A monopoly, as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterised by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

The New York Stock Exchange is an American stock exchange in the Financial District of Lower Manhattan in New York City. It is the largest stock exchange in the world by market capitalization.

Standard Oil Company, Inc., was an American oil production, transportation, refining, and marketing company that operated from 1870 to 1911. At its height, Standard Oil was the largest petroleum company in the world, and its success made its co-founder and chairman, John D. Rockefeller, among the wealthiest Americans of all time and among the richest people in modern history. Its history as one of the world's first and largest multinational corporations ended in 1911, when the U.S. Supreme Court ruled that it was an illegal monopoly.

The Clayton Antitrust Act of 1914, is a part of United States antitrust law with the goal of adding further substance to the U.S. antitrust law regime; the Clayton Act seeks to prevent anticompetitive practices in their incipiency. That regime started with the Sherman Antitrust Act of 1890, the first Federal law outlawing practices that were harmful to consumers. The Clayton Act specified particular prohibited conduct, the three-level enforcement scheme, the exemptions, and the remedial measures.

In the United States, antitrust law is a collection of mostly federal laws that regulate the conduct and organization of businesses to promote competition and prevent unjustified monopolies. The three main U.S. antitrust statutes are the Sherman Act of 1890, the Clayton Act of 1914, and the Federal Trade Commission Act of 1914. These acts serve three major functions. First, Section 1 of the Sherman Act prohibits price fixing and the operation of cartels, and prohibits other collusive practices that unreasonably restrain trade. Second, Section 7 of the Clayton Act restricts the mergers and acquisitions of organizations that may substantially lessen competition or tend to create a monopoly. Third, Section 2 of the Sherman Act prohibits monopolization.

The Wall Street Crash of 1929, also known as the Great Crash or the Crash of '29, was a major American stock market crash that occurred in the autumn of 1929. It started in September, when share prices on the New York Stock Exchange (NYSE) collapsed, and ended in mid-November. The pivotal role of the 1920s' high-flying bull market and the subsequent catastrophic collapse of the NYSE in late 1929 is often highlighted in explanations of the causes of the worldwide Great Depression.

The Panic of 1893 was an economic depression in the United States that began in 1893 and ended in 1897. It deeply affected every sector of the economy and produced political upheaval that led to the political realignment of 1896 and the presidency of William McKinley.

Anti-competitive practices are business or government practices that prevent or reduce competition in a market. Antitrust laws ensure businesses do not engage in competitive practices that harm other, usually smaller, businesses or consumers. These laws are formed to promote healthy competition within a free market by limiting the abuse of monopoly power. Competition allows companies to compete in order for products and services to improve; promote innovation; and provide more choices for consumers. In order to obtain greater profits, some large enterprises take advantage of market power to hinder survival of new entrants. Anti-competitive behavior can undermine the efficiency and fairness of the market, leaving consumers with little choice to obtain a reasonable quality of service.

In economics and business ethics, a coercive monopoly is a firm that is able to raise prices and make production decisions without the risk that competition will arise to draw away their customers. A coercive monopoly is not merely a sole supplier of a particular kind of good or service, but it is a monopoly where there is no opportunity to compete with it through means such as price competition, technological or product innovation, or marketing; entry into the field is closed. As a coercive monopoly is securely shielded from the possibility of competition, it is able to make pricing and production decisions with the assurance that no competition will arise. It is a case of a non-contestable market. A coercive monopoly has very few incentives to keep prices low and may deliberately price gouge consumers by curtailing production.

Predatory pricing is a commercial pricing strategy which involves the use of large scale undercutting to eliminate competition. This is where an industry dominant firm with sizable market power will deliberately reduce the prices of a product or service to loss-making levels to attract all consumers and create a monopoly. For a period of time, the prices are set unrealistically low to ensure competitors are unable to effectively compete with the dominant firm without making substantial loss. The aim is to force existing or potential competitors within the industry to abandon the market so that the dominant firm may establish a stronger market position and create further barriers to entry. Once competition has been driven from the market, consumers are forced into a monopolistic market where the dominant firm can safely increase prices to recoup its losses.

Competition law is the field of law that promotes or seeks to maintain market competition by regulating anti-competitive conduct by companies. Competition law is implemented through public and private enforcement. It is also known as antitrust law, anti-monopoly law, and trade practices law; the act of pushing for antitrust measures or attacking monopolistic companies is commonly known as trust busting.

