underlying entity can be an asset, index, or interest rate, and is often simply called the underlying. Derivatives can be used for a number of purposes, including insuring against price movements (hedging), increasing exposure to price movements for speculation, or getting access to otherwise hard-to-trade assets or markets.

Passive management is an investing strategy that tracks a market-weighted index or portfolio. Passive management is most common on the equity market, where index funds track a stock market index, but it is becoming more common in other investment types, including bonds, commodities and hedge funds.

In finance, an equity derivative is a class of derivatives whose value is at least partly derived from one or more underlying equity securities. Options and futures are by far the most common equity derivatives, however there are many other types of equity derivatives that are actively traded.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

A swaption is an option granting its owner the right but not the obligation to enter into an underlying swap. Although options can be traded on a variety of swaps, the term "swaption" typically refers to options on interest rate swaps.

In finance, a swap is an agreement between two counterparties to exchange financial instruments, cashflows, or payments for a certain time. The instruments can be almost anything but most swaps involve cash based on a notional principal amount.

Volatility risk is the risk of an adverse change of price, due to changes in the volatility of a factor affecting that price. It usually applies to derivative instruments, and their portfolios, where the volatility of the underlying asset is a major influencer of option prices. It is also relevant to portfolios of basic assets, and to foreign currency trading.

In finance, the beta is a statistic that measures the expected increase or decrease of an individual stock price in proportion to movements of the stock market as a whole. Beta can be used to indicate the contribution of an individual asset to the market risk of a portfolio when it is added in small quantity. It refers to an asset's non-diversifiable risk, systematic risk, or market risk. Beta is not a measure of idiosyncratic risk.

Financial risk management is the practice of protecting economic value in a firm by managing exposure to financial risk - principally operational risk, credit risk and market risk, with more specific variants as listed aside. As for risk management more generally, financial risk management requires identifying the sources of risk, measuring these, and crafting plans to mitigate them. See Finance § Risk management for an overview.

A variance swap is an over-the-counter financial derivative that allows one to speculate on or hedge risks associated with the magnitude of movement, i.e. volatility, of some underlying product, like an exchange rate, interest rate, or stock index.

A structured product, also known as a market-linked investment, is a pre-packaged structured finance investment strategy based on a single security, a basket of securities, options, indices, commodities, debt issuance or foreign currencies, and to a lesser extent, derivatives. Structured products are not homogeneous — there are numerous varieties of derivatives and underlying assets — but they can be classified under the aside categories. Typically, a desk will employ a specialized "structurer" to design and manage its structured-product offering.

In finance, correlation trading is a strategy in which the investor gets exposure to the average correlation of an index.

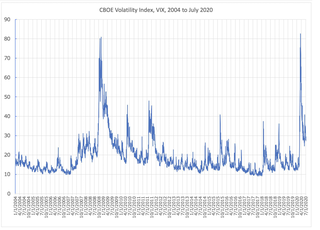

VIX is the ticker symbol and the popular name for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options. It is calculated and disseminated on a real-time basis by the CBOE, and is often referred to as the fear index or fear gauge.

The following outline is provided as an overview of and topical guide to finance:

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell a specific quantity of an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset price, time until expiration, market volatility, the risk-free rate of interest, and the strike price of the option. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, public markets in the form of standardized contracts.

Alternative beta is the concept of managing volatile "alternative investments", often through the use of hedge funds. Alternative beta is often also referred to as "alternative risk premia".

In finance, a volatility swap is a forward contract on the future realised volatility of a given underlying asset. Volatility swaps allow investors to trade the volatility of an asset directly, much as they would trade a price index. Its payoff at expiration is equal to

A reverse convertible security or convertible security is a short-term note linked to an underlying stock. The security offers a steady stream of income due to the payment of a high coupon rate. In addition, at maturity the owner will receive either 100% of the par value or, if the stock value falls, a predetermined number of shares of the underlying stock. In the context of structured product, a reverse convertible can be linked to an equity index or a basket of indices. In such case, the capital repayment at maturity is cash settled, either 100% of principal, or less if the underlying index falls conditional on barrier is hit in the case of barrier reverse convertibles.

A dual-currency note (DC) pays coupons in the investor's domestic currency with the notional in the issuer's domestic currency. A reverse dual-currency note (RDC) is a note which pays a foreign interest rate in the investor's domestic currency. A power reverse dual-currency note (PRDC) is a structured product where an investor is seeking a better return and a borrower a lower rate by taking advantage of the interest rate differential between two economies. The power component of the name denotes higher initial coupons and the fact that coupons rise as the foreign exchange rate depreciates. The power feature comes with a higher risk for the investor, which characterizes the product as leveraged carry trade. Cash flows may have a digital cap feature where the rate gets locked once it reaches a certain threshold. Other add-on features include barriers such as knockouts and cancel provision for the issuer. PRDCs are part of the wider Structured Notes Market.

The S&P/ASX200 VIX (A-VIX) is a financial market product that participants trade based on the market price of the implied volatility in the underlying Australian equity index.