A multiunit auction is an auction in which several homogeneous items are sold. The units can be sold each at the same price (a uniform price auction) or at different prices (a discriminatory price auction).

A multiunit auction is an auction in which several homogeneous items are sold. The units can be sold each at the same price (a uniform price auction) or at different prices (a discriminatory price auction).

A uniform price auction otherwise known as a "clearing price auction", pay-as-clear [1] or marginal price auction, "marginal price system" (MPS), [2] is a multiunit auction in which a fixed number of identical units of a homogenous commodity are sold for the same price. Each bidder in the auction may submit (possibly multiple) bids, designating both the number of units desired and the price he/she is willing to pay per unit. Typically these bids are sealed - not revealed to the other buyers until the auction closes. The auctioneer then serves the highest bidder first, giving them the number of units requested, then the second-highest bidder and so forth until the supply of the commodity is exhausted. All bidders then pay a per unit price equal to the lowest winning bid (the lowest bid out of the buyers who actually received one or more units of the commodity) - regardless of their actual bid. Some variations of this auction have the winners paying the highest losing bid rather than the lowest winning bid.

A uniform price auction may be utilised to aggregate a number of units offered by more than one seller to multiple buyers. This style of auction, sometimes referred to as a call market or double auction, shares the characteristics of an open market mechanism in which all buyers and all sellers interested in trading a homogenous commodity may participate simultaneously. The clearing price mechanism is often utilised in a market context in order to establish a benchmark price index for that market in question. Examples include government bond auctions, electricity market auctions and compliance certificate markets.

In theory, the uniform-price auction provides an incentive for bidders to bid insincerely unless each bidder has demand for only a single unit. For multiple-unit demand, bidders have an incentive to shade their bids for units other than their first because those bids may influence the price the bidder pays. This demand reduction results in an inefficient equilibrium. [3]

A variation that preserves the incentive to bid truthfully is the Vickrey-Clark-Groves auction.

In a discriminatory price auction (or pay-as-bid auction, [4] PAB [2] ), multiple homogeneous items are sold at different prices. [5] An example is the auction system at the Dutch Flower Auctions, where a lot is allocated to (potentially) multiple buyers in different bidding rounds. To speed up this process, the initial auction price for any subsequent bidding round is set just slightly higher than the previous winning bid (around 15-20 cents, or 15-30% on average).

Yankee auction is a special case of multiunit auction. [6] OnSale.com has developed Yankee auction as its trademark in the 1990s. [7] A Yankee auction is a single-attribute multiunit auction running like a Dutch auction, where the bids are the portions of a total amount of identical units. [8] [9] [10] The total amount of auctioned items is firm in a Yankee auction unlike a Brazilian auction. The portions of the total amount, bidders can bid, are limited to lower numbers than the total amount. Therefore, only a portion of the total amount will be traded for the best price and the rest to the suboptimal prices like in the discriminatory price auction.

An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

In a broad sense, an electricity market is a system that facilitates the exchange of electricity-related goods and services. During more than a century of evolution of the electric power industry, the economics of the electricity markets had undergone enormous changes for reasons ranging from the technological advances on supply and demand sides to politics and ideology. A restructuring of electric power industry at the turn of the 21st century involved replacing the vertically integrated and tightly regulated "traditional" electricity market with multiple competitive markets for electricity generation, transmission, distribution, and retailing. The traditional and competitive market approaches loosely correspond to two visions of industry: the deregulation was transforming electricity from a public service into a tradable good. As of 2020s, the traditional markets are still common in some regions, including large parts of the United States and Canada.

The subjective theory of value is an economic theory which proposes the idea that the value of any good is not determined by the utility value of the object, nor by the cumulative value of components or labour needed to produce or manufacture it, but instead is determined by the individuals or entities who are buying or selling the object in question. This trend is often seen in collectable items such as cars, vinyl records, and comic books. The value of an object may have increased substantially since its creation or original purchase due to age, a personal affinity, or scarcity.

A Dutch auction is one of several similar types of auctions for buying or selling goods. Most commonly, it means an auction in which the auctioneer begins with a high asking price in the case of selling, and lowers it until some participant accepts the price, or it reaches a predetermined reserve price. This type of price auction is most commonly used for goods that are required to be sold quickly such as flowers, fresh produce, or tobacco. A Dutch auction has also been called a clock auction or open-outcry descending-price auction. This type of auction shows the advantage of speed since a sale never requires more than one bid. It is strategically similar to a first-price sealed-bid auction.

An online auction is an auction held over the internet and accessed by internet connected devices. Similar to in-person auctions, online auctions come in a variety of types, with different bidding and selling rules.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

An English auction is an open-outcry ascending dynamic auction. It proceeds as follows.

