A red envelope, red packet, hongbao or ang pau is a gift of money given during holidays or for special occasions such as weddings, graduations, and birthdays. It originated in China before spreading across parts of Southeast Asia and other countries with sizable ethnic Chinese populations.

Alibaba Group Holding Limited, branded as Alibaba, is a Chinese multinational technology company specializing in e-commerce, retail, Internet, and technology. Founded on 28 June 1999 in Hangzhou, Zhejiang, the company provides consumer-to-consumer (C2C), business-to-consumer (B2C), and business-to-business (B2B) sales services via Chinese and global marketplaces, as well as local consumer, digital media and entertainment, logistics, and cloud computing services. It owns and operates a diverse portfolio of companies around the world in numerous business sectors.

Taobao is a Chinese online shopping platform. It is headquartered in Hangzhou and is owned by Alibaba. According to Alexa rank, it was the eighth most-visited website globally in 2021. Taobao.com was registered on April 21, 2003 by Alibaba Cloud Computing (Beijing) Co., Ltd.

Alipay is a third-party mobile and online payment platform, established in Hangzhou, China in February 2004 by Alibaba Group and its founder Jack Ma. In 2015, Alipay moved its headquarters to Pudong, Shanghai, although its parent company Ant Financial remains Hangzhou-based.

Tencent Holdings Ltd. is a Chinese multinational technology conglomerate and holding company headquartered in Shenzhen. It is one of the highest grossing multimedia companies in the world based on revenue. It is also the world's largest company in the video game industry based on its equity investments.

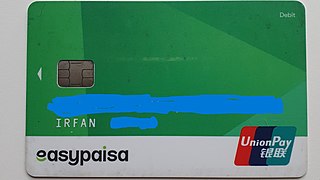

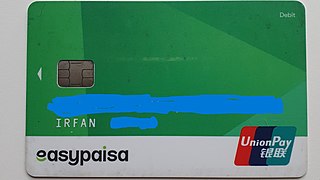

Easypaisa is a Pakistani mobile wallet, mobile payments and branchless banking services provider. It was founded in October 2009 by Telenor Pakistan. It also provides digital payment services through a QR code in partnership with Masterpass and it is the only GSMA mobile money certified service in Pakistan.

WeChat or Weixin in Chinese ; lit. 'micro-message') is a Chinese instant messaging, social media, and mobile payment app developed by Tencent. First released in 2011, it became the world's largest standalone mobile app in 2018 with over 1 billion monthly active users. WeChat has been described as China's "app for everything" and a super-app because of its wide range of functions. WeChat provides text messaging, hold-to-talk voice messaging, broadcast (one-to-many) messaging, video conferencing, video games, mobile payment, sharing of photographs and videos and location sharing.

WeChat red envelope is a mobile application developed by the Chinese technology company Tencent. The concept, also offered by its market competitors Alibaba and Baidu, is based on the Chinese tradition of hongbao, where money is given to family and friends as a gift. The application was launched by Tencent in January 2014 and has subsequently gained popularity, with Tencent reporting 2.3 billion transactions on 1 January 2016 alone.

Venmo is an American mobile payment service founded in 2009 and owned by PayPal since 2013. Venmo is aimed at users who wish to split their bills. Account holders can transfer funds to others via a mobile phone app; both the sender and receiver must live in the United States. Venmo also operates as a small social network, as users can observe other users' public transactions with posts and emoticons. In 2021, the company handled $230 billion in transactions and generated $850 million in revenue. Users can view transactions on the Venmo website but cannot complete transactions on the website.

Ant Group, formerly known as Ant Financial, is an affiliate company of the Chinese conglomerate Alibaba Group. The group owns the world's largest mobile (digital) payment platform Alipay, which serves over 1.3 billion users and 80 million merchants, with total payment volume (TPV) reaching CN¥118 trillion in June 2020. It is the second largest financial services corporation in the world, behind Visa. In March 2019, The Wall Street Journal reported that Ant's flagship Tianhong Yu'e Bao money-market fund was the largest in the world, with over 588 million users, or more than a third of China's population, contributing cash to it.

