|

|---|

An unofficial referendum on governmental economic policies, debt repayment and tax law was held in Bolivia on 24 July 1986. [1] The policies were rejected by 97.9% of those who voted, although turnout was just 23%. [1]

|

|---|

An unofficial referendum on governmental economic policies, debt repayment and tax law was held in Bolivia on 24 July 1986. [1] The policies were rejected by 97.9% of those who voted, although turnout was just 23%. [1]

Faced with an economic crisis, the government of Víctor Paz Estenssoro attempted to solve some of the problems by passing Supreme Decree 21060, which led to layoffs, cuts in subsidies and repayment of foreign debts. As a result, the COB trade union called a general strike. [1]

| Choice | Votes | % |

|---|---|---|

| For | 30,500 | 2.1 |

| Against | 1,390,000 | 97.9 |

| Invalid/blank votes | – | |

| Total | 1,420,500 | 100 |

| Registered voters/turnout | 6,200,000 | 23.0 |

| Source: Direct Democracy | ||

The International Monetary Fund (IMF) is a major financial agency of the United Nations, and an international financial institution, headquartered in Washington, D.C., consisting of 190 countries. Its stated mission is "working to foster global monetary cooperation, secure financial stability, facilitate international trade, promote high employment and sustainable economic growth, and reduce poverty around the world." Formed in 1944, started on 27 December 1945, at the Bretton Woods Conference primarily by the ideas of Harry Dexter White and John Maynard Keynes, it came into formal existence in 1945 with 29 member countries and the goal of reconstructing the international monetary system. It now plays a central role in the management of balance of payments difficulties and international financial crises. Countries contribute funds to a pool through a quota system from which countries experiencing balance of payments problems can borrow money. As of 2016, the fund had XDR 477 billion. The IMF is regarded as the global lender of last resort.

The Department of the Treasury (USDT) is the national treasury and finance department of the federal government of the United States, where it serves as an executive department. The department oversees the Bureau of Engraving and Printing and the U.S. Mint. These two agencies are responsible for printing all paper currency and coins, while the treasury executes its circulation in the domestic fiscal system. The USDT collects all federal taxes through the Internal Revenue Service; manages U.S. government debt instruments; licenses and supervises banks and thrift institutions; and advises the legislative and executive branches on matters of fiscal policy. The department is administered by the secretary of the treasury, who is a member of the Cabinet. The treasurer of the United States has limited statutory duties, but advises the Secretary on various matters such as coinage and currency production. Signatures of both officials appear on all Federal Reserve notes.

The economy of Bolivia is the 95th-largest economy in the world in nominal terms and the 87th-largest economy in terms of purchasing power parity. Bolivia is classified by the World Bank to be a lower middle income country. With a Human Development Index of 0.703, it is ranked 114th. Driven largely by its natural resources, Bolivia has become a region leader in measures of economic growth, fiscal stability and foreign reserves, although it remains a historically poor country.

Tertiary education fees in Australia are payable for courses at tertiary education institutions. The Commonwealth government provides loans and subsidies to relieve the cost of tertiary education for some students. Some students are supported by the government and are required to pay only part of the cost of tuition, called the "student contribution", and the government pays the balance. Some government supported students can defer payment of their contribution as a HECS-HELP loan. Other domestic students are full fee-paying and do not receive direct government contribution to the cost of their education. Some domestic students in full fee courses can obtain a FEE-HELP loan from the Australian government up to a lifetime limit of $150,000 for medicine, dentistry and veterinary science programs and $104,440 for all other programs.

Public finance is the study of the role of the government in the economy. It is the branch of economics that assesses the government revenue and government expenditure of the public authorities and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones. The purview of public finance is considered to be threefold, consisting of governmental effects on:

A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees, such as tuition, books and supplies, and living expenses. It may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. It also differs in many countries in the strict laws regulating renegotiating and bankruptcy. This article highlights the differences of the student loan system in several major countries.

Landsbanki, also commonly known as Landsbankinn which is now the name of the current rebuilt bank, was one of the largest Icelandic commercial banks that failed as part of the 2008–2011 Icelandic financial crisis when its subsidiary sparked the Icesave dispute. On October 7, 2008, the Icelandic Financial Supervisory Authority took control of Landsbanki and created a new bank for all the domestic operations called Nýi Landsbanki so that the domestic bank could continue to operate, the new bank continued to operate under the Landsbanki name in Iceland.

Australia suffered badly during the period of the Great Depression of the 1930s. The Depression began with the Wall Street Crash of 1929 and rapidly spread worldwide. As in other nations, Australia suffered years of high unemployment, poverty, low profits, deflation, plunging incomes, and lost opportunities for economic growth and personal advancement.

