An auction is usually a process of buying and selling goods or services by offering them up for bids, taking bids, and then selling the item to the highest bidder or buying the item from the lowest bidder. Some exceptions to this definition exist and are described in the section about different types. The branch of economic theory dealing with auction types and participants' behavior in auctions is called auction theory.

A Dutch auction is one of several similar types of auctions for buying or selling goods. Most commonly, it means an auction in which the auctioneer begins with a high asking price in the case of selling, and lowers it until some participant accepts the price, or it reaches a predetermined reserve price. This type of price auction is most commonly used for goods that are required to be sold quickly such as flowers, fresh produce, or tobacco. A Dutch auction has also been called a clock auction or open-outcry descending-price auction. This type of auction shows the advantage of speed since a sale never requires more than one bid. It is strategically similar to a first-price sealed-bid auction.

An online auction is an auction held over the internet and accessed by internet connected devices. Similar to in-person auctions, online auctions come in a variety of types, with different bidding and selling rules.

A Vickrey auction or sealed-bid second-price auction (SBSPA) is a type of sealed-bid auction. Bidders submit written bids without knowing the bid of the other people in the auction. The highest bidder wins but the price paid is the second-highest bid. This type of auction is strategically similar to an English auction and gives bidders an incentive to bid their true value. The auction was first described academically by Columbia University professor William Vickrey in 1961 though it had been used by stamp collectors since 1893. In 1797 Johann Wolfgang von Goethe sold a manuscript using a sealed-bid, second-price auction.

An English auction is an open-outcry ascending dynamic auction. It proceeds as follows.

A bid price is the highest price that a buyer is willing to pay for a goods. It is usually referred to simply as the "bid". In bid and ask, the bid price stands in contrast to the ask price or "offer", and the difference between the two is called the bid–ask spread. An unsolicited bid or purchase offer is when a person or company receives a bid even though they are not looking to sell.

In economics, a reservationprice is a limit on the price of a good or a service. On the demand side, it is the highest price that a buyer is willing to pay; on the supply side, it is the lowest price a seller is willing to accept for a good or service.

Bid rigging is a fraudulent scheme in procurement auctions resulting in non-competitive bids and can be performed by corrupt officials, by firms in an orchestrated act of collusion, or between officials and firms. This form of collusion is illegal in most countries. It is a form of price fixing and market allocation, often practiced where contracts are determined by a call for bids, for example in the case of government construction contracts. The typical objective of bid rigging is to enable the "winning" party to obtain contracts at uncompetitive prices. The other parties are compensated in various ways, for example, by cash payments, or by being designated to be the "winning" bidder on other contracts, or by an arrangement where some parts of the successful bidder's contract will be subcontracted to them. In this way, they "share the spoils" among themselves. Bid rigging almost always results in economic harm to the agency which is seeking the bids, and to the public, who ultimately bear the costs as taxpayers or consumers.

A Japanese auction is a dynamic auction format. It proceeds in the following way.

Gmarket is an e-commerce website based in South Korea. The company was founded in 2000 as a subsidiary of Interpark, and was acquired by eBay in 2009.

Hi-Living is a Korean online auction website and shopping mall where people from all around the world buy and sell goods and services.

Auction theory is an applied branch of economics which deals with how bidders act in auction markets and researches how the features of auction markets incentivise predictable outcomes. Auction theory is a tool used to inform the design of real-world auctions. Sellers use auction theory to raise higher revenues while allowing buyers to procure at a lower cost. The conference of the price between the buyer and seller is an economic equilibrium. Auction theorists design rules for auctions to address issues which can lead to market failure. The design of these rulesets encourages optimal bidding strategies among a variety of informational settings. The 2020 Nobel Prize for Economics was awarded to Paul R. Milgrom and Robert B. Wilson “for improvements to auction theory and inventions of new auction formats.”

A request for quotation (RfQ) is a business process in which a company or public entity requests a quote from a supplier for the purchase of specific products or services. RfQ generally means the same thing as Call for bids (CfB) and Invitation for bid (IfB).

Market design is a practical methodology for creation of markets of certain properties, which is partially based on mechanism design. In some markets, prices may be used to induce the desired outcomes — these markets are the study of auction theory. In other markets, prices may not be used — these markets are the study of matching theory.

Customer to customer markets provide a way to allow customers to interact with each other. Traditional markets require business to customer relationships, in which a customer goes to the business in order to purchase a product or service. In customer to customer markets, the business facilitates an environment where customers can sell goods or services to each other. Other types of markets include business to business (B2B) and business to customer (B2C).

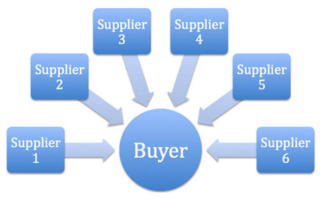

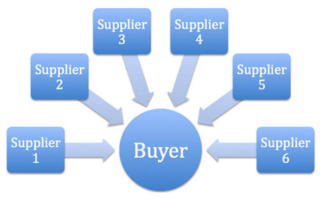

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

An invitation to tender is a formal, structured procedure for generating competing offers from different potential suppliers or contractors looking to obtain an award of business activity in works, supply, or service contracts, often from companies who have been previously assessed for suitability by means of a supplier questionnaire (SQ) or pre-qualification questionnaire (PQQ).

An ‘‘‘electronic bidding system ‘‘‘ is an electronic bidding event according to defined negotiation rules (eAgreement). A buyer and two or more suppliers take part in this online event.

National Agriculture Market or eNAM is an online trading platform for agricultural commodities in India. The market facilitates farmers, traders and buyers with online trading in commodities.

In mechanism design, a branch of economics, a weakly-budget-balanced (WBB) mechanism is a mechanism in which the total payment made by the participants is 0. This means that the mechanism operator does not incur a deficit, i.e., does not have to subsidize the market. Weak budget balance is considered a necessary requirement for the economic feasibility of a mechanism. A strongly-budget-balanced (SBB) mechanism is a mechanism in which the total payment made by the participants is exactly 0. This means that all payments are made among the participants - the mechanism has neither a deficit nor a surplus. The term budget-balanced mechanism is sometimes used as a shorthand for WBB, and sometimes as a shorthand for SBB.