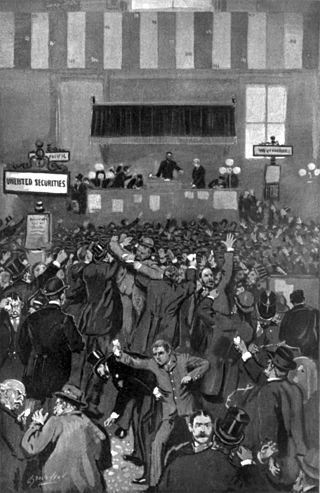

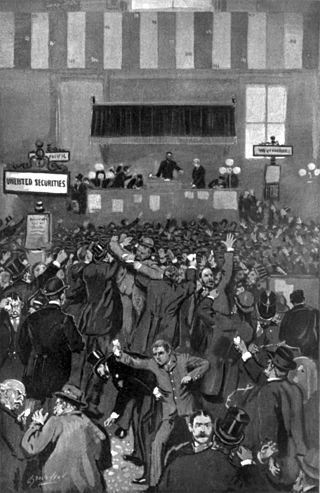

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs affecting banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.

Deutsche Börse AG, or the Deutsche Börse Group, is a German multinational that offers a marketplace for organizing the trading of shares and other securities. It is also a transaction services provider, giving companies and investors access to global capital markets. It is a joint stock company and was founded in 1992, with headquarters in Frankfurt. On 1 October 2014, Deutsche Börse AG became the 14th announced member of the United Nations Sustainable Stock Exchanges initiative.

A trust or corporate trust is a large grouping of business interests with significant market power, which may be embodied as a corporation or as a group of corporations that cooperate with one another in various ways. These ways can include constituting a trade association, owning stock in one another, constituting a corporate group, or combinations thereof. The term trust is often used in a historical sense to refer to monopolies or near-monopolies in the United States during the Second Industrial Revolution in the 19th century and early 20th century. The use of corporate trusts during this period is the historical reason for the name "antitrust law".

The Panic of 1901 was the first stock market crash on the New York Stock Exchange, caused in part by struggles between E. H. Harriman, Jacob Schiff, and J. P. Morgan/James J. Hill for the financial control of the Northern Pacific Railway. The stock cornering was orchestrated by James Stillman and William Rockefeller's First National City Bank financed with Standard Oil money. After reaching a compromise, the moguls formed the Northern Securities Company. As a result of the panic, thousands of small investors were ruined.

FTC v. Actavis, Inc., 570 U.S. 136 (2013), was a United States Supreme Court decision in which the Court held that the FTC could make an antitrust challenge under the rule of reason against a so-called pay-for-delay agreement, also referred to as a reverse payment patent settlement. Such an agreement is one in which a drug patentee pays another company, ordinarily a generic drug manufacturer, to stay out of the market, thus avoiding generic competition and a challenge to patent validity. The FTC sought to establish a rule that such agreements were presumptively illegal, but the Court ruled only that the FTC could bring a case under more general antitrust principles permitting a defendant to assert justifications for its actions under the rule of reason.

Big Tech, also known as the Tech Giants, are the largest information technology companies. The term most often refers to the Big Five tech companies in the United States: Alphabet (Google), Amazon, Apple, Meta, and Microsoft. In China, Baidu, Alibaba, Tencent, and Xiaomi (BATX) are the equivalent of the Big Five. Big Tech can also include smaller tech companies with high valuations, such as Netflix, or non-tech companies with high-tech practices, such as the automaker Tesla.

The New Brandeis or neo-Brandeis movement is an antitrust academic and political movement in the United States which argues that excessively centralized private power is dangerous for economical, political and social reasons. Initially called hipster antitrust by its detractors, as also referred to as the "Columbia school" or "Neo-Progressive antitrust," the movement advocates that United States antitrust law return to a broader concern with private power and its negative effects on market competition, income inequality, consumer rights, unemployment, and wage growth.

United States v. Google LLC is an ongoing federal antitrust case brought by the United States Department of Justice (DOJ) against Google LLC on October 20, 2020. The suit alleges that Google has violated the Sherman Antitrust Act of 1890 by illegally monopolizing the search engine and search advertising markets, most notably on Android devices.