Related Research Articles

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. Debit cards are similar to a credit card, but the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

A loyalty program or a rewards program is a marketing strategy designed to encourage customers to continue to shop at or use the services of one or more businesses associated with the program.

A stored-value card (SVC) or cash card is a payment card with a monetary value stored on the card itself, not in an external account maintained by a financial institution. This means no network access is required by the payment collection terminals as funds can be withdrawn and deposited straight from the card. Like cash, payment cards can be used anonymously as the person holding the card can use the funds. They are an electronic development of token coins and are typically used in low-value payment systems or where network access is difficult or expensive to implement, such as parking machines, public transport systems, and closed payment systems in locations such as ships.

A scrip is any substitute for legal tender. It is often a form of credit. Scrips have been created and used for a variety of reasons, including exploitative payment of employees under truck systems; or for use in local commerce at times when regular currency was unavailable, for example in remote coal towns, military bases, ships on long voyages, or occupied countries in wartime. Besides company scrip, other forms of scrip include land scrip, vouchers, token coins such as subway tokens, IOUs, arcade tokens and tickets, and points on some credit cards.

A gift card, also known as a gift certificate in North America, or gift voucher or gift token in the UK, is a prepaid stored-value money card, usually issued by a retailer or bank, to be used as an alternative to cash for purchases within a particular store or related businesses. Gift cards are also given out by employers or organizations as rewards or gifts. They may also be distributed by retailers and marketers as part of a promotion strategy, to entice the recipient to come in or return to the store, and at times such cards are called cash cards. Gift cards are generally redeemable only for purchases at the relevant retail premises and cannot be cashed out, and in some situations may be subject to an expiry date or fees. American Express, MasterCard, and Visa offer generic gift cards which need not be redeemed at particular stores, and which are widely used for cashback marketing strategies. A feature of these cards is that they are generally anonymous and are disposed of when the stored value on a card is exhausted.

The Community HeroCard (CHC), introduced in Minneapolis, Minnesota in 1998, is a community currency that uses debit cards.

Touch 'n Go is a contactless smart card system used for electronic payments in Malaysia. The system was introduced in 1997 and is widely used for toll payments on highways, public transportation, parking, and other services. The card is equipped with a radio-frequency identification (RFID) chip that allows users to make payments by simply tapping the card on a reader device. Touch 'n Go cards can be reloaded with funds either online or at designated reload kiosks. The system has become a popular and convenient way for Malaysians to make cashless transactions.

In marketing, a rebate is a form of buying discount and is an amount paid by way of reduction, return, or refund that is paid retrospectively. It is a type of sales promotion that marketers use primarily as incentives or supplements to product sales. Rebates are also used as a means of enticing price-sensitive consumers into purchasing a product. The mail-in rebate (MIR) is the most common. A MIR entitles the buyer to mail in a coupon, receipt, and barcode in order to receive a check for a particular amount, depending on the particular product, time, and often place of purchase. Rebates are offered by either the retailer or the product manufacturer. Large stores often work in conjunction with manufacturers, usually requiring two or sometimes three separate rebates for each item, and sometimes are valid only at a single store. Rebate forms and special receipts are sometimes printed by the cash register at time of purchase on a separate receipt or available online for download. In some cases, the rebate may be available immediately, in which case it is referred to as an instant rebate. Some rebate programs offer several payout options to consumers, including a paper check, a prepaid card that can be spent immediately without a trip to the bank, or even as a PayPal payout.

Credit card interest is a way in which credit card issuers generate revenue. A card issuer is a bank or credit union that gives a consumer a card or account number that can be used with various payees to make payments and borrow money from the bank simultaneously. The bank pays the payee and then charges the cardholder interest over the time the money remains borrowed. Banks suffer losses when cardholders do not pay back the borrowed money as agreed. As a result, optimal calculation of interest based on any information they have about the cardholder's credit risk is key to a card issuer's profitability. Before determining what interest rate to offer, banks typically check national, and international, credit bureau reports to identify the borrowing history of the card holder applicant with other banks and conduct detailed interviews and documentation of the applicant's finances.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

A cashback website is a type of reward website that pays its members a percentage of the money that they spend when they purchase goods and services via its affiliate links.