Kakao Pay (Korean: 카카오페이) is a mobile payment and digital wallet service by Kakao based in South Korea that allows users make mobile payments and online transactions. The service supports contactless payments using near-field communications and QR codes.

A QR code payment is a mobile payment method where payment is performed by scanning a QR code from a mobile app. This is an alternative to doing electronic funds transfer at point of sale using a payment terminal. This avoids a lot of the infrastructure traditionally associated with electronic payments such as payment cards, payment networks, payment terminal and merchant accounts.

PayMe is a mobile payment service from HSBC, currently available only for Hong Kong users with local phone numbers and banks. Users can pay businesses, transfer money to one another using a mobile app, linked to their credit card or bank account.

Liaotianbao, formerly known as Bullet Messenger, is a Chinese social media application developed by Beijing Kuairu Technology company. It was released by Luo Yonghao the CEO of Smartisan company on August 20, 2018. The slogan of Liaotianbao is that "We want to talk to the world". Originally, the logo was bullet and now the logo of the software is a Sycee with "smiling faces". It allows to send voice and text messages, voice and video calls, shopping, red envelope, and play mini-games etcetera. The service requires users to register by phone number. User can log in not only with their mobile phones, but also with computer websites. Indeed, the essential feature is that users can earn virtual currency through chatting, shopping, games, etcetera and those virtual currency can be converted into cash by pro rata.

BATX is an acronym standing for Baidu, Alibaba, Tencent, and Xiaomi, the four biggest tech firms in China, often compared to GAMMA in the United States. BATX were some of the first tech companies started in the 2000s during the rise of the Chinese technology revolution and quickly became widely used among Chinese netizens. Notably after 2015, some other tech companies like Huawei, DiDi, JD, DJI and ByteDance have also become some of the up-and-coming biggest tech giants in the industry.

GCash is a Philippine mobile payments service owned by Globe Fintech Innovations, Inc., and operated by its wholly-owned subsidiary, G-Xchange, Inc.

Touch 'n Go eWallet is a Malaysian digital wallet and online payment platform, established in Kuala Lumpur, Malaysia, in July 2017 as a joint venture between Touch 'n Go and Ant Financial. It allows users to make payments at over 280,000 merchant touch points via QR code; pay for tolls, street parking, payment on e-hailing, car-sharing apps or taxis via RFID or PayDirect; pay bills; top-up mobile prepaid; pay for purchases on e-commerce websites or apps; order food delivery; perform peer-to-peer money transfers; renew car insurance and purchase unique insurance plans; and purchase movie, bus, trains, and airline tickets.

Digital renminbi, or Digital Currency Electronic Payment, is a central bank digital currency issued by China's central bank, the People's Bank of China. It is the first digital currency to be issued by a major economy, undergoing public testing as of April 2021. The digital RMB is legal tender and has equivalent value with other forms of renminbi, also known as the Chinese yuan (CNY), such as bills and coins.

A super-app, also known as an everything-app, is a mobile or web application that can provide multiple services including payment and instant messaging services, effectively becoming an all-encompassing self-contained commerce and communication online platform that embraces many aspects of personal and commercial life. Notable examples of super-apps include Tencent's WeChat in China, Tata Neu in India, and Grab in Southeast Asia.

The app of UnionPay is a mobile and online payment service, developed and operated by UnionPay, the national Chinese bank card clearing service. Launched in 2017, it was designed to compete with the existing third-party Chinese mobile payment platforms, Alibaba Group's Alipay and Tencent's WeChat Pay. The mobile app allows the user to add their UnionPay bank card, and use it for various types of online and mobile payments, including in-app online payments, QR code payments, as well as contactless payments on NFC-enabled devices using UnionPay's QuickPass feature.