Via Rail Canada Inc., operating as Via Rail or Via, is a Canadian Crown corporation that is mandated to operate intercity passenger rail service in Canada. It receives an annual subsidy from Transport Canada to offset the cost of operating services connecting remote communities.

Telefilm Canada is a Crown corporation reporting to Canada's federal government through the Minister of Canadian Heritage. Headquartered in Montreal, Telefilm provides services to the Canadian audiovisual industry with four regional offices in Vancouver, British Columbia; Toronto, Ontario; Montreal, Quebec; and Halifax, Nova Scotia. The primary mandate of the corporation is to finance and promote Canadian productions through its various funds and programs.

A budget is a financial plan for a defined period, often one year. It may also include planned sales volumes and revenues, resource quantities, costs and expenses, assets, liabilities and cash flows. Companies, governments, families, and other organizations use it to express strategic plans of activities or events in measurable terms.

The National Energy Program (NEP) was an energy policy of the Canadian federal government from 1980 to 1985. Created under the Liberal government of Prime Minister Pierre Trudeau by Energy Minister Marc Lalonde in 1980, the program was administered by the Department of Energy, Mines and Resources. Introduced following the oil crises and stagflation of the 1970s, the NEP proved to be a highly controversial policy initiative that pitted centralized economic nationalism and federal aspirations of energy self-sufficiency against provincial jurisdiction with hundreds of billions of dollars in oil revenue at stake. The result was a dispute that sparked intense opposition and anger in Canada's West, particularly in Alberta, and the rise of the Reform Party, a development that would shape Canadian politics for years to come.

Taxation in Canada is a prerogative shared between the federal government and the various provincial and territorial legislatures.

Hydro One Limited is an electricity transmission and distribution utility serving the Canadian province of Ontario. Hydro One traces its history to the early 20th century and the establishment of the Hydro-Electric Power Commission of Ontario. In October 1998, the provincial legislature passed the Energy Competition Act which restructured Ontario Hydro into separate entities responsible for electrical generation, transmission/delivery, and price management with a final goal of total privatization.

Canada Lands Company Limited is a self-financing federal Crown corporation reporting to the Parliament of Canada through Public Services and Procurement Canada. The company is responsible for managing property on behalf of the federal government, conducting public consultation and integrating properties back into their surrounding communities for development. Most of its assets are located in Canadian urban centres, and are sold after the CLC revalued the property by providing managerial support and subsidizing immediate costs such as decontamination. However, the company retains ownership of some of Canada's most valued properties, such as Downsview Park, the CN Tower, the Old Port of Montreal and the Montreal Science Centre, from which it draws rental and hospitality revenues.

The Corporation of the City of Toronto, or simply the City of Toronto, is the organization responsible for the administration of the municipal government of Toronto, Ontario, Canada. Its powers and structure are set out in the City of Toronto Act.

Canada is the only G7 country that does not have high-speed rail. In the press and popular discussion, there have been two routes frequently proposed as suitable for a high-speed rail corridor:

Public services in Toronto are funded by municipal property taxes, financial transfers from the Government of Ontario and Government of Canada, or are operated and financed by the higher-level governments. Funding for services provided by the municipal government is determined by a vote of the Toronto City Council in favour of the year's proposed operating budget.

Since its election to power on January 23, 2006, the Conservative Party of Canada led by Prime Minister Stephen Harper adopted several positions and policies in regard to the economic issues of Canada, including various tax cuts, exemptions and credits as well as discussing the issue of fiscal imbalance among provinces and measures to cope with more troubled sectors of the Canadian economy.

Canadian government debt is the liabilities of the government sector. For 2020, the market value of financial liabilities, or gross debt, was $2,852 billion for the consolidated Canadian general government. As a ratio of GDP, gross debt was 129.2% in 2020, the highest level ever recorded. Approximately half, or 66.4% as a ratio of GDP, was debt of the federal government. The increase in debt in 2020 was driven primarily by massive deficits generated to finance numerous relief measures, notably in the form of transfers to households and subsidies to businesses during the COVID-19 pandemic.

