The economy of Costa Rica has been very stable for some years now, with continuing growth in the GDP and moderate inflation, though with a high unemployment rate: 11.49% in 2019. Costa Rica's economy emerged from recession in 1997 and has shown strong aggregate growth since then. The estimated GDP for 2023 is US$78 billion, up significantly from the US$52.6 billion in 2015 while the estimated 2023 per capita is US$26,422.

The economic activity of the Federated States of Micronesia consists primarily of subsistence agriculture and fishing. The islands have few mineral deposits worth exploiting, except for high-grade phosphate. The potential for a tourist industry exists, but the remoteness of the location and a lack of adequate facilities hinder development. Financial assistance from the US is the primary source of revenue, with the US pledged to spend $1.3 billion in the islands in 1986–2001. Geographical isolation and a poorly developed infrastructure are major impediments to long-term growth.

The economy of Grenada is a largely tourism-based, small and open economy. Over the past two decades, the main thrust of Grenada's economy has shifted from agriculture to services, with tourism serving as the leading foreign currency earning sector. The country's principal export crops are the spices nutmeg and mace. Other crops for export include cocoa, citrus fruits, bananas, cloves, and cinnamon. Manufacturing industries in Grenada operate mostly on a small scale, including production of beverages and other foodstuffs, textiles, and the assembly of electronic components for export.

The economy of Lebanon has been experiencing a large-scale multi-dimensional crisis since 2019, including a banking collapse, a liquidity crisis and a sovereign default. It is classified as a developing, lower-middle-income economy. The nominal GDP was estimated at $19 billion in 2020, with a per capita GDP amounting to $2,500. In 2018 government spending amounted to $15.9 billion, or 23% of GDP.

The economy of Nicaragua is focused primarily on the agricultural sector. Nicaragua itself is the least developed country in Central America, and the second poorest in the Americas by nominal GDP. In recent years, under the administrations of Daniel Ortega, the Nicaraguan economy has expanded somewhat, following the Great Recession, when the country's economy actually contracted by 1.5%, due to decreased export demand in the American and Central American markets, lower commodity prices for key agricultural exports, and low remittance growth. The economy saw 4.5% growth in 2010 thanks to a recovery in export demand and growth in its tourism industry. Nicaragua's economy continues to post growth, with preliminary indicators showing the Nicaraguan economy growing an additional 5% in 2011. Consumer Price inflation have also curtailed since 2008, when Nicaragua's inflation rate hovered at 19.82%. In 2009 and 2010, the country posted lower inflation rates, 3.68% and 5.45%, respectively. Remittances are a major source of income, equivalent to 15% of the country's GDP, which originate primarily from Costa Rica, the United States, and European Union member states. Approximately one million Nicaraguans contribute to the remittance sector of the economy.

The economy of the Republic of the Congo is a mixture of subsistence hunting and agriculture, an industrial sector based largely on petroleum extraction and support services. Government spending is characterized by budget problems and overstaffing. Petroleum has supplanted forestry as the mainstay of the economy, providing a major share of government revenues and exports. Nowadays the Republic of the Congo is increasingly converting natural gas to electricity rather than burning it, greatly improving energy prospects.

The economy of Bahrain is heavily dependent upon oil and gas. The Bahraini Dinar is the second-highest-valued currency unit in the world. Since the late 20th century, Bahrain has heavily invested in the banking and tourism sectors. The country's capital, Manama is home to many large financial structures. Bahrain's finance industry is very successful. In 2008, Bahrain was named the world's fastest growing financial center by the City of London's Global Financial Centres Index. Bahrain's banking and financial services sector, particularly Islamic banking, have benefited from the regional boom driven by demand for oil. Petroleum is Bahrain's most exported product, accounting for 60% of export receipts, 70% of government revenues, and 11% of GDP. Aluminium is the second most exported product, followed by finance and construction materials.

The economies of Canada and the United States are similar because both are developed countries. While both countries feature in the top ten economies in the world in 2022, the U.S. is the largest economy in the world, with US$24.8 trillion, with Canada ranking ninth at US$2.2 trillion.

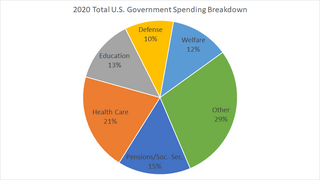

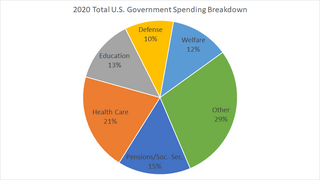

The United States budget comprises the spending and revenues of the U.S. federal government. The budget is the financial representation of the priorities of the government, reflecting historical debates and competing economic philosophies. The government primarily spends on healthcare, retirement, and defense programs. The non-partisan Congressional Budget Office provides extensive analysis of the budget and its economic effects. It has reported that large budget deficits over the next 30 years are projected to drive federal debt held by the public to unprecedented levels—from 98 percent of gross domestic product (GDP) in 2020 to 195 percent by 2050.

The Ministry of Finance of Chile is the cabinet-level administrative office in charge of managing the financial affairs, fiscal policy, and capital markets of Chile; planning, directing, coordinating, executing, controlling and informing all financial policies formulated by the President of Chile.

Hernán Sáenz Jiménez is a Costa Rican economist and lawyer, who was the Minister of Finance for the administration of President Rodrigo Carazo Odio in Costa Rica from 1979 to 1981. He served as the Executive Secretary of the Administrative Tribunal of the Inter-American Development Bank in Washington, D.C., from late 1987 until his retirement from the Bank in 2015.

Canadian public debt, or general government debt, is the liabilities of the government sector. Government gross debt consists of liabilities that are a financial claim that requires payment of interest and/or principal in future. They consist mainly of Treasury bonds, but also include public service employee pension liabilities. Changes in debt arise primarily from new borrowing, due to government expenditures exceeding revenues.

Greece faced a sovereign debt crisis in the aftermath of the financial crisis of 2007–2008. Widely known in the country as The Crisis, it reached the populace as a series of sudden reforms and austerity measures that led to impoverishment and loss of income and property, as well as a small-scale humanitarian crisis. In all, the Greek economy suffered the longest recession of any advanced mixed economy to date. As a result, the Greek political system has been upended, social exclusion increased, and hundreds of thousands of well-educated Greeks have left the country.

The United Kingdom national debt is the total quantity of money borrowed by the Government of the United Kingdom at any time through the issue of securities by the British Treasury and other government agencies.

Deficit reduction in the United States refers to taxation, spending, and economic policy debates and proposals designed to reduce the federal government budget deficit. Government agencies including the Government Accountability Office (GAO), Congressional Budget Office (CBO), the Office of Management and Budget (OMB), and the U.S. Treasury Department have reported that the federal government is facing a series of important long-run financing challenges, mainly driven by an aging population, rising healthcare costs per person, and rising interest payments on the national debt.

Government spending in the United States is the spending of the federal government of the United States, and the spending of its state and local governments.