Italy has a well developed transport infrastructure. The Italian rail network is extensive, especially in the north, and it includes a high-speed rail network that joins the major cities of Italy from Naples through northern cities such as Milan and Turin. The Florence–Rome high-speed railway was the first high-speed line opened in Europe when more than half of it opened in 1977. Italy has 2,507 people and 12.46 km2 per kilometer of rail track, giving Italy the world's 13th largest rail network. The Italian rail network is operated by state-owned Ferrovie dello Stato, while the rail tracks and infrastructure are managed by Rete Ferroviaria Italiana.

Getlink, formerly Groupe Eurotunnel, is a European public company based in Paris that manages and operates the infrastructure of the Channel Tunnel between England and France, operates the LeShuttle railway service, and earns revenue on other trains that operate through the tunnel.

The Autostrada A3 is a motorway in Southern Italy, which runs from Naples to Salerno, in the region Campania.

Until 2017 the route was much longer, going after Salerno further south until Reggio Calabria; on this year, this section became part of the new A2 motorway and of its two spur routes.

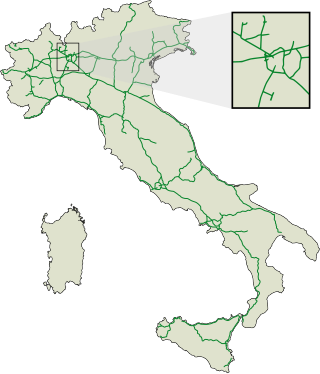

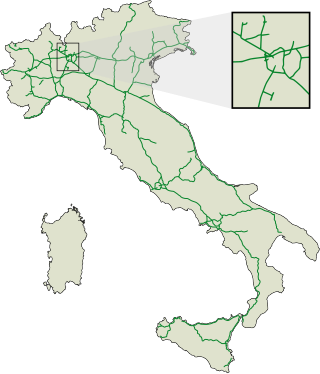

The autostrade are roads forming the Italian national system of motorways. The total length of the system is about 7,016 kilometres (4,360 mi), as of 30 July 2022. To these data are added 13 motorway spur routes, which extend for 355 kilometres (221 mi).

Four members of the Italian Benetton family founded the Benetton Group S.p.A. fashion company in 1965. The three brothers and one sister were all born in Treviso, Veneto, Italy. Their father owned a bicycle shop. Through Edizione, a financial holding company, they control a number of other businesses including 30% of Atlantia S.p.A., an operator of nearly two-thirds of Italy's motorways, 60% of Autogrill, a chain of roadside restaurants, and investments in the hotel industry including the Hotel Monaco & Grand Canal in Venice, Italy.

Florence Airport, Peretola, in Italian Aeroporto di Firenze-Peretola, formally Amerigo Vespucci Airport, is the international airport of Florence, the capital of the Italian region of Tuscany. It is the second-busiest Tuscan airport in terms of passengers after Pisa International Airport.

Abertis Infraestructuras, S.A. is a Spanish worldwide corporation engaged in toll road management. The company is headquartered in Madrid. The company runs over 8,600 kilometres of toll roads in the world. In October 2018, it was acquired by Italian corporation Atlantia and Spanish firm ACS Group and the German company Hochtief.

Autogrill is an Italian-based, multinational catering company, which was controlled with a 50.1% stake by the Edizione Holding investment vehicle of the Benetton family. Over 90% of the company's business derives from outlets in airport terminals and motorway service areas.

The Autostrada A4, or Serenissima, is a motorway which connects Turin and Trieste via Milan and Venice. The city of Venice originally formed a bottleneck on the A4, but is now bypassed by the Passante di Mestre. The A4 passes just north of the city of Milan, where it is toll-free.

The A15 is an Italian autostrada (motorway) connecting Parma and La Spezia through the valleys of the Taro and Magra Rivers. The road is also known as Autostrada della Cisa because it crosses the Northern Apennines at the Cisa pass. The main 101-km expanse of the motorway connects the A1 with the A12, thus directly linking the Po Valley with the Italian Riviera and the Versilia region.

Alessandro Benetton is an Italian businessman.

Vito Gamberale is an Italian manager.

Fondi Italiani per le Infrastrutture SGR S.p.A. or, in short form, F2i SGR S.p.A., is Italy's largest independent infrastructure fund manager, with assets under management of approximately €7 billion. It currently manages five funds and one infrastructure Debt Fund.

Marco Patuano is an Italian economist, manager and President of A2A.

Gilberto Benetton was an Italian billionaire businessman, one of Europe's most influential industrialists. He was a co-founder of Benetton Group, the Italian fashion brand which he started and ran with his three siblings. In October 2018, Forbes estimated the net worth of Gilberto Benetton, and each of his siblings, at US$2.7 billion. In June 2018, the conglomerate he created had assets of €12.1 billion.

Società Azionaria Gestione Aeroporto Torino S.p.A. (SAGAT) is the operator of Turin Airport. The controlling interests of the company was purchased by Italian Infrastructures Investment Fund I in January 2013.

A4 Holding S.p.A. known as Gruppo A4 Holding, is an Italian holding company based in Verona, Veneto region. The company owned Autostrada Brescia Verona Vicenza Padova (100%), the operator of Brescia–Padua section of Autostrada A4 and Autostrada A31, as well as an equity interests in Autostrada del Brennero, the operator of Autostrada A22 and Autostrade Lombarde, the parent company of the operator of Autostrada A35.

Ponte Morandi, officially Viadotto Polcevera, was a road viaduct in Genoa, Liguria, Italy, constructed between 1963 and 1967 along the A10 motorway over the Polcevera River, from which it derived its official name. It connected Genoa's Sampierdarena and Cornigliano districts across the Polcevera Valley. The bridge was widely called "Ponte Morandi" after its structural designer, engineer Riccardo Morandi.

Autostrade per l'Italia S.p.A. is an Italian joint-stock company, originally born as a publicly owned company under the control of IRI, but privatized in 1999 and then incorporated in its current form in 2003. It has as its activity the management of motorway sections under concession, as well as the carrying out of related maintenance.

Giovanni Castellucci is an Italian company director. He is the former chief executive officer of Atlantia SpA.