In Canada, the federal government makes equalization payments to provincial governments to help address fiscal disparities among Canadian provinces based on estimates of provinces' fiscal capacity—their ability to generate tax revenues. A province that does not receive equalization payments is often referred to as a "have province", while one that does is called a "have not province". In 2022-23, all provinces and territories will receive $87.67 billion in major federal transfers, including $21.92 billion in equalization payments in 5 provinces.

Canada's video game industry in terms of employment numbers has around 32,300 employees, 937 companies. In 2021, the industry generated an estimated US$3.4 billion in revenue, having grown by 20% since 2019. Video game development is beginning to rival the film and television production industry as a major contributor to the economy.

The Canadian federal budget for fiscal year 2013–2014 was presented to the House of Commons of Canada by Finance Minister Jim Flaherty on 21 March 2013. The budget bill was tabled in the legislature on 29 April 2013 as the Economic Action Plan 2013 Act, No. 1. A second budget bill will be tabled in the autumn, which will include elements excluded from the first bill, such as the Canada Job Grant. The deficit was projected to be $18.7 billion for the fiscal year 2013-2014, however this was adjusted to $8.1 billion by end of the fiscal year and once the Auditor General's recommendations on the Government's unfunded pension obligations were taken into account.

The Ontario government debt consists of the liabilities of the Government of Ontario. Approximately 82% of Ontario's debt is in the form of debt securities, while other liabilities include government employee pension plan obligations, loans, and accounts payable. The Ontario Financing Authority, which manages the provinces' debt, says that as of March 31, 2020, the Ontario government's net debt is CDN $353.3 billion. Net debt is projected to rise to $398 billion in 2020-21. The Debt-to-GDP ratio for 2019-2020 was 39.7%, and is projected to rise to 47.1% in 2020-21. Interest on the debt in 2019-20 was CDN$12.5 billion, representing 8.0% of Ontario's revenue and its fourth-largest spending area.

The Toronto government debt is the amount of money the City of Toronto government has borrowed to finance capital expenditures. Under the City of Toronto Act, the Toronto government cannot run a deficit for its annual operating budget. In addition, City Council has set the limit of debt charges not to exceed 15% of the property tax revenues. As of the end of 2012, the total debt stood at CDN$3.7 billion.

The Canada Workers Benefit (CWB) is a refundable tax credit in Canada, similar to the Earned Income Tax Credit (EITC) in the United States. Introduced in 2007 under the name Workers Income Tax Benefit (WITB), it offers tax relief to working low-income individuals and encourages others to enter the workforce. The WITB has been expanded considerably since its introduction, and restructured in depth by the 2018 Canadian federal budget when it was renamed the Canada Workers Benefit.

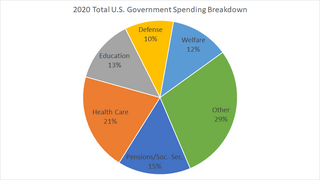

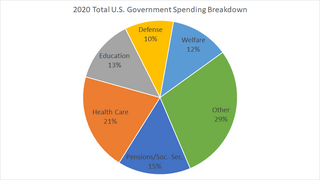

Government spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments.

Carbon pricing in Canada is implemented either as a regulatory fee or tax levied on the carbon content of fuels at the Canadian provincial, territorial or federal level. Provinces and territories of Canada are allowed to create their own system of carbon pricing as long as they comply with the minimum requirements set by the federal government; individual provinces and territories thus may have a higher tax than the federally mandated one but not a lower one. Currently, all provinces and territories are subject to a carbon pricing mechanism, either by an in-province program or by one of two federal programs. As of April 2021 the federal minimum tax is set at C$40 per tonne of CO2 equivalent, set to increase to C$50 in 2022 and C$170 in 2030. In some provinces, the tax is higher, such as British Columbia which has a C$45 tax.