The Student Loans Company (SLC) is an executive non-departmental public body company in the United Kingdom that provides student loans. It is owned by the UK Government's Department for Education (85%), the Scottish Government (5%), the Welsh Government (5%) and the Northern Ireland Executive (5%). The SLC is funded entirely by the UK government and the devolved administrations. It is responsible for both providing loans to students, and collecting loan repayments alongside HM Revenue and Customs (HMRC). The SLC's head office is in Glasgow, with other offices in Darlington and Llandudno.

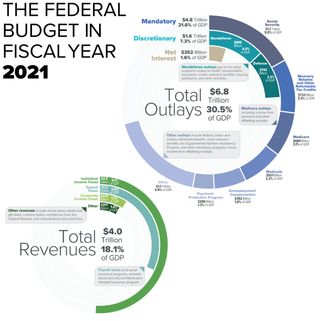

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

Fiscal conservatism is a political and economic philosophy regarding fiscal policy and fiscal responsibility with an ideological basis in capitalism, individualism, limited government, and laissez-faire economics. Fiscal conservatives advocate tax cuts, reduced government spending, free markets, deregulation, privatization, free trade, and minimal government debt. Fiscal conservatism follows the same philosophical outlook of classical liberalism. This concept is derived from economic liberalism.

A mortgage loan or simply mortgage, in civil law jurisdicions known also as a hypothec loan, is a loan used either by purchasers of real property to raise funds to buy real estate, or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. The loan is "secured" on the borrower's property through a process known as mortgage origination. This means that a legal mechanism is put into place which allows the lender to take possession and sell the secured property to pay off the loan in the event the borrower defaults on the loan or otherwise fails to abide by its terms. The word mortgage is derived from a Law French term used in Britain in the Middle Ages meaning "death pledge" and refers to the pledge ending (dying) when either the obligation is fulfilled or the property is taken through foreclosure. A mortgage can also be described as "a borrower giving consideration in the form of a collateral for a benefit (loan)".

In the United States, student loans are a form of financial aid intended to help students access higher education. In 2018, 70 percent of higher education graduates had used loans to cover some or all of their expenses. With notable exceptions, student loans must be repaid, in contrast to other forms of financial aid such as scholarships, which are not repaid, and grants, which rarely have to be repaid. Student loans may be discharged through bankruptcy, but this is difficult.

The Guano Era refers to a period of stability and prosperity in Peru during the mid-19th century. It was sustained on the substantial revenues generated by the export of guano and the strong leadership of president Ramón Castilla. The starting date for the guano era is commonly considered to be 1845, the year in which Castilla started his first administration. It ended shortly after the war between Spain and Peru in 1866.

People's Republic of China – Zambia relations refers to the current and historical relationship between the People's Republic of China (PRC) and Zambia.

Fiscal policy are "measures employed by governments to stabilize the economy, specifically by manipulating the levels and allocations of taxes and government expenditures". In the Philippines, this is characterized by continuous and increasing levels of debt and budget deficits, though there were improvements in the last few years of the first decade of the 21st century.

The Premiers' Plan was a deflationary economic policy agreed by a meeting of the Premiers of the Australian states in June 1931 to combat the Great Depression in Australia that sparked the 1931 Labor split.

The Peruvian nitrate monopoly was a state-owned enterprise over the mining and sale of saltpeter created by the government of Peru in 1875 and operated by the Peruvian Nitrate Company. Peru intended for the monopoly to capitalize on the world market's high demand for nitrates, thereby increasing the country's fiscal revenues and supplementing the financial role that guano sales had provided for the nation during the Guano Era (1840s-1860s).

Bolivia joined the IMF on December 27, 1945. Since 1945, Bolivia has cooperated with the IMF to achieve social reforms and economic growth. These efforts have involved strategies to reduce poverty, increase social equity, improve the education system and healthcare system, and expand social services to rural populations and underserved urban communities. Since 1984, Bolivia has been an active client of the fund, accessing 19 credit lines with the fund since joining.

The Sri Lankan economic crisis is an ongoing crisis in the island country of Sri Lanka that started in 2019. It is the country's worst economic crisis since its independence in 1948. It has led to unprecedented levels of inflation, near-depletion of foreign exchange reserves, shortages of medical supplies, and an increase in prices of basic commodities. The crisis is said to have begun due to multiple compounding factors like tax cuts, money creation, a nationwide policy to shift to organic or biological farming, the 2019 Sri Lanka Easter bombings, and the impact of the COVID-19 pandemic in Sri Lanka. The subsequent economic hardships resulted in the 2022 Sri Lankan protests.