In economics, a price mechanism is the manner in which the profits of goods or services affects the supply and demand of goods and services, principally by the price elasticity of demand. A price mechanism affects both buyer and seller who negotiate prices. A price mechanism, part of a market system, comprises various ways to match up buyers and sellers.

Bid rigging is a fraudulent scheme in procurement auctions resulting in non-competitive bids and can be performed by corrupt officials, by firms in an orchestrated act of collusion, or between officials and firms. This form of collusion is illegal in most countries. It is a form of price fixing and market allocation, often practiced where contracts are determined by a call for bids, for example in the case of government construction contracts. The typical objective of bid rigging is to enable the "winning" party to obtain contracts at uncompetitive prices. The other parties are compensated in various ways, for example, by cash payments, or by being designated to be the "winning" bidder on other contracts, or by an arrangement where some parts of the successful bidder's contract will be subcontracted to them. In this way, they "share the spoils" among themselves. Bid rigging almost always results in economic harm to the agency which is seeking the bids, and to the public, who ultimately bear the costs as taxpayers or consumers.

A bidding fee auction, also called a penny auction, is a type of all-pay auction in which all participants must pay a non-refundable fee to place each small incremental bid. The auction is extended each time a new bid is placed, typically by 10 to 20 seconds. Once time expires without a new bid being placed, the last bidder wins the auction and pays the amount of that bid. The auctioneer profits from both the fees charged to place bids and the payment for the winning bid; these combined revenues frequently total more than the value of the item being sold. Empirical evidence suggests that revenues from these auctions exceeds theoretical predictions for rational agents. This has been credited to the sunk cost fallacy. Such auctions are typically held over the Internet, rather than in person.

Auction sniping is the practice, in a timed online auction, of placing a bid likely to exceed the current highest bid as late as possible—usually seconds before the end of the auction—giving other bidders no time to outbid the sniper. This can be done either manually or by software on the bidder's computer, or by an online sniping service.

A double auction is a process of buying and selling goods with multiple sellers and multiple buyers. Potential buyers submit their bids and potential sellers submit their ask prices to the market institution, and then the market institution chooses some price p that clears the market: all the sellers who asked less than p sell and all buyers who bid more than p buy at this price p. Buyers and sellers that bid or ask for exactly p are also included. A common example of a double auction is stock exchange.

Auction theory is an applied branch of economics which deals with how bidders act in auction markets and researches how the features of auction markets incentivise predictable outcomes. Auction theory is a tool used to inform the design of real-world auctions. Sellers use auction theory to raise higher revenues while allowing buyers to procure at a lower cost. The conference of the price between the buyer and seller is an economic equilibrium. Auction theorists design rules for auctions to address issues which can lead to market failure. The design of these rulesets encourages optimal bidding strategies among a variety of informational settings. The 2020 Nobel Prize for Economics was awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.”

A first-price sealed-bid auction (FPSBA) is a common type of auction. It is also known as blind auction. In this type of auction, all bidders simultaneously submit sealed bids so that no bidder knows the bid of any other participant. The highest bidder pays the price that was submitted.

Bidding is an offer to set a price tag by an individual or business for a product or service or a demand that something be done. Bidding is used to determine the cost or value of something.

Competitive equilibrium is a concept of economic equilibrium, introduced by Kenneth Arrow and Gérard Debreu in 1951, appropriate for the analysis of commodity markets with flexible prices and many traders, and serving as the benchmark of efficiency in economic analysis. It relies crucially on the assumption of a competitive environment where each trader decides upon a quantity that is so small compared to the total quantity traded in the market that their individual transactions have no influence on the prices. Competitive markets are an ideal standard by which other market structures are evaluated.

Revenue equivalence is a concept in auction theory that states that given certain conditions, any mechanism that results in the same outcomes also has the same expected revenue.

A Vickrey–Clarke–Groves (VCG) auction is a type of sealed-bid auction of multiple items. Bidders submit bids that report their valuations for the items, without knowing the bids of the other bidders. The auction system assigns the items in a socially optimal manner: it charges each individual the harm they cause to other bidders. It gives bidders an incentive to bid their true valuations, by ensuring that the optimal strategy for each bidder is to bid their true valuations of the items; it can be undermined by bidder collusion and in particular in some circumstances by a single bidder making multiple bids under different names. It is a generalization of a Vickrey auction for multiple items.

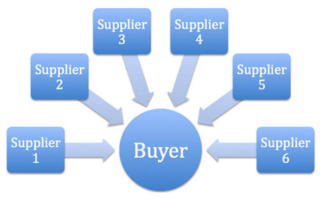

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

Bayesian-optimal pricing is a kind of algorithmic pricing in which a seller determines the sell-prices based on probabilistic assumptions on the valuations of the buyers. It is a simple kind of a Bayesian-optimal mechanism, in which the price is determined in advance without collecting actual buyers' bids.