Interchange fee is a term used in the payment card industry to describe a fee paid between banks for the acceptance of card-based transactions. Usually for sales/services transactions it is a fee that a merchant's bank pays a customer's bank.

A fuel card or fleet card is used as a payment card most commonly for gasoline, diesel, and other fuels at gas stations. Fleet cards can also be used to pay for vehicle maintenance and expenses at the discretion of the fleet owner or manager. Most fuel cards are charge cards.

Loyalty marketing is a marketing strategy in which a company focuses on growing and retaining existing customers through incentives. Branding, product marketing, and loyalty marketing all form part of the customer proposition – the subjective assessment by the customer of whether to purchase a brand or not based on the integrated combination of the value they receive from each of these marketing disciplines.

The Green Dot Corporation is an American financial technology and bank holding company headquartered in Austin, Texas. It is the world's largest prepaid debit card company by market capitalization. Green Dot is also a payment platform company and is the technology platform used by Apple Cash, Uber, and Intuit. The company was founded in 1999 by Steve Streit as a prepaid debit card for teenagers to shop online. In 2001, the company pivoted to serving the "unbanked" and "underbanked" communities. In 2010, Green Dot Corporation went public with a valuation of $2 billion. Since its inception, Green Dot has acquired a number of companies in the mobile, financial, and tax industries including Loopt, AccountNow, AchieveCard, UniRush Financial Services, and Santa Barbara Tax Products Group.

A credit card is a payment card, usually issued by a bank, allowing its users to purchase goods or services or withdraw cash on credit. Using the card thus accrues debt that has to be repaid later. Credit cards are one of the most widely used forms of payment across the world.

Gas rebate credit cards or gas cashback cards became popular in the United States in the wake of the 2000s energy crisis and the rising price of gasoline.

A surcharge, also known as checkout fee, is an extra fee charged by a merchant when receiving a payment by cheque, credit card, charge card or debit card which at least covers the cost to the merchant of accepting that means of payment, such as the merchant service fee imposed by a credit card company. Retailers generally incur higher costs when consumers choose to pay by credit card due to higher merchant service fees compared to traditional payment methods such as cash.

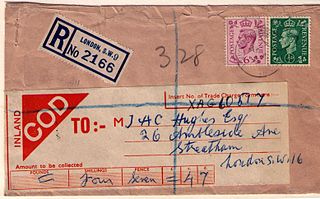

Cash on delivery (COD), sometimes called payment on delivery, cash on demand, payment on demand or collect on delivery is the sale of goods by mail order where payment is made on delivery rather than in advance. If the goods are not paid for, they are returned to the retailer. Originally, the term applied only to payment by cash but as other forms of payment have become more common, the word "cash" has sometimes been replaced with the word "collect" to include transactions by checks, money orders, credit cards or debit cards.

Card transaction data is financial data generally collected through the transfer of funds between a card holder's account and a business's account. It consists of the use of either a debit card or a credit card to generate data on the transfer for the purchase of goods or services. Transaction data describes an action composed of events in which master data participates. Transaction focuses on the price, discount and method of payment interaction between the customer and the organization. They are based on volatility as each transaction data changes every time a purchase is made, one time it could be $10, the next $55. Since debit and credit cards are commonly used to pay for goods and services, they represent a strong percentage of the consumption expenditure in the country.

References

- 1 2 3 "Are gas-rebate cards for you?". NBC News . 21 August 2006. Archived from the original on December 13, 2013.

- ↑ "Rebates are keeping dollars in town". www.startribune.com. Archived from the original on 2008-07-20.

- 1 2 http://www.walletpop.com/blog/2009/09/28/when-a-rebate-isnt-a-rebate-its-a-ripoff/?icid=main%7Chtmlws-main%7Cdl9%7Clink4%7Chttp%3A%2F%2Fwww.walletpop.com%2Fblog%2F2009%2F09%2F28%2Fwhen-a-rebate-isnt-a-rebate-its-a-ripoff%2F

- ↑ "Pahrump Valley Times - Nye County's Largest Newspaper Circulation". www.pahrumpvalleytimes.com. Archived from the original on 2008-12-11.

- ↑ Kuperstein, Adam (March 22, 2010). "Solution to Lousy Rebate Cards". NBC.