In finance, a put or put option is a financial market derivative instrument that gives the holder the right to sell an asset, at a specified price, by a specified date to the writer of the put. The purchase of a put option is interpreted as a negative sentiment about the future value of the underlying stock. The term "put" comes from the fact that the owner has the right to "put up for sale" the stock or index.

In finance, a straddle strategy involves two transactions in options on the same underlying, with opposite positions. One holds long risk, the other short. As a result, it involves the purchase or sale of particular option derivatives that allow the holder to profit based on how much the price of the underlying security moves, regardless of the direction of price movement.

Volatility smiles are implied volatility patterns that arise in pricing financial options. It is a parameter that is needed to be modified for the Black–Scholes formula to fit market prices. In particular for a given expiration, options whose strike price differs substantially from the underlying asset's price command higher prices than what is suggested by standard option pricing models. These options are said to be either deep in-the-money or out-of-the-money.

In finance, risk reversal can refer to a measure of the volatility skew or to a trading strategy.

In finance, a butterfly is a limited risk, non-directional options strategy that is designed to have a high probability of earning a limited profit when the future volatility of the underlying asset is expected to be lower or higher than that asset's current implied volatility.

In options trading, a box spread is a combination of positions that has a certain payoff, considered to be simply "delta neutral interest rate position". For example, a bull spread constructed from calls combined with a bear spread constructed from puts has a constant payoff of the difference in exercise prices assuming that the underlying stock does not go ex-dividend before the expiration of the options. If the underlying asset has a dividend of X, then the settled value of the box will be 10 + x. Under the no-arbitrage assumption, the net premium paid out to acquire this position should be equal to the present value of the payoff.

In finance, a calendar spread is a spread trade involving the simultaneous purchase of futures or options expiring on a particular date and the sale of the same instrument expiring on another date. These individual purchases, known as the legs of the spread, vary only in expiration date; they are based on the same underlying market and strike price.

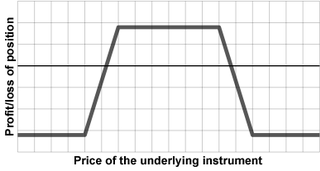

The iron condor is an option trading strategy utilizing two vertical spreads – a put spread and a call spread with the same expiration and four different strikes. A long iron condor is essentially selling both sides of the underlying instrument by simultaneously shorting the same number of calls and puts, then covering each position with the purchase of further out of the money call(s) and put(s) respectively. The converse produces a short iron condor.

In options trading, a bull spread is a bullish, vertical spread options strategy that is designed to profit from a moderate rise in the price of the underlying security.

In options trading, a bear spread is a bearish, vertical spread options strategy that can be used when the options trader is moderately bearish on the underlying security.

A naked put is a put option contract where the option writer does not hold the underlying position, in this case a short equity position, to cover the contract in case of assignment. The seller receives the premium cost of the put price, and hopes that the underlying equity or stock price stays the same or rises modestly, in which case the seller retains the premium. A put option buyer is hoping for a decrease in the price of the underlying equity, and upon exercise or expiration will collect cash representing the difference between the strike price of the option and the price of the underlying equity.

In finance an iron butterfly, also known as the ironfly, is the name of an advanced, neutral-outlook, options trading strategy that involves buying and holding four different options at three different strike prices. It is a limited-risk, limited-profit trading strategy that is structured for a larger probability of earning smaller limited profit when the underlying stock is perceived to have a low volatility.

Option strategies are the simultaneous, and often mixed, buying or selling of one or more options that differ in one or more of the options' variables. Call options, simply known as Calls, give the buyer a right to buy a particular stock at that option's strike price. Opposite to that are Put options, simply known as Puts, which give the buyer the right to sell a particular stock at the option's strike price. This is often done to gain exposure to a specific type of opportunity or risk while eliminating other risks as part of a trading strategy. A very straightforward strategy might simply be the buying or selling of a single option; however, option strategies often refer to a combination of simultaneous buying and or selling of options.

Options spreads are the basic building blocks of many options trading strategies. A spread position is entered by buying and selling options of the same class on the same underlying security but with different strike prices or expiration dates. An option spread shouldn't be confused with a spread option. The three main classes of spreads are the horizontal spread, the vertical spread and the diagonal spread. They are grouped by the relationships between the strike price and expiration dates of the options involved -

A Ratio spread is a complex, multi-leg options position that is a variation of a vertical spread. Like a vertical, the ratio spread involves buying and selling options on the same underlying security with different strike prices and the same expiration date. Unlike a vertical spread, a number of option contracts sold is not equal to a number of contracts bought. An unequal number of options contracts gives this spread certain unique properties compared to a regular vertical spread. A typical ratio spread would be where twice as many option contracts are sold, thus forming a 1:2 ratio.

The backspread is the converse strategy to the ratio spread and is also known as reverse ratio spread. Using calls, a bullish strategy known as the call backspread can be constructed and with puts, a strategy known as the put backspread can be constructed.

In finance, an option is a contract which conveys to its owner, the holder, the right, but not the obligation, to buy or sell an underlying asset or instrument at a specified strike price on or before a specified date, depending on the style of the option. Options are typically acquired by purchase, as a form of compensation, or as part of a complex financial transaction. Thus, they are also a form of asset and have a valuation that may depend on a complex relationship between underlying asset value, time until expiration, market volatility, and other factors. Options may be traded between private parties in over-the-counter (OTC) transactions, or they may be exchange-traded in live, orderly markets in the form of standardized contracts.

In finance, a credit spread, or net credit spread is an options strategy that involves a purchase of one option and a sale of another option in the same class and expiration but different strike prices. It is designed to make a profit when the spreads between the two options narrows.

In finance, a strangle is a trading strategy involving the purchase or sale of two options, allowing the holder to profit based on how much the price of the underlying security moves, with minimal exposure to the direction of price movement. A strangle consists of one call and one put with the same expiry and underlying but different strike prices. Typically the call has a higher strike price than the put. If the put has a higher strike price instead, the position is sometimes called a guts.

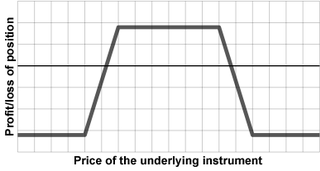

A condor is a limited-risk, non-directional options trading strategy consisting of four options at four different strike prices. The buyer of a condor earns a profit if the underlying is between or near the inner two strikes at expiry, but has a limited loss if the underlying is near or outside the outer two strikes at expiry. Therefore, long condors are used by traders who expect the underlying to stay within a limited range, while short condors are used by traders who expect the underlying to make a large move in either direction. Compared to a butterfly, a condor is profitable at a wider range of potential underlying values, but has a higher premium and therefore a lower maximum profit.